Don’t be surprised by the recent numbers. I mentioned months ago that many Canadian markets changed on a dime and the same would happen in major US cities. A recent Redfin report showed that Denver ranked second behind Boise in price drops amongst 97 cities. What does this mean for prices in Denver? What does this mean for the real estate throughout Colorado? 5 reasons prices are being cut and what is the long term impact

What was in the Redfin survey?

A high share of home sellers dropped their asking price in July, particularly in pandemic boomtowns, as they struggled to match their expectations with the reality of the cooling housing market.

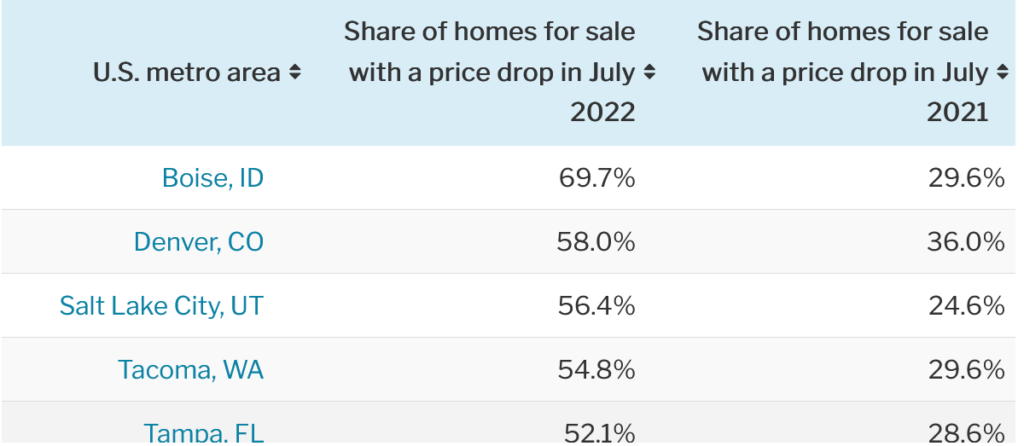

Nearly 70% of homes for sale in Boise, ID, had a price drop in July, the highest share of the 97 metros in this analysis. Next come Denver, where 58% of homes for sale had a price drop, Salt Lake City (56.4%) and Tacoma, WA (54.8%). Those four metros also topped the list in June, and Boise, Salt Lake City and Tacoma were also among the 10 metros with the biggest upticks in their price-drop rates from a year earlier.

Nationwide, the share of homes for sale with price drops reached a record high in July. Sellers had to cut their prices because they were catching up with buyers, who had come to expect lower prices amid a cooling market. Rising mortgage rates and the prospect of falling home values also made buyers hesitant to pay sky-high prices, and an uptick in supply gave them more to choose from. Price drops are likely to flatten out as sellers come to terms with the shifting market.

Why are prices being cut in Denver?

Denver appreciated rapidly during the covid pandemic as zoom workers relocated from the coasts to the mountain west. According to the Denver metro Association of realtors, the median home price in Denver is 685k, this is up over 50% since 2019. With such a large run up over a short period of time, it is no surprise that the market is starting to take a breather with 58% of sellers cutting prices. This is quite the change from just a few months ago with bidding wars on pretty much every property. Why is Denver now seeing such a swift change in the market?

- Inventory rising: Inventory is up 94% from last year while closings are down 24%. The changing real estate landscape is leading to considerable pressure on sellers

- Interest rates rise: Denver is more susceptible to higher rates than many other markets as the average home is over 750k which is double the national home price

- Prices got ahead of themselves compared to income: With prices in Denver soaring, incomes could not keep up with the increased prices. For a while, rock bottom low interest rates enabled buyers to afford more house than traditionally available. We are seeing now that this trend no longer holds true as incomes are not high enough to support the average home prices in the area.

- Recession fears: As fears of recession continue buyers are becoming increasingly nervous on the long term prospects for the economy and holding off on large purchase like homes. This is happening throughout the country as the number of closings plummets.

- Back to office trends: Do not discount back to office trends. As the economy softens, employers are getting the upper hand and workers are migrating closer to their employers and in office work days are becoming the new normal.

What do price cuts mean for future values in Denver?

Price cuts are a harbinger for falling values in Denver. The price cuts we are seeing are not a onetime event, look for this trend to continue/accelerate as the economy continues to correct. With prices being cut and inventory continuing to rise, the only direction for prices is down. Look for a 10-15% decline in values from their peak.

Note this could be larger if interest rates trend even higher as the federal reserve is forced to be more aggressive to combat inflation. If mortgage rates crest 7%, maybe a 30-40% probability, then the fall in prices in Denver would be closer to 15-20% plus from the highs.

Denver is a Bellwether for Colorado real estate

Historically, whatever happens in Denver real estate ultimately flows to the rest of the state. The Denver metro is still the economic driver for the state of Colorado and as Denver’s real estate begins to slide look for the rest of the state to follow suit. The impacts to other areas will not be immediate, sometimes there is a 12-18 month lag behind Denver but ultimately look for other cities from CO Springs to Greeley to the Western Slope to eventually emulate Denver.

Summary

Although it appears the Denver market changed overnight, this could not be further from the truth. The Denver market, like others throughout the country, was overwhelmed by the Covid mentality that real estate will go up forever. Unfortunately gravity always rules and Denver, like many other markets, is embarking on a reckoning with reality. Gone are the days of bidding wars and paying 20% over asking. This is now replaced by soaring inventory and almost 60% of sellers cutting their asking price.

This change in fortune for Denver’s real estate values is not a blip. This is the beginning of a downward trend due to market fundamentals, interest rates, rising inventory, etc… It is critical to keep this market change in perspective. Since Covid Denver real estate has gone up over 50% so a 10-15% correction is expected to let some air out of the hot market. A minor correction is my base case, but there could be a much larger correction depending on how high the federal reserve must raise rates to tame consumer spending and in turn inflation.

Additional Reading/Resources

- https://www.redfin.com/news/home-sellers-drop-prices-july-2022/

- https://www.bloomberg.com/news/articles/2022-08-22/cheap-homes-house-prices-are-being-slashed-in-former-pandemic-boomtowns?srnd=premium

- https://www.thedenverchannel.com/news/360/denvers-june-housing-report-is-out-whats-changing-and-what-it-means-for-buyers-sellers

- https://www.dmarealtors.com/sites/default/files/file/2022-07/DMAR_MarketTrendsReport_July2022.pdf

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender