As the first Colorado resort is set to open today (Arapahoe Basin). Allot is happening in the industry that will impact real estate, visitation, etc… The last 12 months have been quite the roller coaster with consolidation galore and financial duress starting to surface. If you missed it, Aspen bought WinterPark, Steamboat, and Mammoth. Vail has recently bought Park City, Whistler (in BC), Stowe (in VT) and Perisher(largest resort in Australia). What does this all mean for the industry? What about everyone else? What resort might go under as a result?

With all the acquisitions, it is easy to see that the ski industry is quickly becoming a two-horse race with Aspen/KSL partners and Vail leaving most of the rest in the dust. With two major players in the ski industry pass sales will drive further traffic to the two largest. This recent industry consolidation will allow the first major competitor to Vail’s “Epic Pass”. Most avid skiers and many vacationers will likely get lured into one pass or the other.

Vail’s strategy and now Aspen’s strategy is to use smaller resorts to feed into larger destination resorts. For example, if you bought a season pass to Stowe, in Vermont, you would get free days at Vail, Breckenridge, etc… thereby encouraging customers to travel to these destinations. Smaller resorts have no way of competing with this model.

Along with increasing sales, the real value in the season pass is you get money upfront regardless of the weather conditions. For example, most pass sales take place in the summer and basically locks in the consumer for the upcoming season to the respective resorts before the first flakes are even imagined. Smaller and independent resorts do not have this luxury to smooth out their income.

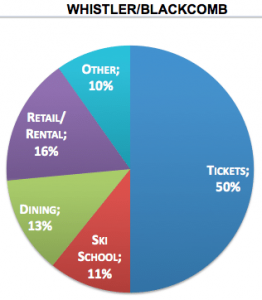

According to the CEO of Vail “Just under 40 percent of our lift tickets come from season passes sold before the ski season begins” The goal is not just the pass sales, it is the ancillary revenue: rentals, food/beverage, ski school, lodging, etc… all owned by the resort. Below is a chart from the Atlantic which shows the revenue breakdown of the Whistler resort.

As the recent mergers highlight, scale is critical for success in the ski industry. The last major ski resort to open was in the 1980s, Beaver Creek in Colorado. With no new large resorts coming online the remaining resorts will continue consolidating profitable smaller properties.

What is the impact? The smaller resorts will have a harder time competing and many will go under. There is a smaller ski resort, Ski Granby Ranch, located about 30 minutes north of Winterpark. It was recently in the local paper since they failed to pay their taxes. They also haven’t paid their property taxes so they are heading to tax sale. Ski resorts like Granby ranch will have a hard time surviving without scale and in my opinion, have greater than a 50% chance of closing in the next 3-5 years

What should you do? Ironically before all the industry consolidation, I thought Granby Ranch was a value for real estate owners. Unfortunately, with the changes in the market, places like Granby will no longer be viable and could lead to huge losses for real estate owners. Let’s say the resort goes under, what do you do with all the condos people bought looking at a ski mountain that is now a steep grass sledding hill at best? As a prudent investor, you should avoid real estate near some of the smaller/weaker resorts.

What else is going on in the industry? Along with consolidation, the industry is getting a little more interesting for smaller resorts. There are two major trends beginning to emerge:

- Renting out the entire resort: Areas like Silverthorne, CO have begun renting out the entire resort to a group. “Private ski resorts are the new private jet,” says Jack Ezon, president of Ovation Vacations, a Virtuoso Ltd. travel agency. “They give luxury travelers a hassle-free, line-free experience, so they can focus more attention on their family and travel partners.” (see Bloomberg article). This trend is also occurring in Vermont. For a cool 60k, you and 99 friends can have free reign of the Hermitage club

- Developing private ski areas: This trend was started by the Yellowstone club in Montana and is now coming to other areas including Cimarron Mountain Club outside of Crested Butte (see Denver Post article). This is not cheap in the Yellowstone club you can buy a lot starting over 3m, pay a 300k initiation fee, and then 40k/year in dues

What is driving the change? There are two main drivers of the change that is upending the ski industry: Climate/expense to cope with climate and Demographic shifts.

Climate: Whether you agree with global warming or not doesn’t matter. The goal of resorts is to be open by Thanksgiving. Most natural snow occurs later than that so man made snow becomes more important. New technology is critical to make ample snow for early season skiing. This technology is expensive and a small resort does not have the resources for these capital expenditures.

Demographics. Today in the Steamboat springs paper there was an article titled “As baby boomers leave skiing, millennials are failing to fill in the gaps”. In essence skiing is turning into golf with an age problem. Less young professionals are as avid snowsports fans as the older generation. This changing demographic is leading to less skier visits of this demographic which will ultimately lead to less revenue for the ski industry.

Transition always upsets markets and there are clear winners and losers. According to ski industry veteran Bill Jensen, in an article for Curbed, he predicted that over 150 resorts will fail and turn off the lifts. A ski hill is typically an economic engine/anchor for as area. Without this driver of tourism/revenue there is sure to be enormous financial distress in the market. This will no doubt impact the economies of the areas left without a resort and the real estate. If you are looking to invest in ski real estate, bigger is definitely better in today’s ski economy. You don’t want to be sitting with a property you paid a premium for now looking at a grass hill!

Resources/Additional Reading

- http://www.denverpost.com/2017/10/09/cimarron-mountain-club-launches-new-plan-for-wealthy-skiers-while-preserving-powder-protecting-mission/

- http://www.denverpost.com/2017/10/09/granby-ranch-still-owes-380k-delinquent-property-taxes/

- https://www.forbes.com/sites/larryolmsted/2017/04/11/skiings-biggest-deal-may-be-game-changer-for-your-winter-vacation-plans/#5c3f57b52793

- https://www.theatlantic.com/business/archive/2012/02/no-business-like-snow-business-the-economics-of-big-ski-resorts/252180/

- https://www.bloomberg.com/news/articles/2017-10-06/whistler-north-america-s-best-ski-resort-is-about-to-get-even-better

- https://www.bloomberg.com/news/articles/2017-10-02/the-latest-trend-in-skiing-is-renting-out-the-entire-mountain

- http://www.steamboattoday.com/news/as-baby-boomers-leave-ski-slopes-millennials-are-failing-to-fill-in-the-gaps/

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)