Colorado property taxes were set to jump almost 50% in some markets which finally go the attention of the Colorado Governor. At the last minute, Governor Polis put together a proposal that supposedly will drastically save taxpayers. What is in the new proposal? Hint, your taxes are still going up by double digits even with the fancy math!

What is in the Governor of Colorado’s new property tax proposal?

The new proposal is just coming out as I am writing this article; below are the details I have seen so far:

- Reduction in primary residence valuations by 40k; if you have a rental property, you are out of luck

- Lowering of the residential assessment rate from 7.15% to 6.7% (note there was a prior bill that lowered assessments rates from 7.15% to 6.95% )

- This proposal does nothing for commercial property owners that will also be hit hard by property tax increases (think of multifamily properties that have skyrocketed in value)

- The new proposal does nothing to cap future increases in assessed values

- This is just a proposal and needs to be approved by voters in November

How much will this save property owners in Colorado?

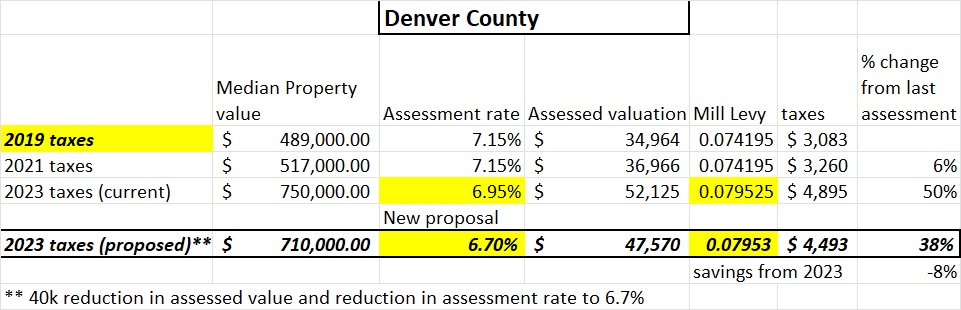

I’m always amazed at the “fuzzy math” our politicians use. The governor said during a news conference Monday that, if approved, the average homeowner in Colorado would see their property tax increases be cut by 50%. I’m not sure where the numbers came from, so I did my own analysis based on the Median home price in Denver. The savings are much less than stated. Taxes in Denver county, based on the median home price and new proposed savings, will still increase 38% resulting in an 8% savings.

| Denver County | ||||||

| Median Property value | Assessment rate | Assessed valuation | Mill Levy | taxes | % change from last assessment | |

| 2019 taxes | $ 489,000.00 | 7.15% | $ 34,964 | 0.074195 | $ 3,083 | |

| 2021 taxes | $ 517,000.00 | 7.15% | $ 36,966 | 0.074195 | $ 3,260 | 6% |

| 2023 taxes (current) | $ 750,000.00 | 6.95% | $ 52,125 | 0.079525 | $ 4,895 | 50% |

| New proposal | ||||||

| 2023 taxes (proposed)** | $ 710,000.00 | 6.70% | $ 47,570 | 0.07953 | $ 4,493 | 38% |

| savings from 2023 | -8% | |||||

| ** 40k reduction in assessed value and reduction in assessment rate to 6.7% | ||||||

Why did taxes jump so much in Colorado in 2023?

Remember, 2023 is a reassessment year as properties in Colorado are reassessed every odd year. All of the pandemic appreciation is now flowing through to the assessed values. Furthermore, the Gallagher amendment was rescinded which capped property taxes by balancing residential and commercial valuations.

Is assessed value market value?

Remember, property tax value is not market value. Property tax value is derived from prior sales (last summer and earlier). The market was in a much different place then than it is now. The statute in Colorado does not care about current market value. The increase you are seeing this year was for “prior” real estate appreciation that is now just flowing through to your property value which ultimately determines your property taxes

What is the better solution for huge increases in Colorado Property taxes

The Colorado Governor’s proposal is a starting point, but does not solve the underlying issue. A simple solution would be to cap assessed value increases based on the consumer price index. For example, if CPI went up 6%, that would be the amount that assessed values could increase. It would be a very simple proposal to stop the current yoyoing of tax policy.

Summary

Even if the Governor’s new proposal passes, your taxes are still going up substantially in Denver and throughout the state of Colorado. The Governor touts a 50% savings, but the reality is radically different. Based on the median home price in Denver, taxes will still increase 38%. Remember the consumer price index is running around 6%, so property taxes are going up 630% faster than the rate of inflation.

Even with the new proposal, the tax burden is not sustainable. There is no reason that property taxes should rise 630% of the rate of inflation. There needs to be a citizen’s initiative on the November ballot to cap taxes based on the consumer price index to put an end to the current crazy property tax policy.

Additional Reading/Resources

- https://www.9news.com/article/money/markets/real-estate/metro-denver-property-value-increase-2023/73-3a3f538a-5ead-4dcd-9d67-27949fef6df4

- https://www.9news.com/article/money/markets/real-estate/colorado-property-taxes-polis-plan/73-cb49795c-c6f3-4316-a633-eca3cb13f0ff

- https://www.denverpost.com/2023/05/01/coloraod-property-tax-increase-polis-law-price-reduction/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender