Hopefully many of you on this list took the time to appeal your Colorado property taxes. I absolutely did! For my appeal, I filed the formal appeal and also spoke with the assessor to discuss. I got my letter this week and the assessor refused to adjust the value even one dollar. Fortunately during the process I found a fundamental error in their reasoning that will help you in the next step. If you got your appeal back and are not satisfied, what do you do now? Fortunately you have an option that you should exercise.

What happened on my Colorado Property Tax Appeal?

I was floored to get the letter in the mail saying that my value was not changing at all. I had three valid comps that showed my property was overvalued by a substantial amount (25%). I spoke with the assessor about my concerns, but he didn’t seem to care.

I was suprised as another house that was nicer than mine that was two doors down sold after the assessment period for 30% less than what the assessment said the value was. Even though this is not a valid sale, it further proved that the assessor was way too aggressive on their valuation.

The assessor had his thoughts on what the value should be regardless of any data I presented but I was still surprised to not get any relief on my assessment even after I pointed out a fundamental flaw in their reasoning. This is the first time I have ever done an appeal and not received a substantial reduction.

What fundamental flaw am I seeing with assessors data?

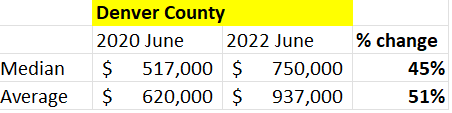

Fortunately, there is a fundamental flaw in the assessor reasoning that could help in the next step of the appeal (I haven’t looked at every county, but I’ve seen this same issue in several counties especially in the mountains). This assessment year was unique. With such a fast moving market, appreciation was off the charts. Any property that was sold during the assessment period had to be brought to 6/30/22. For example, if a house sold on 1/1/22 the assessor would have to adjust the sales price based on annual appreciation. In the case of my property, the assessor calculated that houses were appreciated at 3.2%/ month, so in the example above if a house sold for 1 million on 1/1/22, the adjusted sales price would be (19.2% higher 6 time 3.2%) leading to an adjusted value of 1, 192,000 to use as a comparable.

On the surface this seems logical, but as I dug into the data there was a fundamental flaw. The assessor was not using “price bands” to accurately calculate the appreciation rate. Unfortunately, the market proves that this assumption is not valid. As we see in the data a one-million-dollar house appreciates substantially faster than a 3 million dollar house on a statistical level. We have seen this throughout the market as lower priced houses are appreciating faster than the upper end of the market.

It is no surprise that a 2 million dollar house appreciates substantially slower than an 800 thousand dollar house, yet the assessor was averaging them all together to determine an appreciation rate. The number was substantially different, in my case the appreciation rate per month was 50% lower than the assessor’s. I found another house 4 doors down that “double sold” during the time period. Essentially it sold mid 2021 and then again early 2022. There was 8 months difference between the sales so I could take the appreciation and average it over the 8 month period. The number was substantially lower than the one used by the assessor.

If I use the same example above with a 2% appreciation rate the difference is 70k lower, if I took that over a longer period depending when the house sold the number will be even larger.

Comparables not really comparables

I also saw in my assessment that the comparables used by the assessor were not great comps for my property. Even though the houses are in the same neighborhood, even a few doors down could be huge. For example, one could be on a busy thoroughfare vs backing up to open space with a creek and yet minimal adjustments were made for these differences.

If you have property in the mountains, the differences are huge. For example, the difference between a house with a view vs no view could be 20-30%. With the shear volume of appeals, I don’t think many of the assessors had the time to properly factor these variables in. For example on my house, the field on the assessment data is left blank which means that it has not been defined.

What should you do now?

Once you get your letter you can flip it over and it provides instructions to continue your appeal with the board of equalization. If you have good hard comparables and see fundamental flaws in the data, you should take it to the next level. I just sent my next appeal to the board of equalization and here are a few tips:

- On your appeal, you can attach a letter/documentation, I would highly encourage you to write out your reasoning and why the assessment is not accurate using hard data like comparables to prove your point

- Look at the appreciation rate the assessor is using. If you have any house other than the lower priced in the area, it is likely that the appreciation rate is too high. This is a low hanging fruit.

- Make sure your property characteristics are accurate

- On the letter it requested it be sent certified/registered mail, not sure why as the first appeal did not mention this, but I went ahead and sent via a fedex envelope to be safe.

- The appeal must be postmarked by 7/15 so you do not have much time

- The Board of Equalization will set a hearing to discuss the appeal and then provide a ruling by 9/15

Summary

There is no doubt that appreciation during the last assessment period was off the charts but that does not mean that your property appreciated the same as the average in the market. Averages can be grossly misleading with lower priced properties appreciating at a much faster rate than higher price properties. Hopefully you won in the first round of appeals, but if you didn’t fortunately there is a step to continue the appeal. I would encourage you to go this route as you don’t really have much to lose if anything other than your time.

I’ll keep everyone posted on my journey with the appeal and would love to hear how your appeal went/is going.

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender