With much fanfare, CO legislators met in a special session to focus on tax relief once again after the searing defeat of HH. As suspected, the agenda was filled with allot of stuff not related to property taxes (Tabor checks, low income tax credits, food assistance, etc…) so you can only imagine the outcome. In the end your taxes are still going up a ton with only minimal relief. What other taxes are being increased in Colorado? How are commercial properties impacted?

What is in the new property tax proposal?

There are two key changes to help reduce property taxes

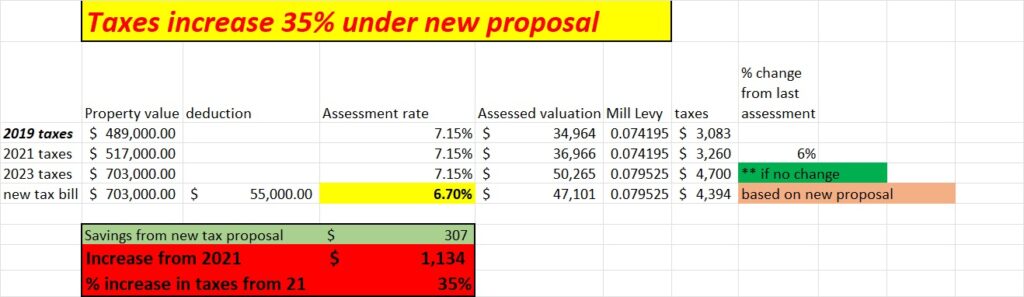

Property tax cuts that would be achieved by changes in the formula used to determine residential property taxes. The deduction from a property’s value for tax purposes would rise from $15,000 to $50,000. The assessment rate, which is applied to determine the assessed value, or what’s taxable, would be reduced from 6.765% to 6.7%.

New tax bill allows taxes to still rise substantially

Unfortunately you shouldn’t get too excited about the proposal as it will save the median homeowner $302 dollars. Furthermore taxes will increase 35% with an annual increase of 1,139 assuming a median home price.

*** Also note commercial property taxes are excluded from this bill as the legislation only focuses on residential properties. ***

Other tax bills coming down the pipeline in Colorado

No legislative session would be complete without the legislature figuring out how to redistribute more tax dollars. This session is no different as Tabor is once again on the docket. Instead of having tabor refunds based on how much you pay, it flattens the refunds to 800 each person. So someone owning the median home would now receive several thousand less in Tabor. Once again, the net savings of 300 is coupled with a 2000 reduction in the tabor refund.

Other tax measure on nightly rentals

The proposal to tax nightly rentals as commercial properties has now advanced out of committee. This will tax properties that provide nightly rentals greater than 90 days as commercial properties. The bill is not final, but definitely worth watching as it will have substantial impacts especially in every ski town. Here is a link to the most recent nightly rental tax legislation.

Summary

Once again, our legislature promises the moon on tax relief, while at the same time,ironically, your taxes will increase. This is exactly what is happening with the current tax proposal. The average savings from the new tax bill will save the median homeowner 300 dollars, while taxes are still increasing 1,139. While at the same time more money is being taken away from homeowners tabor refunds to help non homeowners that aren’t even paying the property taxes.

Unfortunately I doubt property owners are going to be happy with the new legislation. Furthermore, 2024 is going to usher in considerable changes in Colorado property taxation with nightly rentals clearly in the sights of the governor and legislature to tax as commercial properties. Also, I assume land use and various other tax policies will be revived once again. With all these changes it will be critical to stay in the loop on Colorado tax policy this legislative session.

Additional Reading/Resources

- https://www.denverpost.com/2023/11/17/colorado-legislature-special-session-property-taxes-tabor/

- https://leg.colorado.gov/sites/default/files/images/committees/bill_6_24-0388.pdf

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender