Does the Ford f150 predict Colorado real estate prices?

Will Oil impact Colorado Real estate?

With Oil prices falling from 100 a barrel to a low of 40 a barrel, what does this mean for Colorado? Colorado has become a major producer in the energy sector behind Texas with many counties contributing a large portion of their growth directly to the boom in this sector (see article from Greeley Tribune: Oil prices plunge, signaling drilling slowdown)

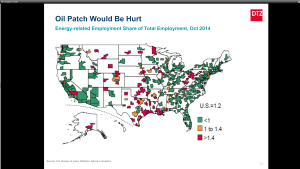

So how will this impact Colorado as a whole? Cassidy Turley recently released a research piece highlighting the areas in Colorado with energy as a large percentage of total employment (I put a copy of the map in Colorado and the counties at risk on our site)

What does this mean for real estate prices? According to Arch Mortgage Insurance, Colorado is now on a short list with much higher probability of decline than other markets (see Denver Post Article). According to their study, Colorado has a 17% probability of decline. This might get worse… much worse.

What is the cause of the rapid price declines? What is the f150 impact I alluded to? Just like any other market prices are driven by the basics of supply and demand. Recently there has been a huge surge in supply (Colorado has more oil in storage now than at any time in 80 years; there is so much supply that we are actually running out of places to store it). Not only is there a supply problem, there is a demand problem. I like to call this the Ford F150 effect. In past years a ford truck (the number one selling vehicle in the US used to get 10-12 miles per gallon, the new lighter truck that came out today gets a combined 22 miles per gallon). This new model is twice as efficient as the last one which further reduces demand. This same trend is happening all over the auto industry. Along with fuel efficiency of vehicles, electric plants are also consuming less energy. One of the top reasons is energy efficiency in the house. For example I just switched out a few 100 watt light bulbs in my house with LED bulbs, instead of 100 watts, the new bulbs might use 10 watts.

As a result of the huge increase in supply and drop-off in demand oil prices have been in a free fall and likely will not recover anytime soon, according to some analysts this could mean sub 50 (and even 20 a barrel oil is here to stay) and here is a recent article from Bloomberg on why low oil prices are here to stay

Along with supply and demand there are political factors at play. There is a recent proposal to put a ballot initiative on that would ban fracking. If this occurs many of the wells in Colorado would no longer be profitable (it would be too expensive to use other technologies right now). See the Denver post article

So what is my prediction? Where will these impacts be felt? I think real estate prices will be impacted in many markets especially Northern Colorado and the Western Slope (Coal is already in the tanks due to the low oil prices). Fortunately Denver is diversified enough with various industries that the impact will be limited although there could be some impact in the office sector due to the large number of energy tenants (the Cassidy Turley webinar is a pretty interesting analysis of the commercial sector. The wild card are the political forces, if the production costs in Colorado rise, many of the wells in Colorado could be underwater from a price standpoint and drastic cutbacks could ensue. Stay tuned for the 16 election, it is going to be interesting.

Written by: Glen Weinberg: COO/Partner Fairview Commercial Lending. He specializes in Hard Money/ Private money loans on both residential (no primary) and commercial properties throughout Colorado along with Georgia, Illinois (commercial only), and Florida.

Learn More about our Colorado Hard Money Programs: www.ColoradoHardMoney.com