Zillow analyzed appreciation over the last 4 years (basically the pandemic real estate gold rush) to see the cumulative appreciation. Which markets performed the best and which ones the worst in Colorado and even more importantly why? Why are some markets hotter than others and will this past success bread future appreciation or will the tides reverse? Which markets are currently performing the best and worst now that real estate has settled into a more normal pattern?

What are the hottest markets in Colorado over the last 4 years?

It is no surprise that the mountain markets steal the cake on the hottest markets. Edwards (outside of Vail) takes the crown with an astonishing 107% appreciation. Basically the rest of the list are also mountain towns (Steamboat, Telluride, Snowmass, etc).

Interesting trend; you are seeing not just the actual ski towns on the list, but areas close to ski towns that have seen huge appreciation, for example Oak Creek which is about a half hour outside of Steamboat Springs. The spillover effect of ski towns into surrounding areas is huge and real for example Basalt outside of Aspen. Here are the next few fastest appreciating towns:

| · Oak Creek (South of Steamboat) |

| · Clark (North of Steamboat) |

| · Ouray (outside Telluride) |

| · Silverton (outside of Telluride) |

Note: some towns should not be on the list but due to very little data a few sales could radically skew the average, these include Mclave, Kit Carson, etc..

Note: other towns like Breckenridge, Aspen, Vail still appreciated quickly but they started at much higher price points so on a percentage basis did not appreciate as quickly.

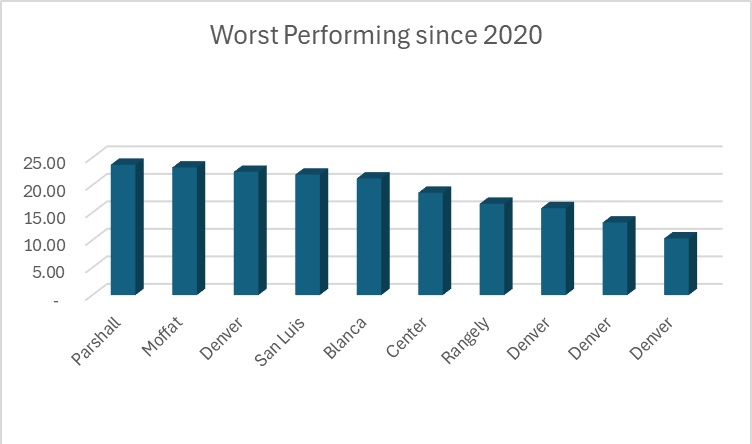

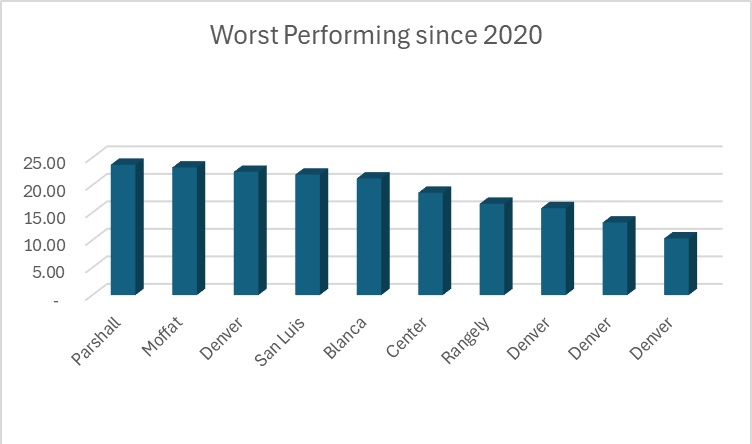

What are the coldest markets in Colorado over the last 4 years?

This should be no surprise either. Denver zip codes took four of the top spots for worst performing markets as the pandemic trends were real with flights to suburban/rural locations. The worst performing Denver zip codes were: 80202, 80203, 80205, and 80218. Also on the list were smaller markets without a huge draw, for example Parshall between Kremmling and Granby.

On the worst performing markets over the last four years, I didn’t see any surprises that jumped off the page, they were about what I would have guessed without even looking at the data.

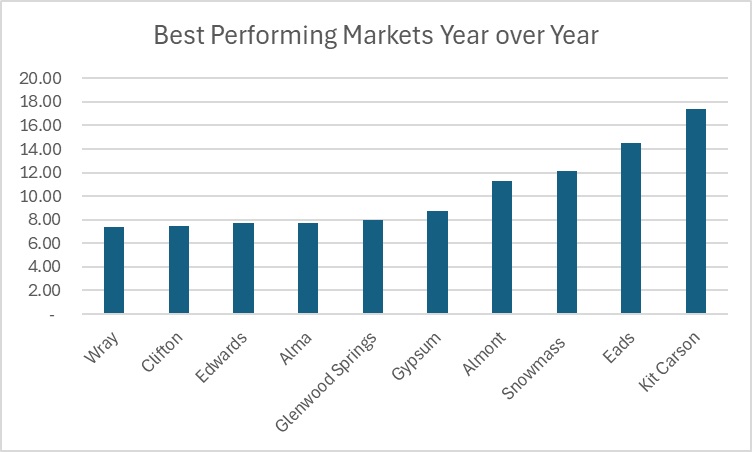

Best performing Colorado real estate markets Year over Year

I would take this list with a grain of salt as many of the markets like Wray or Eads are way too small to have meaningful data as there is way too much noise in the data from an averaging standpoint.

Even with all the noise from the smaller markets, there are still some trends like Snowmass continuing to appreciate as Aspen’s run continues, Oak Creek outside of Steamboat, Glenwood (gateway to Aspen/Snowmass), Alma, outside of Breckenridge, etc… so the spillover effect of the ski towns is still helping some of the immediate towns appreciate but it is not uniform as we will see below.

Worst Performing markets in Colorado Year over Year

This list for the most part did not surprise me. Each one is a smaller rural market. As pandemic trends reverse, the movement to non resort town smaller markets is also reversing as we can see from the data below.

There are two interesting inclusions on the worst performing list: Silverthorne (in Summit County) and Granby (North of Winter Park). Why are these two included on the list?

- Silverthorne: This market got way ahead of itself in appreciating over the last 4 years, at the end of the day, it is not a ski town and with traffic it could easily take over an hour to get to Breckenridge. Furthermore the restrictions on nightly rentals altered this market as long term rents can not sustain the prices people were trying to get from short term rentals. I don’t see this trend reversing as even more supply continues coming on line in Silverthorne.

- Granby: Granby is North of Winter Park and on the West side of Rocky mountain national park. This market also got pretty far ahead of itself very quickly. One of the reasons was that when the large fire went through and burned hundreds of houses there was an inventory shortage, this is now reversing a little and prices are coming back down to reality.

What can we learn from the data to predict future price appreciation?

As the old saying goes, the past may or may not indicate future performance, but I can see some trends in this data that is worth noting.

- Rural properties will underperform: I have said this for years that the pandemic flight to the middle of nowhere will be fleeting, we are seeing this clearly in the data

- Denver: need to be even more careful of where you are in the metro. I would not write off all of Denver from real estate, certain areas like Cherry Creek will continue performing well while others will continue to struggle, the takeaway is that you have to know the areas well before investing

- Suburban will continue to hold up well: I do not see the suburban trend reversing as they have lower taxes, better schools, and typically less crime, these traits will remain desirable as most companies are migrating at least to some sort of Hybrid arrangement so people are typically not commuting 5 days a week.

- On ski real estate, closer to the resort will hold up better than outlying areas, many of the outlying areas that have overperformed in the past, like Silverthorne, will get a wake up call as real estate normalizes post pandemic. Here is a past blog on the best ski investments.

Summary of best and worst Colorado real estate markets

The craziness of the pandemic real estate is in the rear-view mirror and as a result Colorado real estate is undergoing big changes. We are at an inflection point. Not everything is going up like the past four years. Hot markets like Silverthorne and Granby are now the softest while ski markets are still holding up like Snowmass. Suburban markets continue to perform well, and small rural areas are giving back their pandemic gains. If you are buying real estate now, it is important to focus on areas that can hold up even with a real estate reset that we will see in the next year or so as rates stay well above their pandemic lows.

I’ll be doing a follow up post in a few weeks on where I am investing in Colorado and my favorite property types. If you are not on my email to get weekly updates on Colorado real estate trends, shoot a quick email to info at Fairviewlending.com and put CO newsletter in the title or you can click on link below to sign up.

Additional Reading/Resources

- https://www.denverpost.com/2024/04/16/pandemic-housing-colorado-edwards-appreciationd-some-colorado-housing-markets-and-sidelined-others/

- https://www.zillow.com/home-values/102001/united-states/

- https://coloradohardmoney.com/best-colorado-ski-real-estate/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal from this blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lending