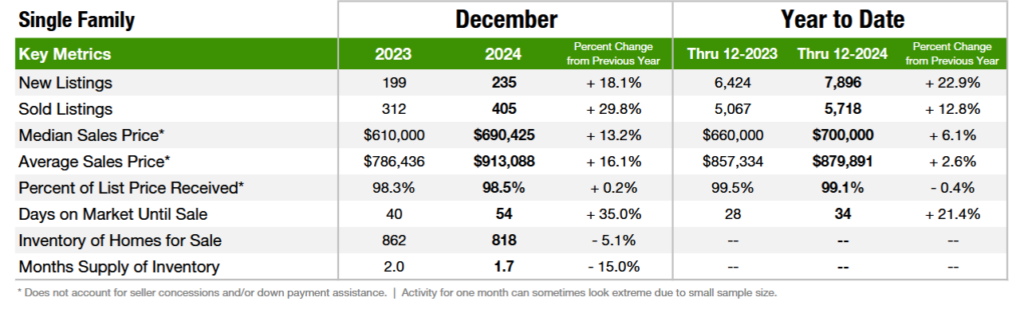

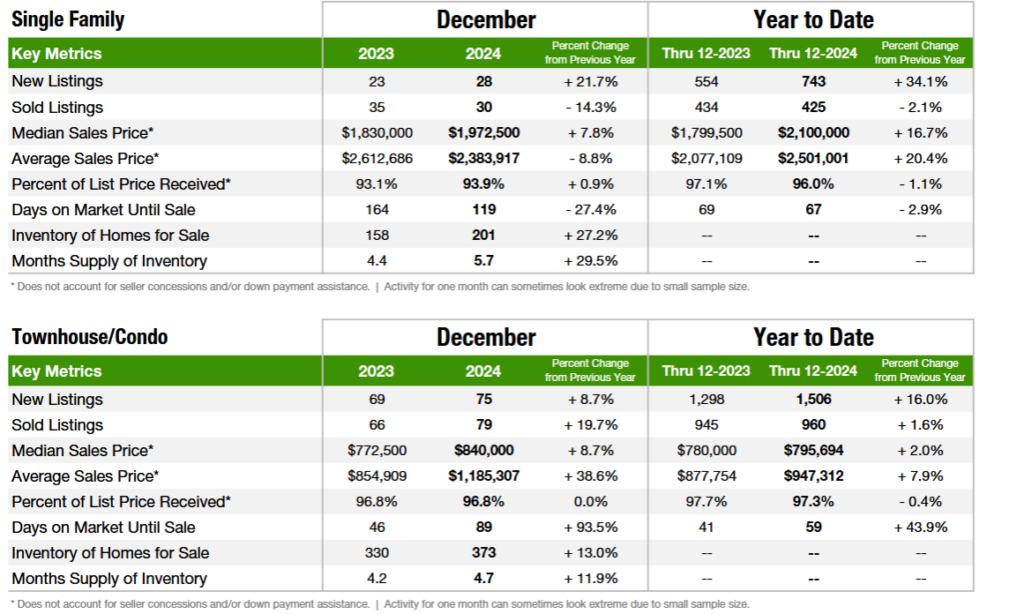

I’ve heard from every realtor that 2024 was a tough year in Colorado, interest rates were high and closing volumes plummeted, look at the chart above of Denver it tells a much different story, but is that the whole story. Are volumes actually down regardless of the data above? (look at the chart below) What Colorado ski town had sales volume drop 40% in one year? What does 2025 have in store for Colorado real estate?

One chart doesn’t tell the story of closings in Denver

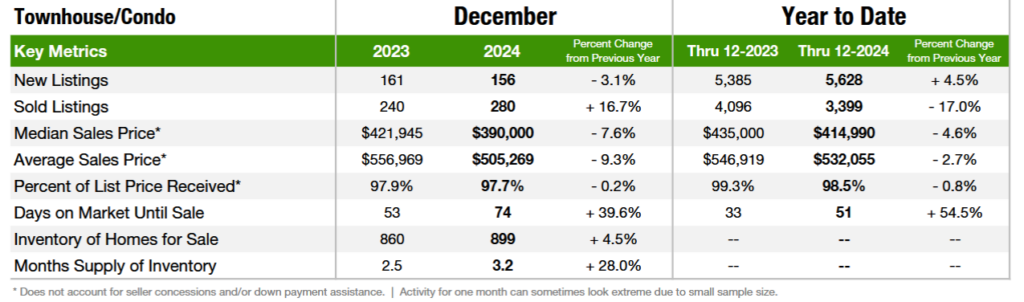

Looking at the second chart above, you can see that condo sales have plummeted dropping 17% year-over-year. On the flip side, if I average all the sales in Denver County, the sales are basically flat (down 1%). This is definitely not what I was expecting to see. Every realtor I’ve talked to in Denver metro says the market is totally dead and yet the numbers are painting a different picture. Essentially the market has softened a bit but the market is holding up pretty nicely.

| Denver County Sales | |||

| 2023 | 2024 | % change | |

| Single Family | 5067 | 5718 | 13% |

| Condos | 4096 | 3399 | -17% |

| Total | 9163 | 9117 | -1% |

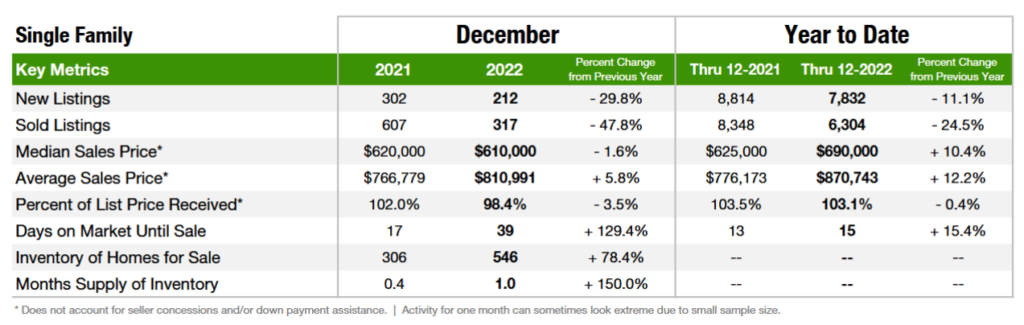

How do current sales volumes compare to the peak?

If I look at single family homes, 2024 is off about 10% from 2022, but if I look back at 2021 which was about the peak in Denver real estate sales volume are off about 46% which is why the real estate industry is definitely hurting and talking about the huge decline in sales volumes

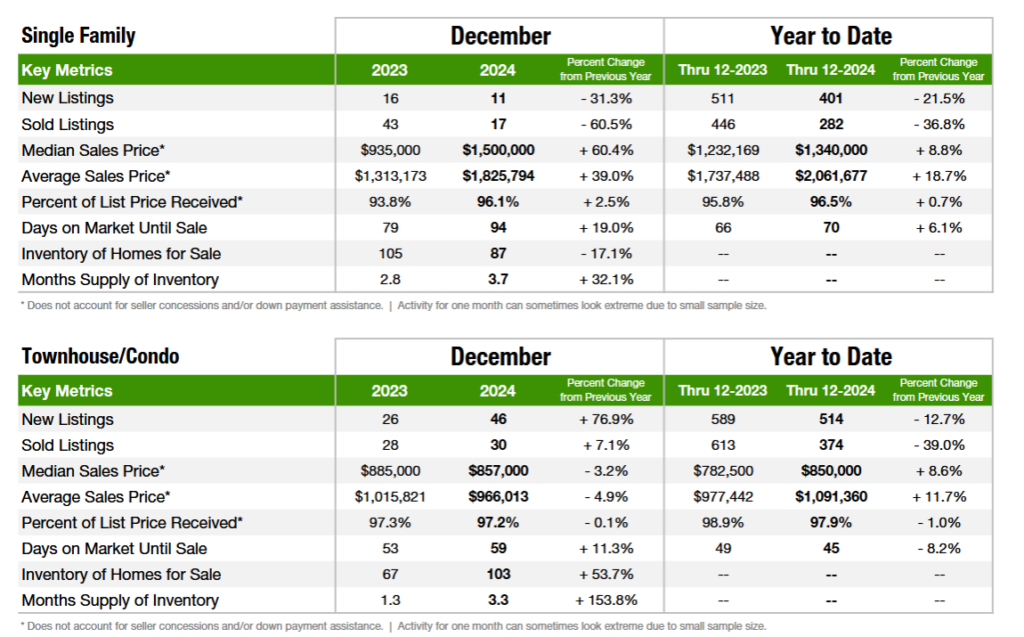

Are closing volumes down in Colorado ski towns

Along with Denver, I wanted to see what was happening in the Colorado ski towns. Unfortunately when I looked at two mountain towns, they are reacting very differently in 2024. Steamboat sales volume is down almost 40% while median and average sales prices continue to increase.

On the flip side, Summit county (home to Breckenridge, Copper Mountain, Keystone) is basically flat when averaging condo and single family sales, very similar to what is happening in Denver.

Although Steamboat sales volumes have dropped, it is not due to interest rates. The driver in Steamboat is that inventory has declined 17% so there is just not a lot on the market. Furthermore, prices have increased substantially faster than other ski towns pricing many out of the market.

Steamboat/Routt County sales plummet

Summit County/ Breckenridge sales basically flat

Why do realtors feel that the market has slowed?

After talking with hundreds of realtors over the last few months, the universal theme is that the market has slowed substantially. The statistics in Denver are painting two different markets, the single family vs condo market (here is an article I did which goes in depth as to why houses are outperforming condos in Denver). So if the statistics are showing a stable market, what is really going on?

- Increasing number of realtors decreases transactions/realtor: the sheer number of realtors that have entered the profession since the pandemic is astounding leaving fewer transactions/realtor

- Days on the market increasing: in Denver, days on the market increased 35% December vs. last December leading to much longer sales cycle than we have seen in the last 5 years.

- Months supply of inventory increasing: Along with days on the market, the amount of inventory available for sale on condos has jumped 28%

- Off 46% from the peak: Volumes are off substantially from 2021 furthermore on the lending side volumes are maybe 25% of their peak as there are basically no refinance transactions due to the huge jump in rates.

Trouble ahead for closing volumes in 2025

2024 was a transition year where the market started to digest higher interest rates with the hope of a much better market in 2025. Unfortunately it looks like 25 will be a continuation of 24 but with even lower sales volumes. In expensive markets like Denver, interest rates are a huge driver of the market. Recently rates have touched on highs from several years ago which will put a huge dent on closings in Denver in 2025. Along with interest rates, inventory is starting to tick up, especially on the condo side which will ultimately lead to more price reductions.

Summary

Although the numbers did not initially back up my assumptions that closing volumes fell substantially in 25 (other than in Steamboat and some other mountain towns), 2024 was still a tough year in real estate. Furthermore, volumes are down substantially from 2021 which was around the peak for closings.

Fortunately I don’t foresee a cliff drop for real estate, but 2025 looks to be a continuation of 2024 with some additional hiccups due to rising inventory coupled with higher interest rates Also note, that condos are going to get the brunt of the price resets as I have mentioned in previous blogs. Furthermore, the Colorado ski towns are not immune, as Denver hiccups watch markets like Breckenridge and Winter Park.

Additional Reading/Resources

- https://coloradohardmoney.com/who-owns-nightly-rentals-in-colorado/

- https://coloradohardmoney.com/why-are-houses-outperforming-condos-in-denver/

- https://coloradorealtors.com/market-trends/regional-and-statewide-statistics/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, Hard Money Lender, Private lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender