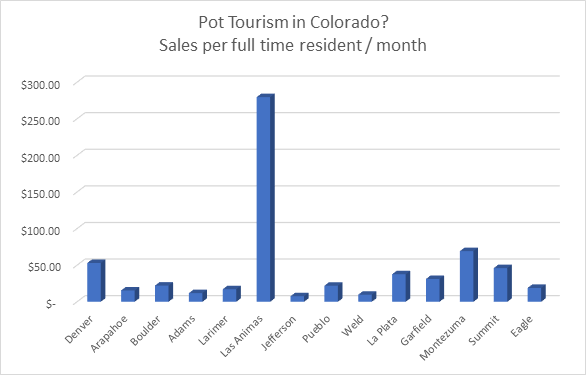

Cannabis was the new goldmine for many years. I always am entertained by the chart above form a few years ago showing the sales of marijuana/resident. Unfortunately, the high does not last and is turning more into a hangover as marijuana becomes more mainstream with legalization in other states. As a result Colorado marijuana prices have hit a new low, according to the state Department of Revenue, with the median price per pound dropping over 63 percent since 2021. What is happening in the Cannabis business? Who are the winners and losers in the new paradigm? What is the impact on real estate?

The last six months or so I’ve started getting an influx in calls about sales of retail and grow operations. I could feel a change underfoot as last week I had two eerily similar calls asking if I knew anyone who wanted to buy retail locations outside a ski town, the seller was willing to walk for basically with what they had in it. Why the sudden change of heart after the industry was touted as the next Gold Rush in the West?

What was in the data on Marijuana sales?

Last October, the price slid to a record low of $658 per pound. But the DOR’s latest average market rates (AMR) for a pound of marijuana flower are now at $649, the lowest price since recreational marijuana sales began in Colorado in 2014.

Released every quarter, the marijuana AMR measures median prices of various wholesale marijuana categories — despite the inclusion of “average” in the name — and extrapolates prices for the next quarter, in this case from April 1 through June 30, 2023. For four straight quarters, the AMR for flower has dropped to a new record low, and a few other marijuana plant matter categories have hit the floor, too.

The steep drop in most marijuana prices has coincided with a decline in dispensary revenue. After dropping 21 percent from 2021 to 2022, this year is already off to a slower start. Colorado dispensaries reported slightly under $129.4 million in sales for the first month of 2023, according to the DOR, which is nearly 15 percent less than the $151.1 million sold in January of last year, and more than 30 percent less than sales in January 2021.

Corporate America coming

As Canada legalized marijuana nationwide, corporate America has not gotten involved. Two major brands, Constellation the alcohol maker (corona, etc..) and Coca Cola, the soda maker, have begun investing in the industry along with countless others. Both Constellation and Coca Cola are multibillion-dollar companies that will put substantial dollars towards establishing a “first mover” advantage. This influx of dollars will radically change the “mom/pop” culture of the industry. Think of what happened to the corner hardware store after Home Depot and Lowes rolled out. Most smaller independent hardware stores have closed. The same will happen in the marijuana industry. If these two companies are making a bet in the space, look for countless others to follow suit as other states and countries legalize Cannabis the draw for corporate America will only increase.

Consolidation

With corporate America now engaged in the Cannabis industry, look for continued consolidation. To survive businesses will either mass produce or become niche players. This is similar to how the wine or craft beer industry has evolved. For example, Gallo winery has almost a 23% market share. The top six wine producers account for almost 60% of all wine sales (wine folly). The cannabis industry soon look eerily like the wine industry in the not so distant future.

Commoditization

As larger players enter, volumes should increase while at the same time prices will drop. The entrance of corporate America will lead to the commoditization of the Cannabis industry. It is unlikely that Constellation could find enough Marijuana manufactured indoors in a controlled environment to meet their needs. They will scale the business with outdoor grows to inexpensively produce the raw materials for their product. This will force prices into a freefall as the “commoditization” of the product intensifies.

No longer the “new thing”

Denver has already embarked on the next chapter legalizing magic mushrooms in the last election (note, they can’t actually legalize merely state that they will not prioritize prosecution, this is similar to how the marijuana movement began in Colorado). Currently in many towns/cities there are strict laws in place limiting the number and location of Cannabis stores. This has created “monopolies” for particular stores as competition has been severely limited. As cities/towns become more comfortable with Cannabis and its impact, more will “liberalize” their policies. For example, in Steamboat Springs there are currently two dispensaries. A new proposal will allow many more stores to open in the town in more highly trafficked areas.

As more stores open demand will not increase substantially, the revenue will merely be split over a larger number of players driving down the cost and profitability. The market will continue to be oversaturated. This will hurt many of the existing retail operators. Furthermore, as more states open to Cannabis, this will further dilute the revenues to more players and drive down prices with increased supply.

Real estate woes

As corporate America continues to plow into the Cannabis industry, real estate will be drastically altered. There are three distinct impacts:

- Indoor grows: Indoor grows will not be profitable as prices continue to decline. Many of these growing operations will be mothballed. This is where the largest impacts will be in real estate.

- Manufacturing: The manufacturing of oils/products should do better than the grow side. There will be a continued demand for oils/finished products and specialized locations/equipment for these processes. You will see consolidation on the manufacturing side as larger players either build their own processing capabilities (like a bottling plant for wine) or buy up smaller players.

- Retail Operations: Retail operations will be impacted as I see Cannabis evolving like liquor stores where it is a specialty store. There will be consolidation on the retail side as you will see large chains in many markets (like McDonalds or Wendy’s on the food side). Colorado has made online sales of recreational marijuana legal during the coronavirus pandemic. Now under Colorado’s emergency rules, customers can pay for marijuana online and then pick up their purchase at the store. This will further consolidate the retail side of the industry to larger players. What happens when sales go fully online with some sort of delivery option?

Summary

The woes for Colorado’s marijuana industry are just in their infancy. The impacts are already starting to flow through the real estate industry with consolidation and reduced prices for real estate. Prices will continue to adapt to the industry changes and heavily impact indoor grows and retail leaving this real estate worth considerably less than today.

Manufacturing and Retail should fare better but will still feel the impact of the industry changes. As more states legalize Cannabis further pricing pressure will occur driving even more consolidation and commoditization. Colorado real estate is at the forefront of the changes occurring throughout the country. Retail and indoor grows are the two areas to watch out for steep declines.

Additional Reading/Resources:

- https://tax.colorado.gov/average-market-rate

- https://www.westword.com/marijuana/legal-weed-prices-in-colorado-hit-new-record-low-16403612

- https://coloradosun.com/2020/04/13/online-marijuana-sales-delivery-colorado-coronavirus/

- http://fortune.com/2017/10/30/constellation-brands-cannabis-canopy-growth/

- https://money.cnn.com/2018/09/17/news/companies/coca-cola-cannabis/index.html

- https://winefolly.com/update/family-gallo-wine-brands/

- https://www.steamboatpilot.com/news/pot-shops-could-open-in-more-parts-of-town-following-steamboat-council-vote/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender