Although March is typically not a big sales time in the mountains with mud season and the resorts closed, there are some interesting trends emerging. As suspected single family homes sales volumes have dropped dramatically along with median and average sales price. But one thing jumped off the page and was a huge surprise. What is the best property type to invest in Colorado Ski towns?

What was in the recent Colorado ski town data?

I looked at three mountain counties Summit (Breckenridge, Keystone, Silverthorne, Copper, etc..), Eagle (Vail, edwards, etc..), and Routt (Steamboat Springs). I also included Denver as a reference point versus the mountain towns. All the data comes from the Colorado association of realtors. Here are the big takeaways:

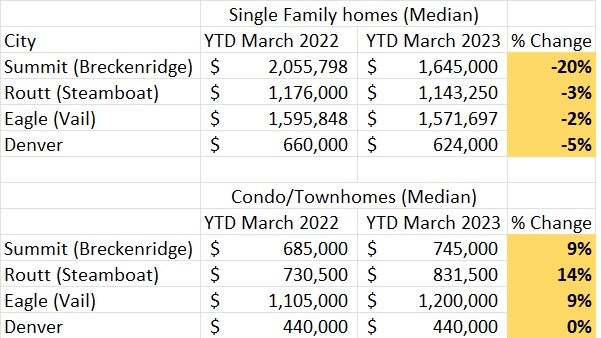

- Single Family Median and Average sales prices are declining. I wouldn’t be overly concerned on the large drops as March is not a big sales month, but there are definitely some trends starting to emerge

- Inventory up dramatically

- Days on Market increasing

- Condos/townhomes median and average staying constant

| Inventory homes Single family | |||

| March 2022 | March 2023 | % Change | |

| Summit (Breckenridge) | 84 | 119 | 42% |

| Routt (Steamboat) | 68 | 55 | -19% |

| Eagle (Vail) | 99 | 157 | 59% |

| Denver | 387 | 561 | 45% |

| Inventory homes Condo/Townhomes | |||

| March 2022 | March 2023 | % Change | |

| Summit (Breckenridge) | 223 | 266 | 19% |

| Routt (Steamboat) | 30 | 33 | 10% |

| Eagle (Vail) | 153 | 155 | 1% |

| Denver | 400 | 568 | 42% |

Big surprise in the data on Townhome/condos

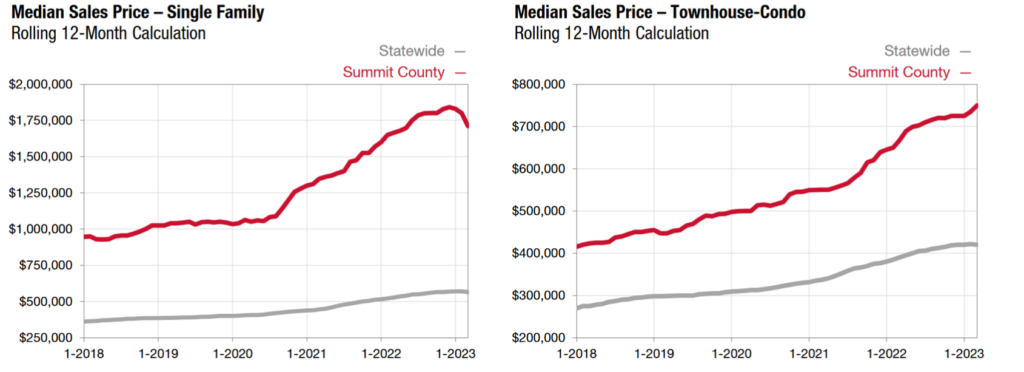

Historically I have seen single family and condo/townhomes move in a similar direction, but that is not the case in the most recent data. Condos/Townhomes are up in all three markets and in some cases up by double digits on both median and average.

Note, this is not just the mountains seeing the divergence in pricing. I looked at Denver county and the median for condos/townhomes is up almost 5%, while median for single family homes is down 13%.

On my analysis I looked at the median price to factor out the noise of large transactions. For Example, in Breckenridge there were a number of large sales of condo/townhomes, but using the median should mitigate some of the data skewing.

Why are condos/townhomes outperforming

On my analysis I looked at the median price to factor out the noise of large transactions. For example, in Breckenridge there were a number of large sales of condo/townhomes, but using the median should mitigate some of the data skewing.

- Lower price points: In Summit county the median single family home is 300% higher than the median on a condo/townhome. With lower price points there is a much wider available audience.

- Larger drop in inventory: In Breckenridge, the inventory of single family homes has increased 41% while townhomes/condos is only 20%, basic economics show that less inventory will increase prices.

- More desirable as rentals: They are also much more likely to be in allowable rental zones in the various ski towns which make townhomes/condos much more desirable. Furthermore they are desirable as rental properties due to their size and rental rates

Note, I have a ton of bright people on this e-mail list, if anyone has any other/ better theories, please let me know 😊

Will Condos/Townhomes continue to outperform single family?

First, I’m a lender not a realtor so not providing investment advice. With that said, is the recent data a strong enough signal to focus a purchase on a condo/townhome in the mountain town? I would caution against this assumption. At some point we should see a flip in the market where single family stabilizes and condo/townhomes decline. The condo/townhomes correction is just delayed as the lower price points have made them more desirable. The last part of the year should see condos/townhomes come into line with what is occurring in the single family market.

Summary

The Colorado Resort communities are undergoing rapid changes with declines in single family home prices along with declines in closings. Remember though, the Colorado ski towns are very unique as there is very little inventory and it is almost impossible to add any meaningful supply which will keep prices from falling too much.

Furthermore, in the short term Condos/townhomes are outperforming single family currently but over the next twelve months they should come into parity with single family homes. I don’t expect a 2008 repeat, but there is a correction coming even in mountain real estate. On a positive note, even in a correction Colorado ski real estate should outperform most other markets as inventory will always be limited and demand continues for resort properties.

Resources/Additional Reading:

- https://car-co.stats.showingtime.com/docs/lmu/x/EagleCounty?src=page

- https://car-co.stats.showingtime.com/docs/lmu/x/SummitCounty?src=page

- https://car-co.stats.showingtime.com/docs/lmu/x/DenverCounty?src=page

- https://car-co.stats.showingtime.com/docs/lmu/x/RouttCounty?src=page

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender