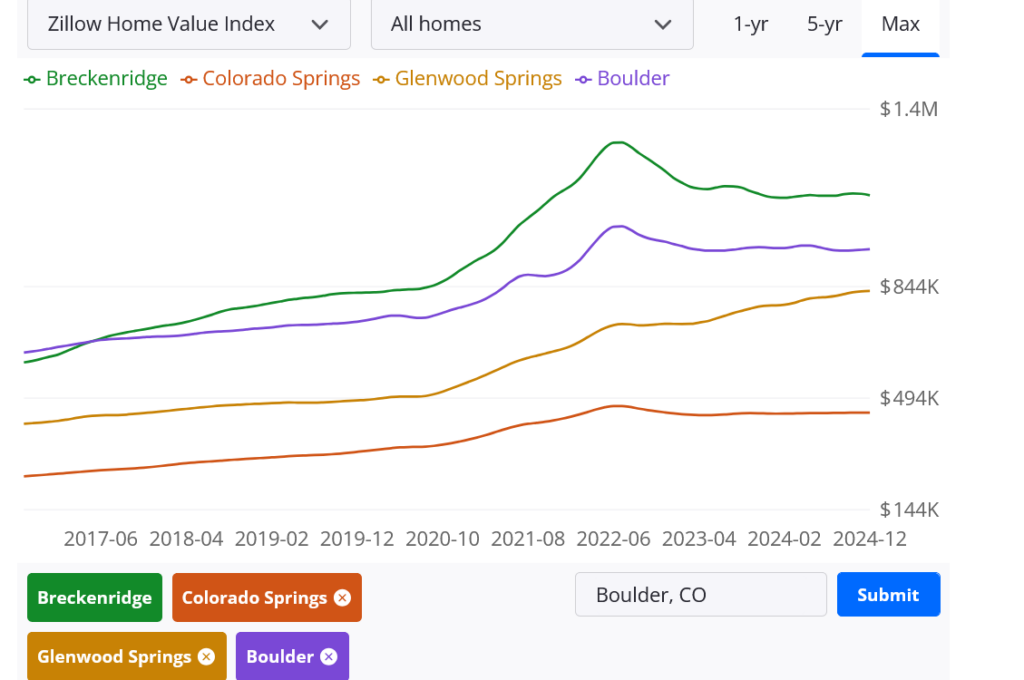

When you look at the chart above of single family homes, there is a major outlier in red. What is happening in Colorado Springs? Is Colorado Springs a warning for real estate throughout Colorado. On the flip side look at Glenwood Springs (orange) it is bucking the trends. Why are Breckenridge and Boulder trending in almost lockstep. What does the chart mean for other markets throughout Colorado? Why are we seeing a huge divergence between markets within Colorado?

What was in the data on Colorado Real Estate?

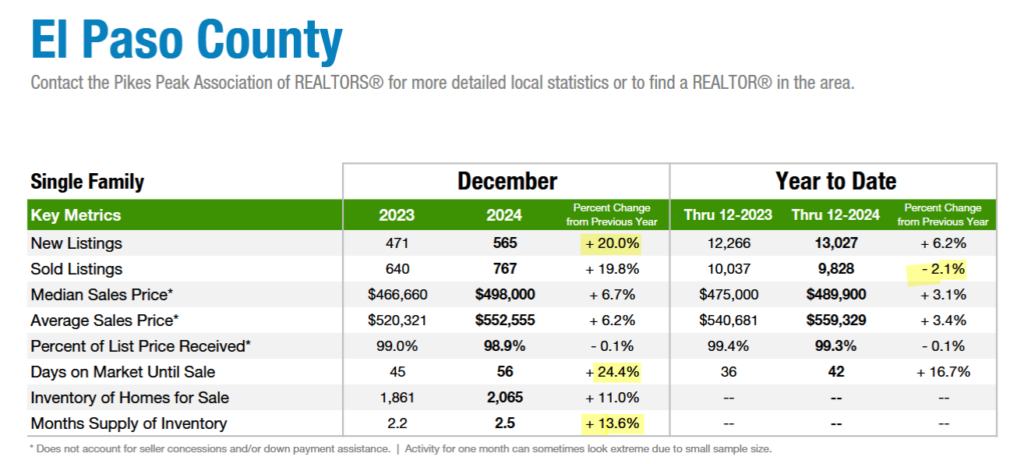

Look at the chart above of El Paso County, home to Colorado Springs. Days on the market has surged 24%, month’s supply has surged 13.6%, while at the same time year over year sold listings are down 2.1%. Essentially supply continues to increase while sales are also slowing. This is not a good combination heading into 2025.

Why is Colorado Springs real estate under performing?

Colorado Springs is a “mid priced” market. If you look at CO springs vs Boulder, the median price is about double. The CO springs market is getting hit hard by the rise in interest rates as less “move up” buyers now qualify. Along with rising rates, insurance, taxes, maintenance, etc… all are increasing which further erodes the buying power of the middle market.

Why are Boulder and Breckenridge following the same trends?

I thought it was interesting to see the chart above that Boulder is almost lockstep with Breckenridge. The reason behind the correlation is that they are similar demographics, a homeowner in Boulder is a good candidate for a second home/condo in Breckenridge for ski/mountain weekends. In essence as prices rise and fall in Boulder this is influencing buying decisions in Breckenridge.

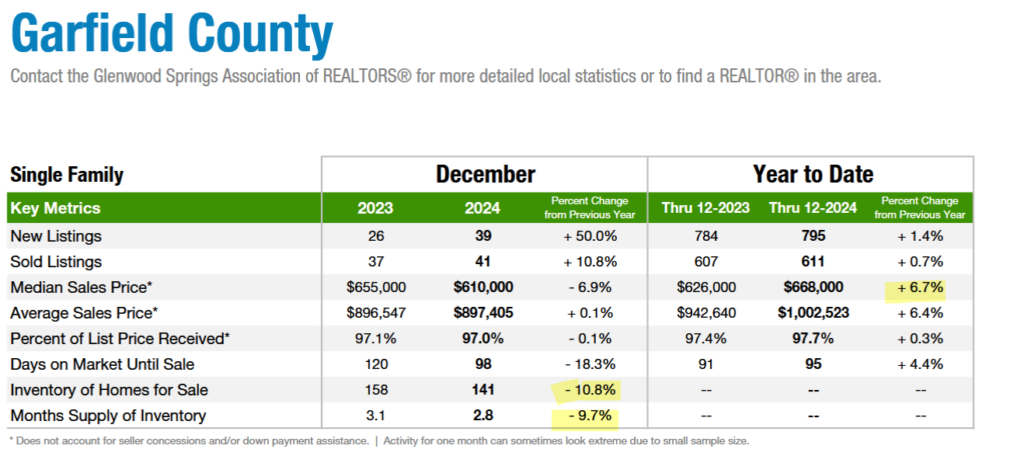

What is causing Glenwood Springs real estate to outperform?

The chart above initially surprised me a little. I would have thought Glenwood would have reacted similarly to CO springs with a big impact on rising rates. Ironically just the opposite is happening in Glenwood as inventory has declined 11% and median sales prices has also continued to increase. The driver of the Glenwood market is the rising costs up valley Carbondale, Basalt, Snowmass, etc…) which is leading to a continued rise in prices as buyers can’t afford to live in many of the towns anymore. We are seeing this same trend happening outside of Steamboat where Oak Creek and Hayden are now seeing increasing values as buyers are priced out of the closer in ski markets.

What does this mean for Colorado real estate prices in 2025?

First, Glenwood is a bit of an outlier as it is being influenced by the huge jump in demand of the up valley resort markets. On the flip side, Colorado Springs should be a warning for other mid priced markets (Greeley, Ft Collins, Pueblo, etc…) as interest rates and rising costs of property taxes and insurance are starting to impact the market.

Although we haven’t seen a reset in prices just yet, increasing inventory coupled with slowing closing volumes can only lead one way which is a decline in prices. Colorado Springs shows that the middle is getting hit hard while lower priced and higher prices are holding up better. Take this into consideration as you are buying/selling real estate throughout Colorado (also refer to my 2025 Colorado Real Estate predictions)

Additional Reading/Resources:

- https://www.fairviewlending.com/will-mortgage-rates-stay-higher-forever/

- https://coloradohardmoney.com/2025-colorado-real-estate-predictions/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share my articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, Hard Money Lender, Private lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender