Regardless of all the talk of a recession, soft landing, or something in between. Many Colorado mountain towns continue to see record tax sales revenue. How is this happening while domestic tourism is pulling back? What does this mean for the upcoming ski season? How will real estate be impacted by the increased tourism spending? Will this trend continue?

No recession in sight based on tax revenue

I saw a recent report on the tax revenue in Steamboat Springs, CO, one of the bigger resorts in Colorado owned by Alterra and part of the Ikon pass and was pleasantly surprised. As of the end of March, revenues from the city’s exaction on taxable items were up 10% over last year. That represents a slowing from 2022, when the sales tax revenue through March had increased about 36% over the first three months of pandemic-impacted 2021.

Domestic travel pulls back what about Colorado ski towns

“As a primarily domestic leisure carrier, this summer presents a unique situation with the unprecedented surge in international demand, not dissimilar to the domestic surge last year,” Alaska Airlines CEO Ben Minicucci said during the company’s earnings call last week. “We believe pent-up international demand has had the effect of a larger pull from would-be domestic travelers than has historically been the case,” he added.

It is interesting that even as domestic travel has pulled back, Colorado ski towns continue increasing their tax revenue. This means there is still a strong demand for higher end vacations as from a pricing perspective going to Aspen is likely not much different than going to Europe from a price standpoint

Bookings down but lodging tax revenue still up.

In the most recent Steamboat tax revenue report, it noted that lodging reservations are down, but this has not had a significant impact on sales tax revenues because lodging fees have gone up. I’m seeing this throughout the mountain towns where actual bookings have declined but room rates have compensated for the decline in bookings.

The one warning is that I’m not sure how much longer this trend will last. As consumer spending slows I assume room rates will also stay constant or fall slightly depending on the overall economy.

What happens this winter in Colorado ski towns

I don’t see much of a slowdown in consumer spending until very late this year or early next year. Most big ski vacations have already been booked or will be booking in the next 90 days for the big holiday weekends of ski season, so I don’t see much impact this year. The later part of the spring ski season is a bigger question in my mind as consumer spending should start slowing early next year.

More stable revenue for Mountain towns

About five years ago I started noticing a big trend that summer was quickly catching up to Winter and there were basically no shoulder seasons. We are seeing this consistently in the data. The breakdown of tax revenue between the three finance seasons — summer, winter and “shoulder” — is expected to remain generally consistent with historical patterns. The city gets about 40% of incoming tax dollars during winter, about a third during summer and the rest during the other months of the year, Weber explained.

This is a drastic change from not long ago when shoulder season/ aka mud season was dead in mountain towns until the summer season got into full swing once school was out. This also has huge implication for real estate as there is more opportunity for rentals, etc… over a longer period of time.

How does sales tax revenue in Colorado ski towns impact real estate?

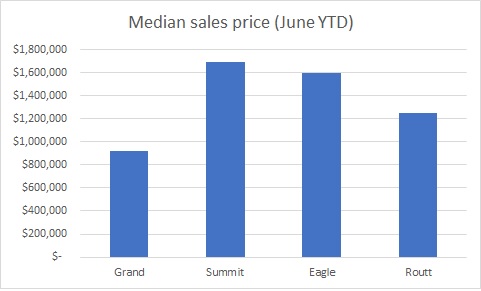

Increasing/stable sales tax revenue is a good sign for Colorado Mountain real estate. Currently most Colorado ski towns are holding up very well from a real estate perspective. Cities like Steamboat and Crested Butte continue to increase in price and Breckenridge and others appear to have stabilized.

There are some big changes occurring. During the pandemic basically anything with 4 walls would sell instantly, now buyers want properties that are move in ready and/or require very little work. This is leading to many properties that are not updated languishing a bit longer on the market and having to reduce prices.

The second change is that properties just a little further out from the resort/city are languishing on the market. Buyers are pulling back from rural properties while in town properties continue to perform well.

Summary

Steady/increasing tax revenue is a good sign for Colorado Mountain real estate. Based on current information, look for this trend to continue through the holiday season. This will keep in town real estate that is updated in high demand with little impact on pricing. On the flip side, rural and not move in ready property will struggle. The wild card is what happens early next year with consumer spending and in turn mountain sales tax revenue as there could be some softening after the first of the year.

Even if sales tax revenue declines in the first quarter, I don’t foresee a cliff drop for real estate prices in the various Colorado ski towns. There will likely be a reset next year somewhere under 15% with rural and not updated properties taking larger hits.

Additional Reading/Resources

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender