Wow, it seems Colorado real estate has turned on a dime. Even with interest rates coming down inventory is increasing throughout the country. What does this mean for Colorado real estate? When I zoom into some of Colorado’s biggest cities, there is one other trend that is even more worrying than inventory that I have not seen before in the last 3 real estate cycles. What is this new trend and what does it mean for Colorado real estate prices?

To develop this analysis, I used data from the Colorado Association of Realtors by county. I’ve been using this data for years and it is collected consistently with ample historical data to draw assumptions.

Why am I looking at condos vs single family homes

Condos are typically a cost-effective option for first time homebuyers and give an indication of what the move up market will be. For example, historically a buyer would start in a condo, gain appreciation, and then move up into the single family market at a little higher price point. Don’t get me wrong not everyone follows this path, but the condo market is an indication of the lower priced segment of the market.

Furthermore, as interest rates have dropped, I would have expected condo demand to pick up as this is a very interest rate sensitive part of the market. Ironically even with rates dropping, condo demand has declined along with prices.

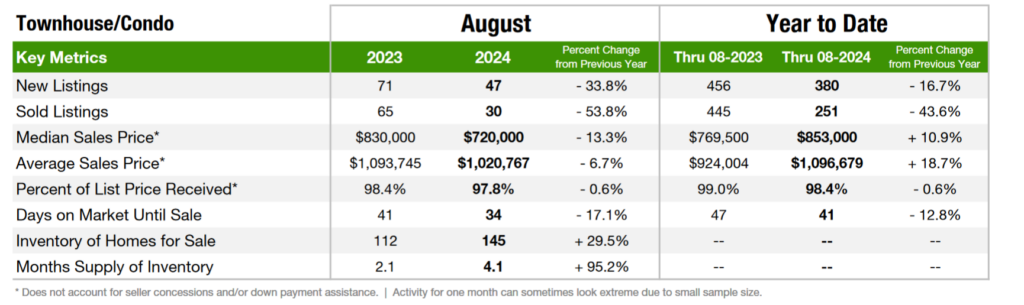

August condo numbers show a huge shift

Look at the chart below. For my analysis I looked at Denver, El Paso (CO Springs), Boulder, Summit (Breckenridge), and Routt (Steamboat) to see how each market is reacting to the shift in the real estate market.

August, which should be one of the biggest months in real estate, shows a huge shift with inventories rising markedly in all five markets and median home prices showing big declines in over half the markets. Below is a table showing each market.

| Condos: August 2024 | ||||

| County | months supply | % change in Inventory | Median condo price | % change in median price23-24 |

| Denver | 4.7 | 51.6% | $ 377,500 | -11.50% |

| El Paso | 4.7 | 74.1% | $ 345,000 | 1.50% |

| Boulder | 4.9 | 58.1% | $ 454,500 | -7.60% |

| Summit | 6.9 | 25.5% | $ 865,000 | 15.90% |

| Routt | 4.1 | 95.2% | $ 720,000 | -13.30% |

Profound changes in the ski towns. Take a look a the chart below for Steamboat. Note the huge jumps in inventory along with a decline in the median and average sales price. Furthermore look at the number of sold listings, down 44% from last year.

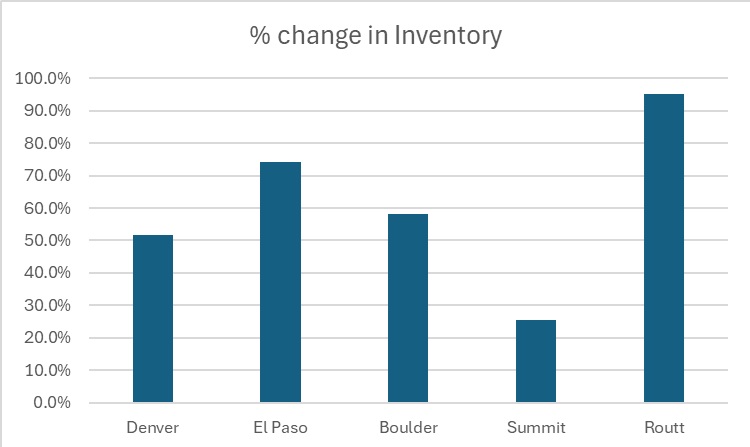

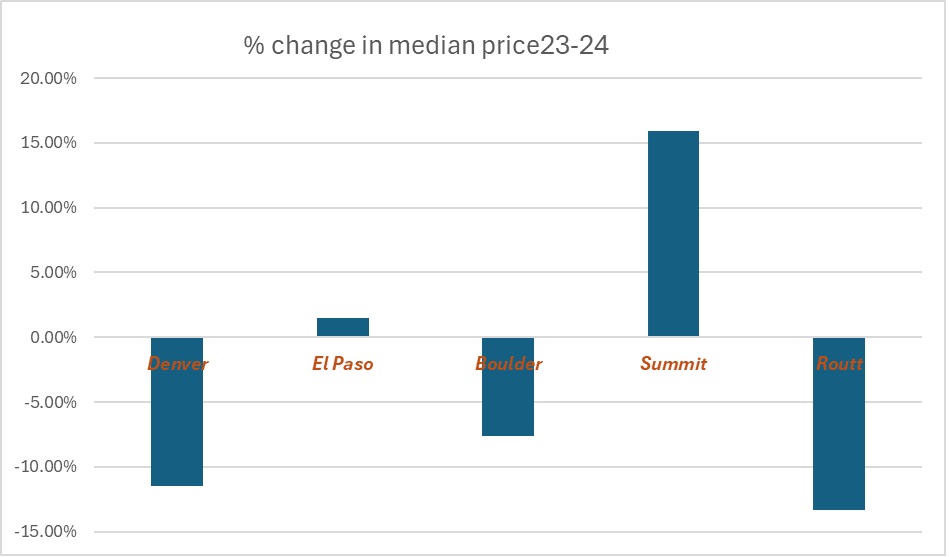

Two graphs that show the huge shifts in the Colorado market

To dig into the data further, I put together two graphs which show the big changes visually. Looking at the changes in condo inventory, the inventory in Routt (Steamboat) basically doubled with Boulder and El Paso also charging higher. Not surprising if you look at the second chart, the huge change in inventory has led to drops in median prices of Condos. Note, I think El Paso is an anomaly and we should see the median condo price drop over the next few months.

Much more of a correlation in markets throughout the state

When I first started looking at the data obviously the huge increases in inventory and subsequent decline in the median price jumped off the page. But, after I thought about it more, the real story is the huge correlation between all five markets. Typically markets like Steamboat and Boulder are lagging Denver and El Paso meaning I would expect Steamboat and Boulder to perform considerably better initially in a real estate cycle.

When I go back to 2008, we saw Denver and El Paso counties fall much earlier than places like Steamboat and Boulder. Steamboat and Boulder were about 6-12 months behind Denver which is very different than we are seeing in this data where Boulder and Steamboat are almost leading Denver into the next market.

Having high correlations means that any downturn will be worse as all five markets will basically fall at the same time as opposed to the last recession where the falls amongst the markets was more staggered. This is a worrying development as I’m convinced that there will be a reset in real estate prices as the economy cools.

Are condos a leading indicator for single family homes?

Condos are a good leading indicator for single family homes. As condos are at a lower price point I suspect that what we are seeing in condos will ultimately “trickle up” the market and ultimately impact single family homes. There will not be an immediate impact on single family homes, but I suspect that we will see a similar trend to condos play out in the single family early in 2025 as inventory continues to increase.

If I look at Denver, days on the market have increased 40% and months of supply has increased 25%, ultimately this will lead to lower prices. One sidenote, in Routt County/Steamboat I don’t see the same trends happening to the same extent as inventory of single-family homes has decreased -16.2%. Long and short, each market will react a bit differently and Steamboat on the single-family side will likely not fall as far as Denver due to substantially less inventory.

Very different paradigm shift in Colorado real estate

It is really interesting to see the data above as it is very different than what we saw in 2008. To see very high correlations to radically different markets throughout the state is a warning that there is a paradigm shift coming for Colorado real estate. Furthermore, when there is a correction it will be more severe due to the high correlation.

Condos are a warning for Colorado real estate with prices down in almost every market. Look for single family homes to pick up on these trends early next year as inventory increases and days on the market increases as well.

The above is all predicated on a soft landing in the economy which is a huge stretch. If there is a major hiccup in the economy, which is a high probability, there will be a huge acceleration of the trends we are just now seeing in condos. Just like the fall weather in Colorado, the most important takeaway is to expect the unexpected!

Additional reading/Resources:

https://car-co.stats.showingtime.com/docs/lmu/x/RouttCounty?src=page

https://www.fairviewlending.com/fed-cuts-rates-why-are-mortgage-rates-rising/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender