by Glen Weinberg | Apr 10, 2023 | 2022 Colorado election impact on real estate, 2023 Colorado real estate predictions, 2023 Denver real estate predictions, Aspen hard money, Best Colorado ski real estate, Boulder Real Estate, Breckenridge hard money, Breckenridge real estate, Colorado 2023 real estate predictions, Colorado commercial real estate, Colorado Election results, Colorado Hard Money, Colorado real estate market trends, Colorado Real Estate values, Colorado Realtor, Colorado residential property values, Colorado statewide zoning, Crested butte hard money, Denver private real estate loans, Denver real estate predictions

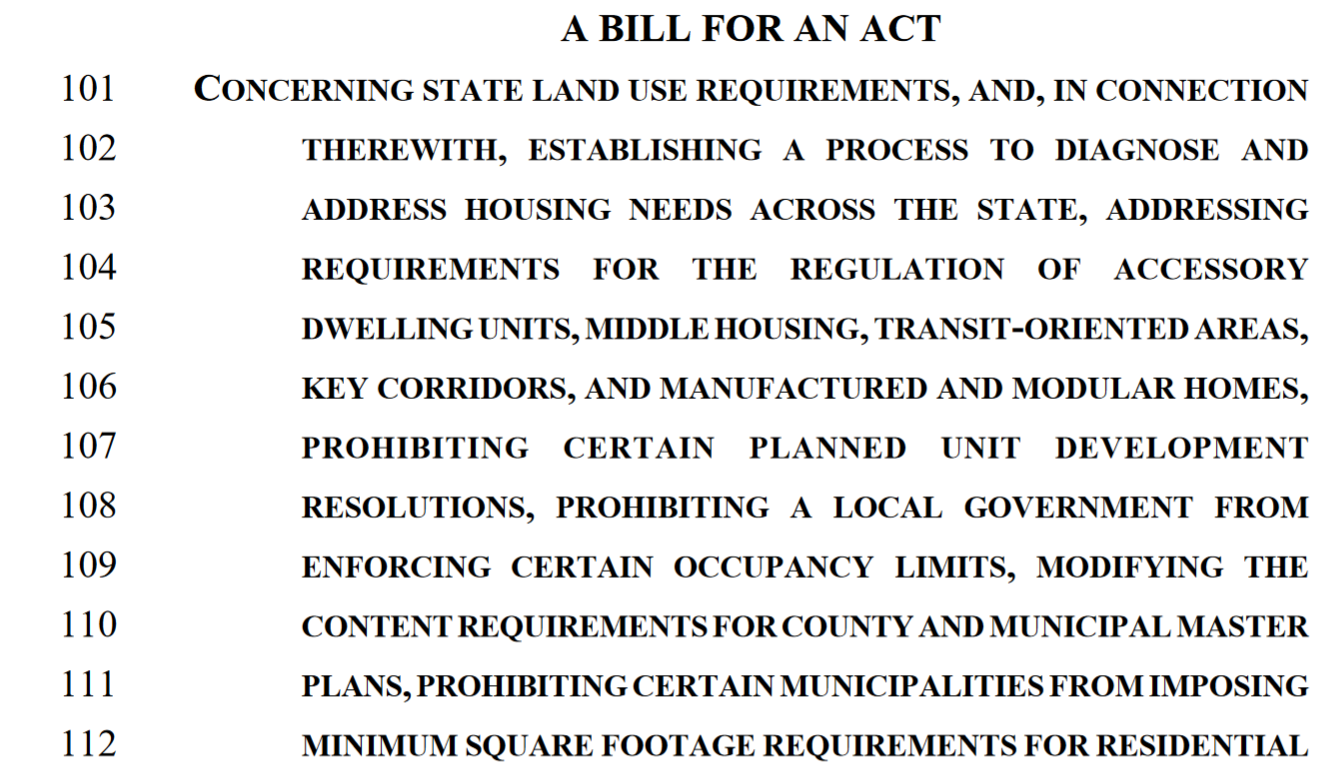

With a supermajority, the legislature has been busy crafting bills that will radically alter the real estate landscape. The recent proposal allows the state to dictate zoning in every county throughout Colorado and eliminate single family zoning. Colorado mayors...

