Colorado has the lowest obesity rate of any state, but when it comes to financial fitness, residents of the state borrowed money at an unrivaled pace last year, contributing to one of the heaviest debt burdens in the country beating all but two states for most indebted per capita. Is this the “real” story? What is driving the debt bonanza in Colorado? What does this mean for real estate? Should you be worried? Is it just mortgage debt or is other debt also above average?

Why is debt an important metric

Not only is debt rising in Colorado but throughout the country. Consumer debt of autos and credit cards just hit an all-time high (American Banker). Unfortunately, debt can be problematic when economic winds change. The more debt a consumer has the higher likelihood of default. This default risk increases substantially when the economy shifts gears. According to the Kansas City Federal Reserve bank in a 2012 research paper “Consumers from lower-income areas and consumers with risk scores in the bottom half of the distribution—that is, individuals deemed to be relatively risky by a credit reporting agency—have been key drivers”. This is typical as we get later in a cycle, new products come online to continue to drive credit volume with the riskier borrowers driving the demand. This could spell trouble on the horizon.

.

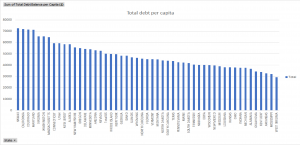

How does Colorado compare in total debt?

In total debt, Colorado is number three closely behind Hawaii and California. Colorado residents have 48% more debt than the national average. (Here is a link to my spreadsheet with the full data I used for the analysis: colorado has highest debt per capita )

Why are Colorado residents substantially more indebted than other states?

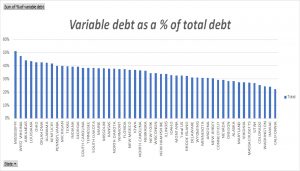

When I first saw the article in the Denver Post, my initial reaction was that the large debt in Colorado was due primarily to mortgages due to home prices rising considerably faster than wages. This was a true assumption with 75% of Colorado’s debt burden due to mortgages. This makes perfect sense as residents in Colorado (the front range and mountain communities) are facing increasingly higher costs for homes. The remainder of the debt was Variable debt (credit cards, auto, student loans)

It is well known that mortgage debt is substantially less risky than variable debt like credit cards. Most mortgages have some fixed rate component and rates are considerably less than credit card debt. On the surface the study looks surprising with Colorado leading the way in total debt. When I dug into the numbers a bit more the risk was opposite of what I thought. Colorado is 47th in risk as 46 other states have considerably higher variable debt comprising up to 51% in Mississippi. This is the real story! Places like MS are considerably riskier than places like Colorado due to the ratio of variable debt.

What does this mean for real estate?

In Colorado having a low relative variable debt is good for real estate. The lower variable debt will allow borrowers to qualify easier for mortgages. On the flip side Colorado (and the front range in particular) need to be careful about total mortgage debt. Prices are going to be capped as wages remain flat. There is only so much borrowers can afford. I suspect this is what is the primary driver of the slowdown in Denver real estate recently. Prices got a bit too far ahead of wages and the consumers balked at paying more for a mortgage. Fortunately this should be a short term issue as the economy goes through another cycle and emerges Colorado and the Denver front range will continue to attract companies that desire knowledge workers and pay higher wages (high tech, medical, etc..). The question is when wages will increase. For now, due to the flat wages, Denver and the front range will remain flat.

Summary

It is interesting that the Denver Post article focused heavily on debt with the headline that Colorado is third in the nation for total debt. On the surface this doesn’t sound good at all, but like always there is a catch. If you look at the median income in Denver (in 2017 $76,643 compared to US median of 60,336) the equation changes a bit. Denver is 27% above the average median income for the country. With higher income people buy more expensive houses, cars, etc… which increases their debt burden. Denver’s percentage of income to debt is only 13% above the national average. This is considerably different than the national average that places Colorado third in total debt.

The real story is below the headline and opposite the initial assumption. Although Colorado has total debt that is 3rd in the Nation. The Variable debt as a percentage of total debt is the real story. A house is an asset, variable debt on the other hand is just the opposite. Rest assured fellow Coloradoans we are doing just fine, but you must read the fine print behind the headlines.

Additional reading/resources

- https://www.denverpost.com/2019/07/19/colorado-debt-credit-experian-california/

- https://coloradohardmoney.com/wp-content/uploads/2019/08/colorado-has-highest-debt-per-capita.xlsx

| 4. https://www.newyorkfed.org/medialibrary/Interactives/householdcredit/data/xls/area_report_by_year.xlsx |

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)