Wow, 2024 has been quite the year in real estate. The beginning of the year started out good but as interest rates rose substantially volumes dropped off a cliff and prices began falling in some markets. At the same time, we are seeing substantial increases in inventory. What do the changes mean for Colorado real estate in 2025? Will prices have a reset? How will the mountain/resort communities perform compared to Denver? What happens to commercial real estate in Colorado? Where should you invest and what should you avoid?

2025 will continue the reset in real estate

Regardless of prices, real estate is already in a deep recession, with closing volumes down close to 20 year lows. At the same time interest rates are remaining above 7% (as of this writing). Late 2024, we started to see the beginning of what is to come in 2025 with inventory rising and values finally starting to come off their epic run in both Denver and most mountain towns. I foresee many of these trends continuing but there are definitely some wildcards.

Some macro economic wild cards that will impact Colorado real estate in 2025

2025 is going to be interesting as rates remain high there is increasing probability of something breaking in the economy. Here are some factors I am watching:

- Deficit spending/financing: The federal deficit has basically doubled over the last 3 years and all of this must be financed through the treasury market. As the treasury continues its borrowing rates could continue to spike. I see no end in sight to the current deficit spending which will lead to rates higher for longer

- Interest rates/inflation: I’m not convinced that we are totally done with inflation, the labor market is still exceptionally strong which will continue upward pressure on wages and in turn products/services. Rates will have to remain high even in the face of a possible moderate recession

- What breaks? The federal reserve continues touting a soft landing, in order to accomplish this rates will need to remain higher for longer. This drastically raises the risk of something breaking. My first thoughts are commercial real estate and regional banks. But I don’t think the economy will come out of the high rate environment unscathed.

How the three factors above play out could have substantial implications on real estate, for example if something in the economy breaks bad enough like commercial real estate, we could enter a recession with higher unemployment than anticipated. My gut says that rates will stay higher for longer due to the tight labor market and increased deficit spending which ultimately will put pressure on commercial and residential real estate prices.

Residential throughout Colorado

I categorized residential real estate into three buckets 1. Front Range/Denver 2. Ski towns 3. Rural I know these are large buckets, but wanted to highlight some important trends in each one

Front range/Denver 2025 real estate predictions

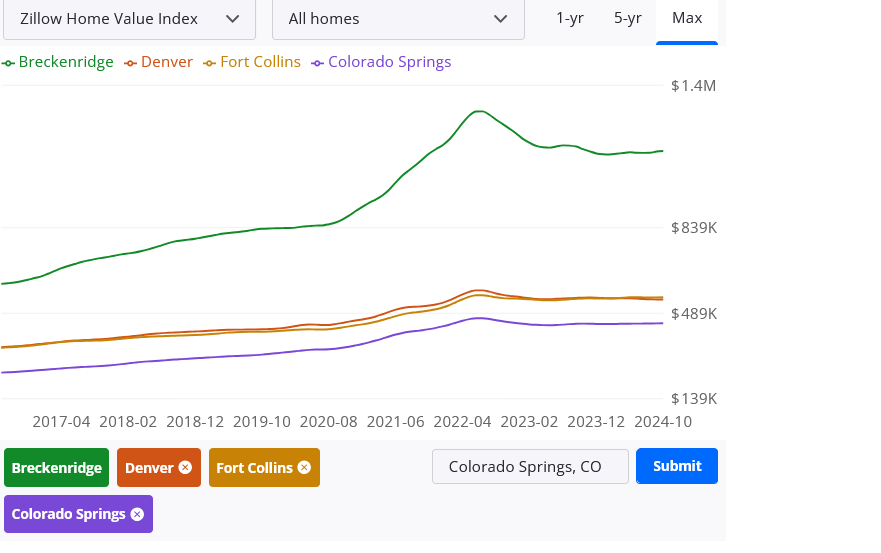

Denver in the past was always a top pick of places to relocate to, but things have changed quickly. Now Denver is commonly on the list of best places to move out of. The number one driver is cost. Denver has gotten expensive and as rates have doubled it has gotten even more expensive. This change is evident in the recent sales data with basically flat prices while inventory and days on the market are jumping.

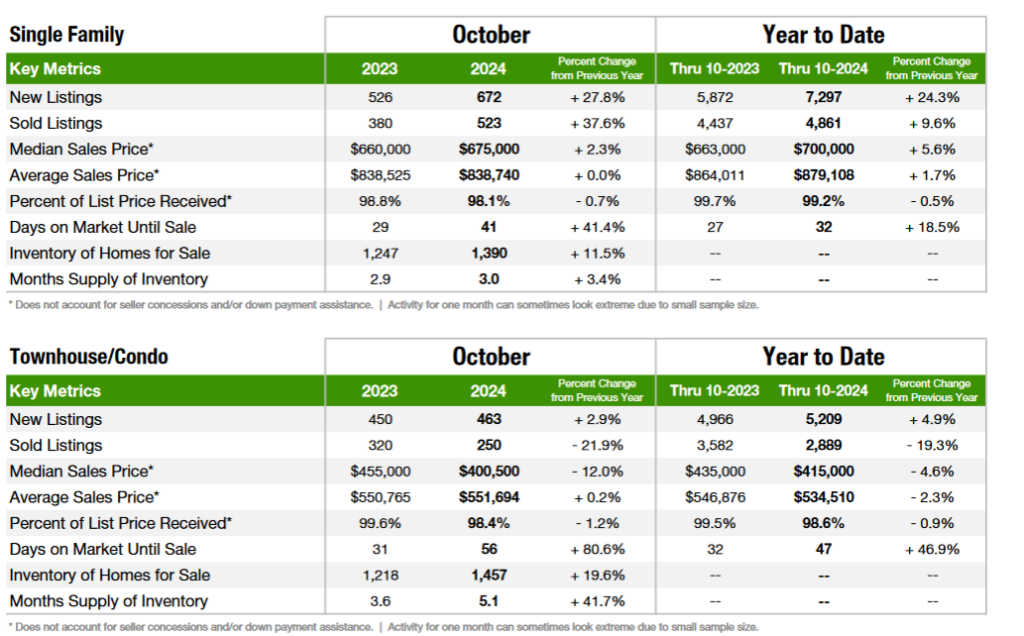

Single Family Homes

Single family homes in Denver will radically outperform condos but they will still be in for a tough year. I see prices down 5-10% next year due to rates remaining high and inventory increases. Furthermore, the increasing property tax and insurance burdens in Denver will continue to weigh on the market.

Condos

Condos are in store for a huge reset, with days on the market almost doubling and months supply up 50%. As of October, prices were off about 5% and unfortunately this trend looks to accelerate in 25. Look for condos to fall a further 10-15% with some of the lower cost condos falling even further as HOA dues, special assessments, etc… make many of these properties more expensive than renting.

Note, the front range suburbs will perform better than Denver due to their lower price points along with lower tax bills, better schools, lower crime, etc… I see the suburbs off around break even to off 5% in 2025.

Ski towns (Steamboat, Breckenridge, Vail, Aspen, Winter Park, Telluride) 2025 real estate predictions

The ski towns will come off their highs. Look for drive up resorts like Breckenridge and Winter Park to come off around 5- 10% as the Denver market softens. The destination resorts like Steamboat and Vail will fare better with prices staying flat to coming off around 5%. Note, single family homes in the ski towns will also outperform condos in Denver for similar reasons of higher HOA dues coupled with an increasing number of special assessments for big projects like roofs, elevators, etc…

The assumptions above could be drastically altered if the stock market goes through a large correction as ski towns have a very high correlation to the stock market.

Other/rural/smaller markets in Colorado real estate predictions

I think the flight to the exurbs/rural areas will continue to be a passing phenomenon in 2025 as people get back into the office and into old patterns. These are the highest risk areas as local income is not high enough to support the prices with the current interest rates. This will lead to a reset in the 10-15% range. I’ve already seen this in some rural markets where prices spiked during the pandemic only to fall back to 2015 values.

2025 Colorado commercial real estate predictions

Overall Commercial real estate will have a tough run in 2025 as interest rates remain elevated, many deals no longer make sense. Furthermore, there is a glut in certain property types like office, apartments and large industrial that will take some time to adjust

Office: A space will get hurt with prices coming down around 20-30% B/C space will get annihilated as the rents cannot keep pace with rising cap rates and vacancies increase. Look for the bottom to fall out in the office space with many building owners simply walking away, we have already seen buildings in Denver core trading at half of their values from just a few years ago.

Multifamily: This sector will stay flat as rents continue to rise or worst case stay flat. Ironically B/C units will fare better as there is more demand for rents at the lower price points. Overall apartments will be okay, they will just kick along in 25 with no huge movements. The suburban markets just like in residential real estate will outperform the Denver downtown markest

Industrial: This sector will languish in 25 as warehousing/distribution slows down with the shift of consumer buying preferences. It could take a few years to work through the large amounts of space which will put pressure on new rents. Long term Denver is well positioned as a hub for the intermountain west but in the short term look for some sizable resets in rents, vacancies, and ultimately prices.

Retail: Class A retail will do fine as most have long term leases, big box/lower tiered retail will struggle as consumers revert to traditional buying patterns and continue their pullback on goods purchase. You will see a continued reset in the Restaurant sector as rising wages and continued price pressures force more closures.

Summary:

2025 is going to be a bumpy year in Colorado real estate. During the Covid years, basically anything with 4 walls went up substantially. Those days are long gone with certain types and locations of real estate performing radically different. For example Denver single family homes are flat while the bottom is dropping out on condos, furthermore better suburban areas are outperforming core downtown areas. What does this all mean for Colorado real estate in 2025.

Also remember whatever happens in Denver eventually spreads throughout the state albeit sometimes with a lag. 2025 will be a repeat of 24 with very low volumes and meandering prices. Fortunately I don’t see a 2008 repeat, in residential but it will still be painful for anyone who bought in the last year or so or who has to sell for whatever reason.

Commercial real estate is a whole different animal with rents dropping, vacancy rising, and ultimately prices facing a huge reset especially in the office sector along with restaurants and certain retail. As rates remain higher for longer, there will be increasing stress on every commercial property type as cap rates remain elevated.

Realtors, lenders, appraisers, etc… will have a tough ride as volumes will stay extremely low throughout Colorado until there is a major reset in the economy that forces individuals and businesses to sell and rates to come down. Long and short 2025 in Colorado looks to stay the same for some but certain sectors like condos or rural properties will worsen. We can always look forward to 2026

Additional Reading/Resources

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender