The data is staggering in three months from June through August, the median home price in Aspen for a single family home doubled, with the average sales price north of 7 million. Has Aspen hit a peak? How do the other Colorado ski towns compare? Are we at risk of a bubble? What resort town is most at risk of a fall?

What was in the Colorado ski town sales data?

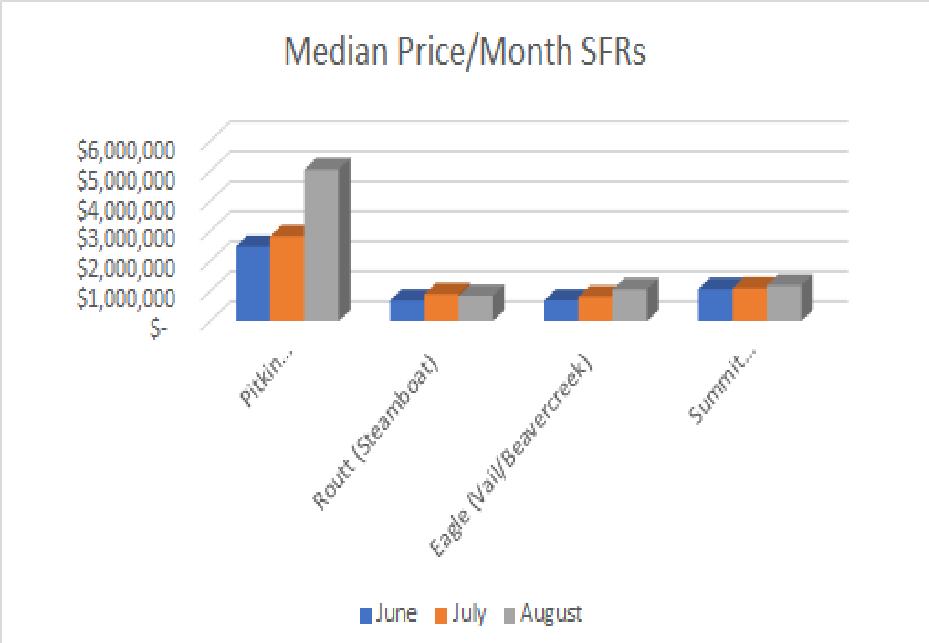

First, I looked at median sales price in four major Colorado Resort Towns (Aspen/Snowmass, Vail/Beavercreek, Breckenridge/Frisco/Keystone/Copper Mountain, and Steamboat. The reason I am focusing on the median is because the average can be greatly skewed in the mountains by large sales prices. For example, a 40 million dollar sale in Aspen greatly increases the average. All of the mountain communities have shown substantial increases in median home prices with Aspen doubling and Vail/Beavercreek up almost 53% during the three months.

Note: (the data comes from the Colorado Association of Realtors) When you look at Routt county the data might seem off… you are correct, the median home price in Steamboat is now around 1.1m as there are lower sales in more rural parts of the county. I broke out the sales by county where each resort is located to keep everything consistent so I didn’t have to compare mountain sales versus town sales, versus etc…

| June | July | August | % change June to August | YTD August increase | |

| Pitkin (Aspen/Snowmass) | $ 2,485,000 | $ 2,830,000 | $ 5,062,500 | 104% | 14.60% |

| Routt (Steamboat) | $ 692,000 | $ 905,000 | $ 847,500 | 22% | 19.70% |

| Eagle (Vail/Beavercreek) | $ 695,000 | $ 818,000 | $ 1,065,000 | 53% | 7.70% |

| Summit (Breck/Frisco/Copper/Keystone) | $ 1,075,000 | $ 1,100,000 | $ 1,197,500 | 11% | 6.90% |

When I annualize the sales over the year, the increases are not as crazy as the three-month summer season.

| YTD August increase | |

| Pitkin (Aspen/Snowmass) | 14.60% |

| Routt (Steamboat) | 19.70% |

| Eagle (Vail/Beavercreek) | 7.70% |

| Summit (Breck/Frisco/Copper/Keystone) | 6.90% |

Days on the market plummets

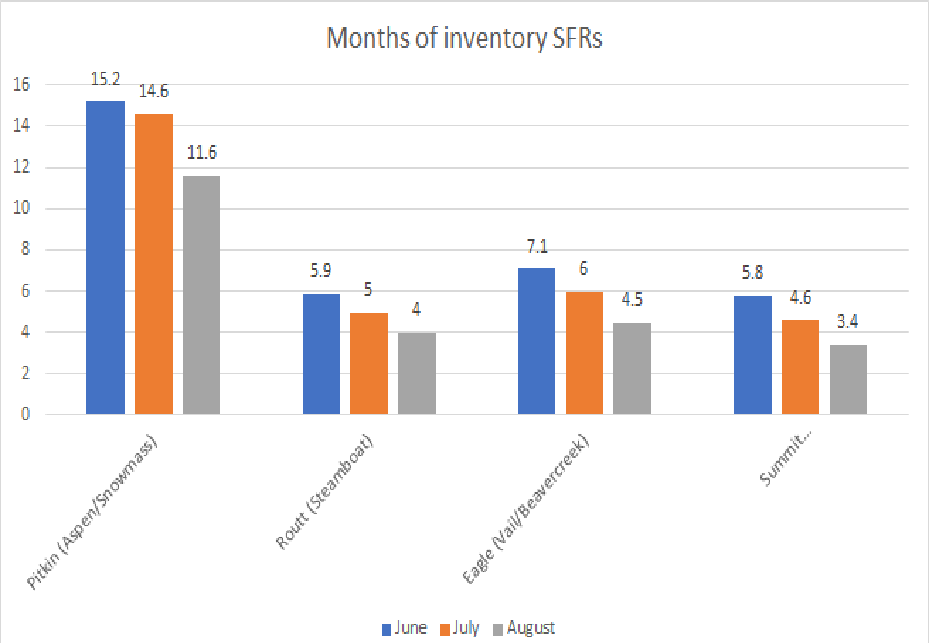

In all of the ski resort markets throughout Colorado, inventory has plummeted. This is not surprising as there is little available land and build costs are extremely high. Low inventories will continue to propel prices higher throughout the resort communities.

| Months of Inventory (SFRs) | ||||

| June | July | August | % Change June to August | |

| Pitkin (Aspen/Snowmass) | 15.2 | 14.6 | 11.6 | -24% |

| Routt (Steamboat) | 5.9 | 5 | 4 | -32% |

| Eagle (Vail/Beavercreek) | 7.1 | 6 | 4.5 | -37% |

| Summit (Breck/Frisco/Copper/Keystone) | 5.8 | 4.6 | 3.4 | -41% |

Has Aspen peaked?

Based on the huge run up in prices over the last three months where the median sales price has doubled, I think Aspen is about at a peak. With an average sales price over $7 million the available pool of buyers is dwindling which will dampen demand. There still might be a little bit of gas left in the tank but Aspen is somewhere near a peak.

Where do we go from here in the Colorado ski towns?

Vail, Breckenridge and Steamboat could have a bit more upside left in this cycle, with days of inventory precipitously low, prices are bound to continue to increase. There is nothing in the pipeline that will substantially alter the inventory situation. Furthermore, as Aspen has gotten so expensive with the average sales price around 7m, Vail, Breckenridge, and Steamboat look like relative bargains which will continue to attract buyers that are priced out of Aspen but still want the Colorado resort lifestyle

Will there be a bubble in the Colorado ski resort real estate?

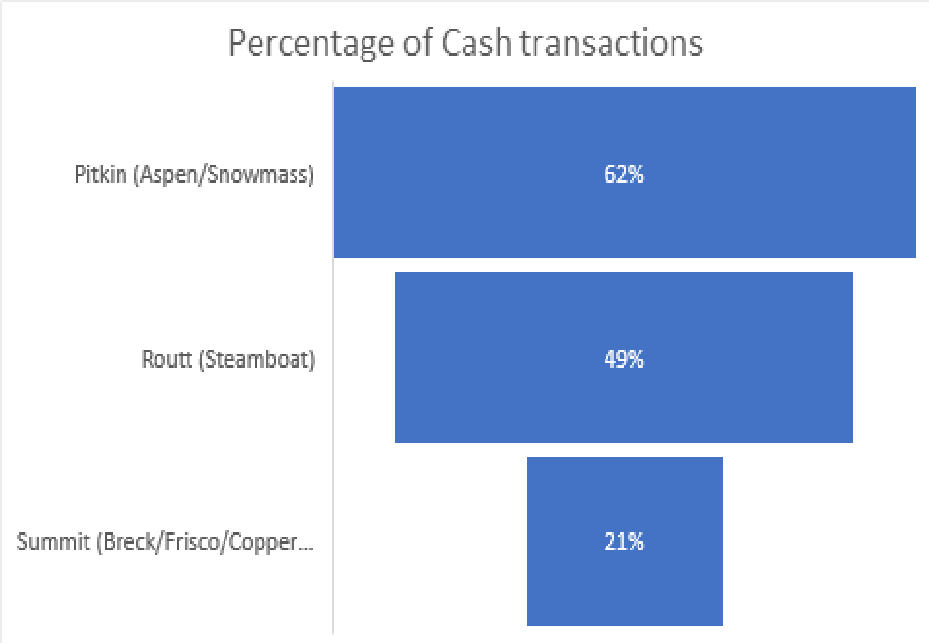

This is the most common question and many are convinced that the mountain towns will endure a precipitous fall. Unfortunately, this couldn’t be farther from the truth. There is no bubble in the various resort communities in Colorado for three reasons.

- There is little if any excess inventory for the market to absorb, furthermore there will not be large defaults due to the equity in properties and jumbo requirements with substantial down payments.

- Demand will stay constant or increase. It is not like all of the sudden Aspen is not going to be a desirable place to live or visit.

- The most important variable is the amount of cash transactions. Look at the percentage of properties bought with cash in each of the resort communities (source land title). For example in Steamboat almost half of all transactions have no financing and in Aspen this number is 62%. The amount of cash transactions greatly mitigate the downside risks as there is unlikely to be a distress situation that forces a fire sale of a property like a foreclosure would.

| July | |

| % of sales paid for in cash | |

| Pitkin (Aspen/Snowmass) | 62% |

| Routt (Steamboat) | 49% |

| Eagle (Vail/Beavercreek) | ** not available |

| Summit (Breck/Frisco/Copper/Keystone) | 21% |

What town is more at risk for a correction?

I use the term “more at risk” in a relative sense as I am very doubtful there will be a large correction. Summit county has the smallest percentage of cash transactions which makes it more susceptible to a correction. Since the pandemic struck Summit county has become a hotbed for remote workers and many workers from the Denver front range that only need to access Denver a few days a week. Breckenridge has become an “ex-urb” of the Denver metro area which is why a higher percentage of transactions involve financing as opposed to destinations like Steamboat or Aspen.

Although Summit county is “more at risk” than Steamboat or Aspen, the risk if very minimal as Summit county has one of the lowest inventories of all the mountain towns.

Summary

When the pandemic struck, I was concerned about real estate values. My prediction was that they would hold steady. I would have never predicted that Aspen would double in a 3 month period, but looking back onto what has transpired since March it is not surprising.

Buyers want to be in safe places and high net worth executives have realized they can work most of the time or even all the time in a great location with many of the same amenities they had in their respective cities without much if any negatives that city life brings. This trend will obviously slow as vaccines are approved, but I don’t think that we will see a bursting of the bubble due to the large amount of cash transactions, low inventory, and desirability to live and play in the various resort towns.

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)