What does Colorado’s debt load mean for real estate prices?

I was surprised to see Colorado exceed every other state in the country on both the amount of debt and debt as a percentage of income. Why do Coloradoans have more debt than others? Why is debt an important indicator for real estate prices in the future? What does this mean for the next economic cycle?

What was in the data on Colorado’s debt binge?

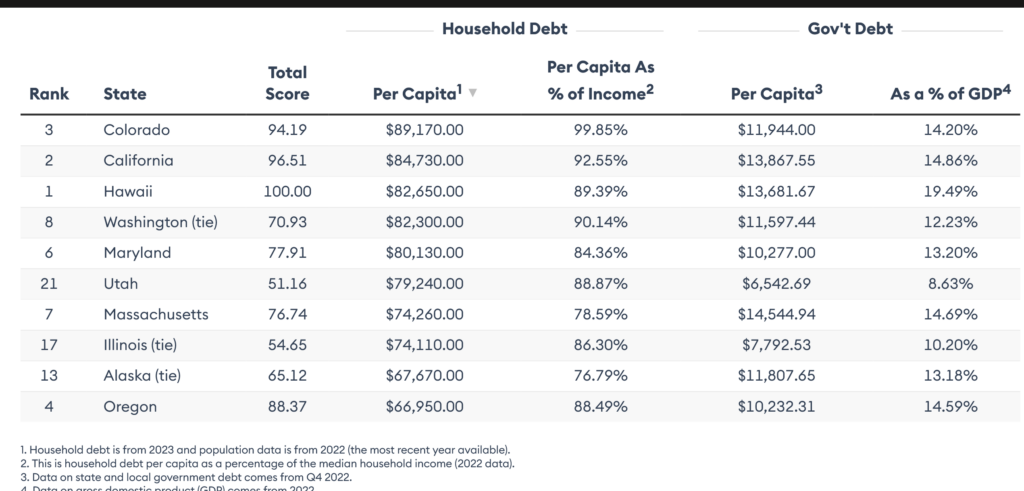

Colorado recorded the highest household debt per capita, with a sum of $89,170, which constitutes 99.85% of the average annual earnings of a Colorado resident. “Average wages are higher in Colorado. According to our recent study on the cost of living by state, Colorado has the eighth-highest salary by state,” said Michael Benninger, lead banking editor at Forbes Advisor, in an email.

Even after accounting for the extra money Colorado workers pull down, household debt as a share of household income is at 99.85%, the heaviest burden of any state. In California, the debt-to-income burden is 92.6% and in Nevada it is 91.3%.

The average household debt to income burden of all states is at 77%, so debt represents a considerably heavier burden in Colorado than in other states.

Why focus on the debt burden of Coloradoans

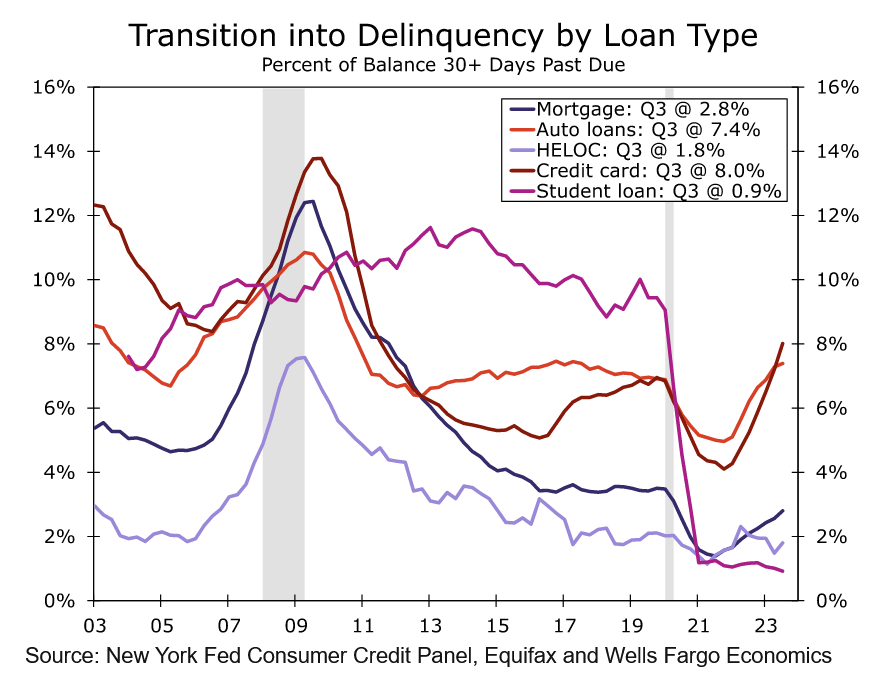

We The increase in consumer credit is particularly striking as higher rates have yet to deter consumer spending. Despite interest rates on credit cards sitting north of 21% through Q4-23, the highest annual percentage rate (APR) in over 30 years (chart), revolving consumer credit has continued to march higher. Rates for other purchases that can comprise large monthly payments for consumers, such as auto purchases, are also much higher. All these financing charges are adding up.

We saw in 2008 that higher debt led to a contagion effect and ultimately substantial mortgage defaults. In this cycle, most mortgage debt is tied to ultra low interest rates, but as consumer debt increases and defaults increase the likelihood that this spills into mortgage payments increases.

What does the high level of debt mean for Colorado

real estate prices

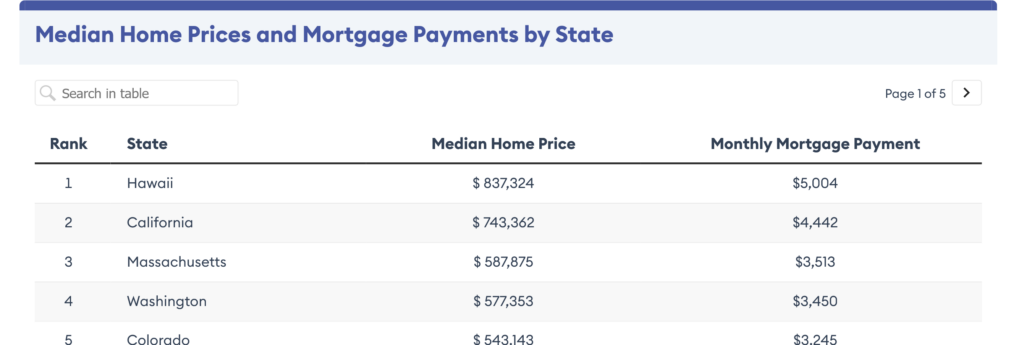

With the high level of debt that Coloradoans are carrying, this will limit upside potential in real estate. The increased debt burden will make it substantially harder for many to qualify for a new mortgage as either a first time homebuyer or move up buyer. The high debt load coupled with higher mortgage rates will best case freeze the current market.

As consumer debt continues to pile up reaching records for auto and credit card debt, the probability something breaks has also increased. If we see a noticeable uptick in unemployment look for consumer defaults to rise further and ultimately mortgages which will put further pressure on prices.

Summary

Colorado has won many awards, but unfortunately leading the nation in debt is not a title that we should be proud of. Higher debt exponentially increases the probability of bad things happening in the economy. In the best-case scenario real estate will be impacted with stagnant prices. The other probable scenario is that the increased consumer debt load will ultimately cause a reduction in prices. My guess is that in markets like Denver we will see about a 15% decline in prices year over year due to increased consumer debt which will ultimately limit demand for houses.

Additional Reading/Resources

- https://wellsfargo.bluematrix.com/links2/html/ff77c773-a8e1-499b-a0b4-ba2833005d71

- https://www.denverpost.com/2023/12/14/colorado-consumers-debt-burden/

- https://www.forbes.com/advisor/banking/us-debt-by-state-and-worldwide/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender