Every time I open the news, I’m amazed at what is happening in the…

Homes for sale in colorado decline.

According to the Denver Metro Association of Realtors, Denver metro new real estate listings fell 12% in October, number of sales dropped 6.4%, and sold prices stayed basically flat. In addition, homes for sale in colorado dropped. Don’t worry, the sky is not falling and there is quite a bit of good news in the data. What is going on with the market? Why is inventory declining yet prices are staying flat? What is the good news in the data?

What does the data say?

October was an interesting month in the Denver metro area. Below are some of the highlights from the Denver Metro Association of Realtors:

- Real estate listings fall 11.6% for detached single family

- Number of sales drop 6.4% from last month, basically flat for the year

- Average sales price basically flat (1.2%), and up 3.5% year over year

- Single family days on market up 15% year over year

- Condo days on market increases 36% from 2018 and 41% vs 2018, this is a bit concerning as it shows considerable softness in the condo market

- Condo sales volume down 7.4%

The data above is interesting as it is not what I would expect. As inventory declines, typically prices increase, but in this case prices stayed flat. Which leads to the question of what is driving the listings of homes for sale in Colorado to decline and prices to flatten.

What is causing the decline number of homes for sale in colorado to decline?

- Weather/Seasonality: This past October was historically cold and snowy in Denver. This likely led to a decline in the listings as sellers decided to wait until better weather in the spring.

- Rise of instant offers: Listing data comes from recolorado.com, this is the online MLS for the Denver metro association of realtors. Instant offers are not counted in the listings. For example, if someone gets an offer from Zillow, this does not show up in the data. There a many players in Denver now competing in instant offers (Zillow, redfin, etc…). The volume of this new real estate model is unknown but is likely impacting the listing number as sellers opt to instantly sell.

- Don’t have to sell: I think this is the primary reason. There is no huge driver forcing a sale. For example, during the recession, people had to sell due to job changes/loss, high payments, etc… None of that is occurring today as people are just opting not to sell which means the market will remain constrained regarding inventory.

How are prices flat?

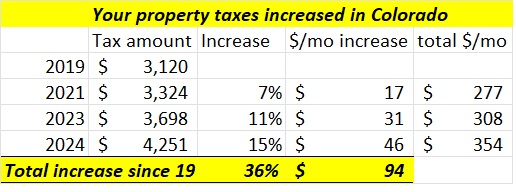

The biggest driver of the flat prices is the federal reserve. By dropping interest rates, the federal reserve has made mortgages on commercial and residential properties cheaper (i.e. interest rates have dropped) which has led to real estate becoming “effectively cheaper”. The reason I say “effectively cheaper” is that the price of real estate in most markets is flat this year, but actual payments made to buy the real estate enables buyers to spend more for the same dollars.

For example, assume a buyer was purchasing a $400,000 house in Denver on a 30 year mortgage with 20% down which is a loan of 320,000. The payment for the house assuming a 4.9% rate (this is when rates peaked last November) this would be a payment of $1,698 per month. Now as the federal reserve has dropped rates, the 30 year mortgage is closer to 3.5%, using the same example as above, the new payment would be 1436.94. Because of the lower payments a buyer can afford a more expensive house or buy the same house with a smaller payment. Furthermore, with the lower rates many renters might move to buyers as the mortgage payment is at or less than a rent payment.

With payments dropping substantially a “floor” has been created meaning real estate values have remained stable even though considerable economic uncertainty remains from tariffs to market volatility . The value of homes in most markets have remained relatively stable as the federal reserve has cut the federal funds rates and mortgage rates have dropped substantially which has increased consumers buying power spurring demand for real estate.

Is this good news or bad news?

Whether the data coming out in October is good news or bad depends on if you are purchasing or selling.

- Good news for sellers: The data coming out in October is positive for Sellers. Basically, prices have stabilized and there is no rush of inventory coming online (no panicked selling). This trend will continue through the remainder of 2019 and early 2020

- Bad news for buyers: Unfortunately, the good news for sellers is not so welcome for buyers. Inventory remains tight which will lead to prices continuing to stay high. I don’t see this trend reversing anytime soon in the Denver metro area. There is one silver lining. There could be opportunity in condos as days on the market has increased significantly.

Summary

The recent October sales numbers shows the market will remain healthy as inventory remains constrained. This is about what I had expected where we have reached a peak in real estate and seem to be continuing to hold steady. With the recent moves by the federal reserve to aggressively lower rates, the decline in homes for sale in Colorado will likely continue to decline for the foreseeable future which is good news for sellers and bad news for buyers.

Additional reading/resources

- https://www.fairviewlending.com/federal-reserve-creates-real-estate-floor/

- https://www.dmarealtors.com/sites/default/files/content/dmar_markettrendsreport_nov2019final.pdf

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)