by Glen Weinberg | Apr 3, 2023 | 2023 Colorado real estate predictions, Aspen hard money, Best Colorado ski real estate, Best colorado ski town, Breckenridge, Breckenridge hard money, Breckenridge real estate, Colorado Hard Money, Colorado hard money lender, Colorado Living, Colorado Private Lending, Colorado Real Estate values, Colorado Ski real estate, Colorado Ski towns, Copper Mountain Hard Money, Crested butte hard money, Frisco hard money, Frisco real estate values, NIghtly rental real estate, Ski lending/ investing, Steamboat hard money, Summit county hard money lender, Telluride hard money, Vail Hard Money, Vail real estate values, Winter Park Hard money

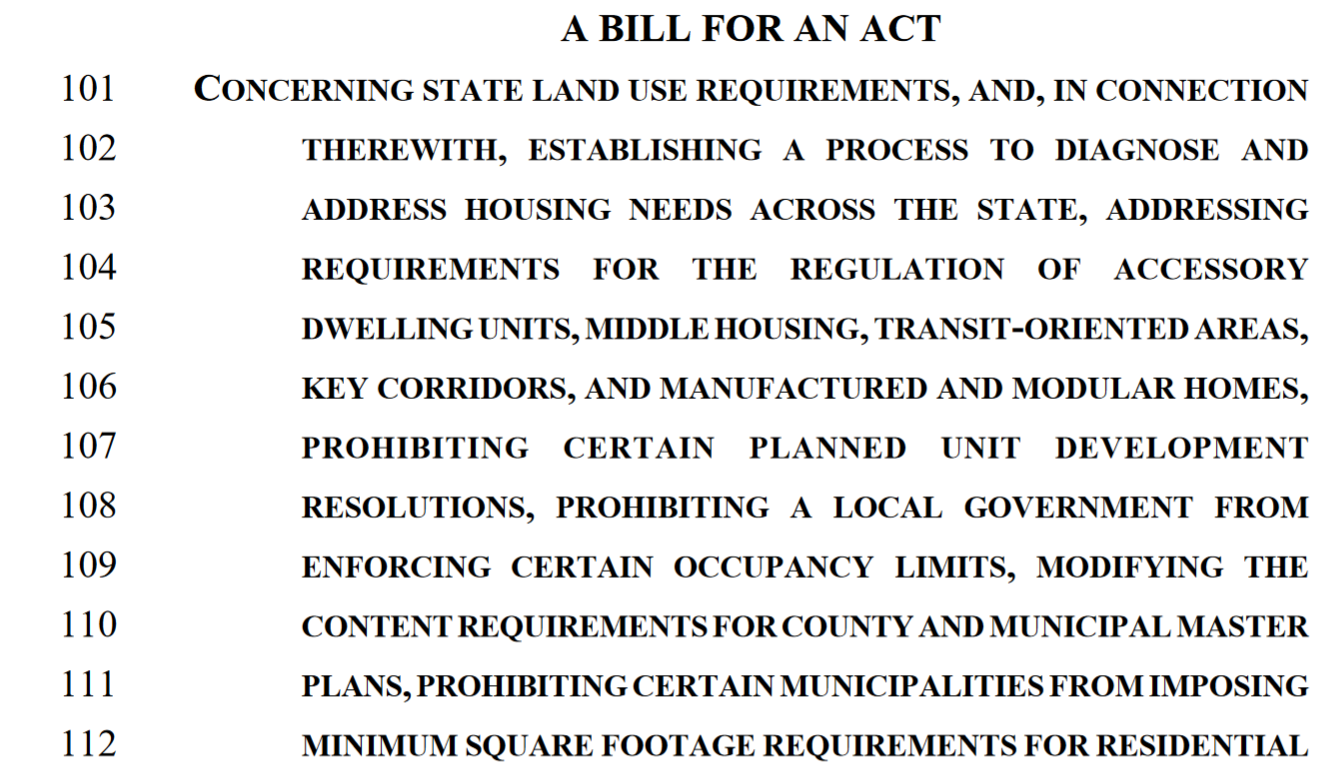

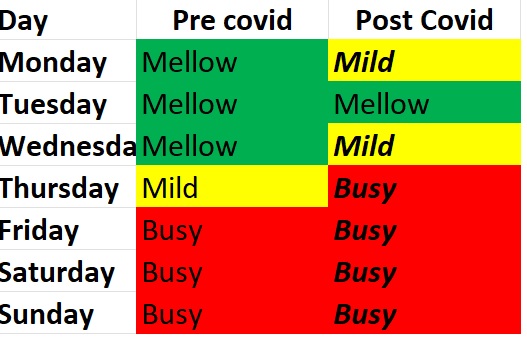

Anyone who has ventured into any Colorado ski town recently has noticed a profound change since Covid. Everything seems to be busy all the time, prices have skyrocketed, and longtime locals are quickly priced out. What is causing the swift changes and what...

by Glen Weinberg | Mar 27, 2023 | 2023 Colorado real estate predictions, are taxes going up or down in Colorado, Colorado Hard Money, Colorado hard money lender, Colorado hard money loans, Colorado property tax appeal, Colorado property taxes, Colorado real estate market trends, Colorado Real Estate values, Colorado Realtor, Denver Hard Money, Denver hard money Lenders, Denver Private Lenders, Denver Private Lending, Denver private real estate loans, Denver real estate predictions, Denver real estate values

The legislature passed a little known bill in 2021 to allow property owners to defer their property taxes above 4% increase starting in 2023. On the surface, this sounds like a great plan. Why wouldn’t someone want to defer their property taxes. Unfortunately the...

by Glen Weinberg | Mar 20, 2023 | 2023 Colorado real estate predictions, 2023 Denver real estate predictions, are taxes going up or down in Colorado, CO hard money, Colorado Affordable housing proposals, Colorado Election results, Colorado Hard Money, Colorado hard money lender, Colorado hard money loans, Colorado Private Lending, Colorado Rent Control, Colorado residential property values, Denver affordable housing initiative, Denver Hard Money, Denver hard money Lenders, Denver Private Lenders, Denver Private Lending, Denver private real estate loans, Denver real estate predictions, Denver real estate values, Denver Realtor, new rent control in Colorado

Every time I turn around there is yet another proposal to implement rent control. The newest house bill concerning requiring just cause for an eviction recently passed its first hearing. On the surface it sounds harmless, but the details are the most...

by Glen Weinberg | Mar 13, 2023 | 2022 Colorado election impact on real estate, 2023 Colorado real estate predictions, 2023 Denver real estate predictions, are taxes going up or down in Colorado, CO hard money, Colorado 2023 real estate predictions, Colorado Affordable housing proposals, Colorado Hard Money, Colorado hard money lender, Denver Hard Money, Denver hard money Lenders, Denver Private Lenders, Denver Private Lending, Denver private real estate loans, Denver real estate predictions, Denver real estate values, Denver Realtor

There is yet another proposal in the statehouse on affordable housing. This new bill would allow governments the first right of refusal on basically any multifamily property. On the surface, the new proposal sounds innocuous, but the devil is always...

by Glen Weinberg | Feb 27, 2023 | Aspen hard money, Best Colorado ski real estate, Best colorado ski town, CO hard money, Colorado Hard Money, Colorado hard money lender, Colorado hard money loans, Colorado Living, Colorado real estate market trends

A local HVAC contractor said of the new code “This is like a really obese person drinking a 12-pack of Diet Coke and feeling good about themselves.” What is in Aspen’s new building code proposal? What impact will this have on new construction, property values, and...