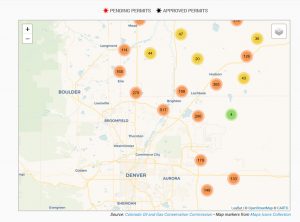

Don’t think this impacts you? Take a look at the map above of the Denver front range. “When Bill Young peers out the window of his $700,000 home in Broomfield, Colo., he drinks in a panoramic view of the Rocky Mountains. Starting next year, he may also glimpse one of the 99 drilling rigs that Extraction Oil & Gas Inc. wants to use to get at the oil beneath his home.” A little-known law known as “pooling” is forcing oil and gas development into more neighborhoods. How can you mitigate your risk? What is pooling? Are you impacted? Why is there a larger impact now? What can you do?

What are mineral rights and how is Colorado unique?

In Colorado, the surface rights were severed from the sub surface rights. So basically, a property owner has rights to everything above the ground, but not below the ground. The minerals and water below the ground have been “bifurcated” and in most cases sold to others. For example, if there is oil below your property, unless you also own the mineral rights, the oil can be extracted by whomever the mineral owner is. This also holds true for water, you can’t just pop in a well and begin irrigating the property if you don’t have the proper ownership of that water. Also, if water passes through your property it doesn’t mean that you have any right to the water (to build a pond, irrigate, use for livestock, etc…)

How does this impact property owners?

Since the subsurface rights have been separated from the above surface rights, property owners can be faced with a very expensive “surprise” when they find out someone wants to drill beneath their property. Under Colorado law surface owners must provide access to subsurface owners and there is very little compensation. For example, a homeowner could end up with drill rig 500 feet or less from their property line with pipes/drilling running underneath their property. Even though this drilling substantially reduced

What is pooling?

In Colorado, whole neighborhoods may have to lease the minerals under their land if just one homeowner agrees. This is forcing oil and gas development into more neighborhoods and your million-dollar house will be worth a whole lot less with a view of a drill rig. Even if you own the mineral right under your house, an extraction company can force you to sell your interest in order to enable development. A mineral rights attorney did an interesting article on forced pooling, the history, etc…:

Forced pooling in a process available through the Colorado Oil & Gas Conservation Commission (COGCC) set forth in Rule 530 that essentially forces production on an unleased mineral interest. The public policy behind forced pooling is that minority interest(s) should not be able to forestall development or production. (source: Mineral Rights Forum)

Colorado is unique that it only takes one person to accept a lease and then the company can force “pool” the other property owners. In other states it takes over 51%

Are you impacted?

Most likely yes. Depending on where you live, you are more than likely impacted. The impact is most profound in the Northern front ranged. The big drilling areas are basically East of Denver and North of Denver to Wyoming and clustered on the Western slope near Grand Junction. Here is a map of active wells, proposed wells, and violations by oil and gas companies

How can you mitigate your risk?

Before buying ask the developer or agent if any wells are proposed. Check with the county and various online sites that track oil and gas applications to see if one is near you or proposed. In many communities, buyers have bought houses that abut to open space and or parks only to find out that a drill rig can also be placed there. Many older/more established neighborhoods don’t have available space for an oil rig and therefore are less likely to have drilling close by. Recently activity is occurring near new developments and more rural neighborhoods where the conflicts are occurring more frequently.

Why is there a larger impact now?

As prices of oil increased and drilling costs decreased, it is more profitable to drill in these areas. From 2010 to 2015 Colorado’s oil production quadrupled. Along with increased drilling there has been substantial development as well. The Northern front range is one of the fastest growing areas in Colorado. The combination of increased drilling activity and increased development has heightened the conflicts. This is an issue for property owners as well as lenders. When a rig is put up near a property, the value plummets. A property owner could easily end up upside down due to an oil rig.

What can you do?

Unfortunately, the way Colorado law is written, if you do not own the mineral rights, and/or get pooled because your neighbors agree to a lease, there is not much you can do. Many cities are trying to impose moratoriums, but this has not been successful in the long term to stop development. (see article on Lafayette’s proposed moratorium) The wildhorse development in Broomfield is an interesting case to watch. This is an affluent suburban neighborhood that attempted to go against the oil/gas developer, it appears they got some concessions, but at the end of the day, a rig was still placed nearby (see Bloomberg article)

If you buy a property that abutted a park, open space, etc… only to find out that an oil rig is your new neighbor, there is no doubt that your property just declined exponentially. In a nutshell, in real estate it is always wise to be proactive verse reactive. Try to avoid properties/locations that are higher risk for oil/gas development. Until there are changes to the laws (if there are any) there is little you can do if you solely own the surface rights vs. the mineral rights. Below, I’ve put a number of links to articles/resources that will be helpful to property owners in affected areas.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)

Resources/Additional reading

- https://www.bloomberg.com/news/articles/2017-10-03/these-suburbanites-may-have-no-fracking-choice

- http://cogcc.state.co.us/documents/about/Help/Surface%20Owners%20Brochure.pdf

- http://cogcc.state.co.us/documents/reg/Rules/LATEST/AppendixV.pdf

- http://www.mineralrightsforum.com/profiles/blogs/the-forced-pooling-card

- https://www.dgslaw.com/images/materials/DALTA-Pooling-Hartford-Nibert.pdf

- http://www.denverpost.com/2017/04/22/colorados-forced-pooling-law-needs-some-updates/

- http://www.dailycamera.com/erie-news/ci_31028251/vista-ridge-residents-erie-officials-wary-fracking-sites

- http://www.denverpost.com/2017/04/21/an-unwelcome-gift-from-oil-and-gas-developers/

- http://www.denverpost.com/2017/05/02/firestone-explosion-oil-wells-pipelines-inspected/

- http://www.denverpost.com/2017/09/30/lafayette-oil-gas-drilling-moratorium/

- http://www.denverpost.com/2017/09/28/oil-gas-pipelines-colorado-failed-testing/

- http://maps.fractracker.org/latest/?appid=3871156863a54ff2ac98b10235dfff57

- http://broomfieldconcerned.org/

- http://www.denverpost.com/2017/09/30/lafayette-oil-gas-drilling-moratorium/

- http://www.denverpost.com/2017/10/30/cogcc-meeting-oil-gas-drill-close-to-homes/