Will Colorado property owners actually see real property tax relief? Property owners are fed up with the run away increases in Colorado property taxes and yet the legislature has done very little. The governor and legislature blinked from the threat at the ballot box of two tax initiatives and have called another session to address property tax bills. What are in the new proposals for property tax relief? What will the proposals really save you?

Why the sudden special session on property taxes again

It seems like we are on a giant hamster wheel with property taxes in Colorado with yet another special session. The reason for this special session is that Polis and the legislature were worried that one or both of the proposed tax measures would pass which would lead to even greater government cuts.

What is in the new proposal on property taxes?

In exchange for dropping Initiatives 50 and 108, here is the framework for the new tax proposal

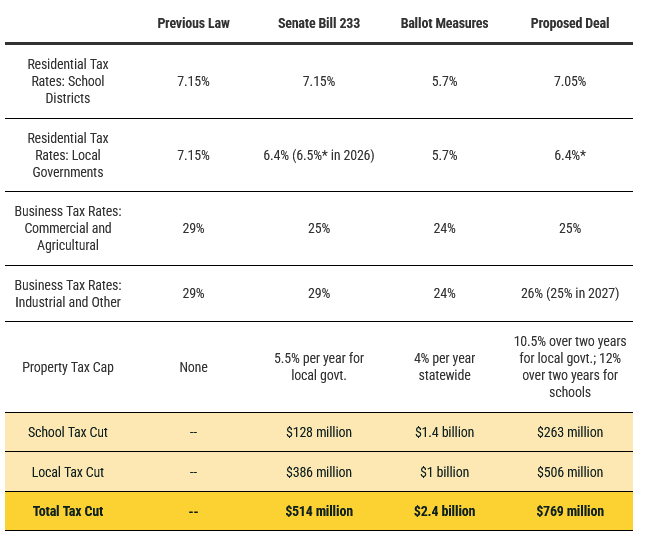

- In the 2025 tax year for taxes owed in 2026, the residential assessment rate for local government taxes would drop an additional 0.15% to 6.25%. Today the rate is 6.7%, but under Senate Bill 233, which was passed by the legislature this year with bipartisan support, it is scheduled to fall to 6.4% in the 2025 tax year for taxes paid in 2026. Residential assessments for schools would remain separate from those of local governments, and would fall to 7.05% from 7.15%. (Both cuts could be larger if property values grow faster than expected next year.)

- In the 2026 tax year, the residential assessment rate for local governments would rise to 6.8%, but the increase is offset by a tax break that kicks in that year, exempting up to $70,000 of a home’s value from taxation. Under current law, it is scheduled to rise to 6.95%. The school assessment rate would remain at 7.05%.

- Nonresidential assessment rates would drop to 25% in the 2027 tax year. Under Senate Bill 233, only commercial and agricultural property assessment rates fall to that level, while the rates for industrial and some other properties increase to 29%. The oil and gas industry, which pays much higher property taxes, would not benefit from the cuts.

- Local government revenue would be limited to 10.5% growth over two years, instead of 5.5% annually under Senate Bill 233. School districts would be limited to 12% growth over two years, a new cap that doesn’t exist in current law

How much will the new tax bill save the average homeowner?

Based on my back of the napkin calculations property owners would save 200-300/year but remember this is after a 21%+ jump in the last reassessment cycle. So long and short, it isn’t going to save a ton of money but long term should prevent huge jumps like we have seen before. Under the new proposal, the max increase is 12% for schools and 10.5% for local governments.

What happens to the two tax initiatives on the ballot.

The agreement at the legislature says that they will both be pulled from the ballot and agree to no new ballot property tax initiatives for 10 years.

Is the new tax bill better than the two tax initiatives on the ballot?

Based on the chart, the ballot initiatives would substantially reduce government spending in the future which depending on your political bent is either a huge win or a huge loss. Long and short, the ballot initiatives are much more aggressive in their cuts than the new law, this is why Polis and the legislature called yet another emergency session to prevent such large cuts.

Summary

Although there is great fanfare about a huge property tax compromise in Colorado, the reality is that property owners will not see much savings and bills can still increase up to 12% every two years. Although this is better than before, it by no means will make property owners happy as they are still paying 21% more than just a few years ago and the rates of increase are still 300% greater than the federal reserve target for inflation.

Additional Reading/Resources

https://coloradohardmoney.com/category/colorado-initiative-50-property-taxes/

https://coloradosun.com/2024/08/15/colorado-special-session-property-taxes-election-2024/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender