In April, Denver County recorded the largest number of eviction filings in one single month. There were 1,665 eviction filings, compared to 1,038 in April 2023 and 576 in April 2022. Why the sudden huge jump in eviction filings? Is this a trend or just a blip? How does this compare to pre-covid? What impact does this have on Denver real estate prices? 3 reasons for the sudden surge in filings.

What was in the data on Denver County eviction filings?

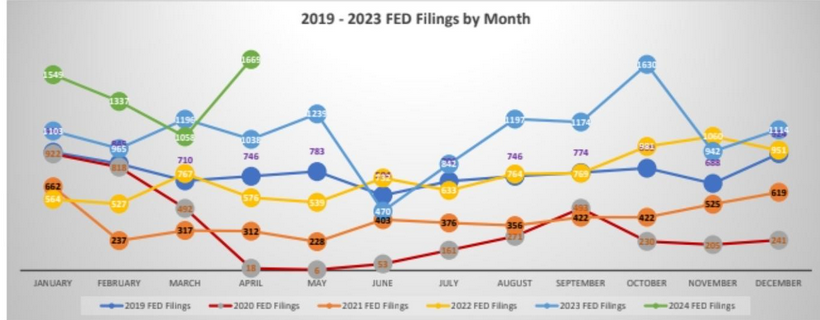

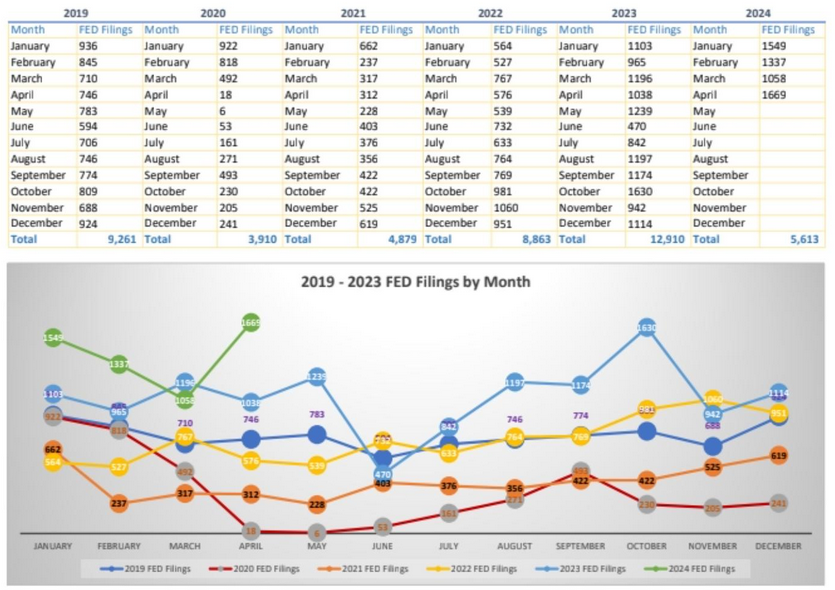

In April, Denver County recorded the largest number of eviction filings in one single month. There were 1,665 eviction filings, compared to 1,038 in April 2023 and 576 in April 2022. Colorado is on pace to see up to 70,000 filings, while there were roughly 55,000 in 2023.

If I annualize the first four months of data, Denver is on pace for 16, 839. Unfortunately, I don’t have historical data back to the last recession, but in 2019, precovid, there were 9261, a roughly 82% increase from 2019.

Long and short, however you slice or dice the data, there are massive increases in foreclosure filings in 2024.

Why are we seeing more eviction filings now in Denver Colorado?

Although the data on foreclosure filings seems alarming, it should not be a huge surprise. If we look at 2020, foreclosure filings were a third of the 2019 numbers, 2021 was roughly half, and it trended upwards from there.

- Government assistance programs funding has stopped/reduced: Without governments funding and rising rents, tenants are unable to keep up and the numbers ultimately do not work for them to continue paying the amount they are in rent.

- Pent up covid filings playing catch up: A number of these filings are “catching up” from the pandemic lows that put moratoriums on evictions.

- Exhaustion of Covid gains from government checks: Eventually all the free money has run out for many renters and forced many to make hard choices.

Is the huge jump in foreclosure filings in Denver a trend or a blip?

Unfortunately the trend of higher foreclosure filings is definitely a trend that will continue around its current pace for a while based on the three items above. Many in the government felt that printing money and sending it to taxpayers would fundamentally change the economy and human behavior. The data shows a drastically different picture in that the huge government stimulus did nothing to actually address the root causes of evictions and financial distress. Time and time again the data shows that all the stimulus did for the overwhelming majority of recipients is delay old habits but nothing fundamentally changed. The root causes of financial distress cannot be resolved with stimulus money as we see above.

What does this mean for Denver real estate prices?

The increase in eviction filings should ultimately free up supply of units which ultimately will lead to lower rent prices in the future. Unfortunately, there is a shortage of overall units so I don’t think that the supply increase will radically alter prices in general in Denver.

Summary

What we are seeing with the data is that the pandemic merely delayed eviction filings and did not fundamentally change the market dynamics occurring in Denver. Denver property owners are essentially playing “catchup” from the pandemic lows. Furthermore, as pandemic stimulus runs out while rents are continuing to more tenants are facing the possibility of evictions. I don’t see any huge changes one way or the other that will drastically alter the number of evictions until there is a major macro-economic change.

Additional Reading/Resources

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender