Get ready for sticker shock as this year is a reassessment year. As values soften throughout the state, will your property taxes finally go down? Unfortunately the short answer is just the opposite, look for your taxes to jump an astronomical amount. How can assessed values continue to increase even though property values are softening? Why is this year worse than any past years? How are property tax values determined? 6 steps to appeal your property taxes and win!

How much are your Colorado Property taxes going up?

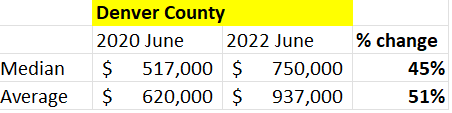

I did a quick analysis on Denver County. Values have gone up 51% for the average home since the last assessment (6/20-6/22). This will be reflected in the new assessed values sent out in a few months and in turn your property taxes will increase substantially. It is counterintuitive that property taxes are increasing when values are falling or at best flat in most markets, but assessments in Colorado are in “arrears” meaning they are backwards looking and only occur in odd years. Below are more details on how taxes work in Colorado and what you can do about it in regards to an appeal.

Huge impacts on property owners

Even though the legislature has talked about property tax reduction, none of the proposals will make a huge dent in the big jump that property owners are facing. Property owners will be facing thousands of dollars in new property taxes. Furthermore, renters will be impacted as the higher taxes are passed through to tenants.

I have assembled a free guide on Colorado property taxes and the appeal process

- When are the values determined?

- Why is this year such a big jump?

- What can you do about it?

- Are further increases on the way?

- 5 tips to appeal and win

How are property tax values determined and when are they determined?

In Colorado every county is the same, each odd numbered year is a revaluation year ( 2023 is a revaluation year). During the revaluation period the tax assessor looks at comparables 24 months prior, so for 2023 they would be using 21 and 22comparables (to be exact you can use a comparable up to 6/22); the last revaluation cycle was based on comparables up to June 2020 (this is what you are seeing with the tax bill you received for last years taxes)

Why is this year such a big jump?

Most areas in Colorado continued picking up steam (aka value) as the pandemic unfolded. In many areas values increased > 15% a year during these two years with some mountain communities almost doubling during the last two years. These increases were reflected in the sales that ultimately are used in the 2023 revaluation cycle. Furthermore last summer was about the peak in this past real estate cycle, with values softening in the fall. Sales after June of 22 are not valid in this revaluation cycle.

Is assessed value market value?

Remember, property tax value is not market value. Property tax value is derived from prior sales (last summer and earlier). The market was in a much different place then than it is now. The statute in Colorado does not care about current market value. The increase you are seeing this year was for “prior” real estate appreciation that is now just flowing through to your property value which ultimately determines your property taxes

Are further increases on the way?

Increases will be determined based on increases in value. Depending on the real estate market, 2025 could provide some relief. Note, counties are fast to raise property values, but very slow to drop them unless you appeal.

Should you protest your taxes

Yes, if there is any chance you think your property is overvalued based on recent sales in the time period of 6/20 to 6/22. There is very little downside risk on an appeal other than a few hours of time. The worst I’ve seen assessors say is no and the value remains the same. The process is relatively easy. Below is a 5 step guide for appealing. Ensure you follow this to a T in order to have your appeal considered and increase your probability of winning.

6 tips to appeal your Colorado Property taxes and win

Although 2021 will be difficult to win a large appeal since values have almost universally gone up throughout the state, you should be able to get at lease minor relief if your property is overvalued. I’ve appealed my property taxes in 3 counties throughout Colorado and won on each one. Below are 6 tips to help you navigate the appeal and increase your odds of winning.

Before starting, it is important to note that the assessor doesn’t care what you “feel” your property tax value should be, what your zestimate says, or what your recent appraisal was for. The property tax value is based on facts during a stated time period. The only way to have a chance at winning an appeal is to follow the directions to a T and leave your feelings behind.

- Dates are important, by statute you have from 5/1 to 6/1 in the reassessment year. If you miss these dates you are out of luck. Most counties allow you to appeal online and the process is easy (just google your county + assessor). They typically have a simple online form where you can put in your information and the appeal information

- Follow the rules: remember for this year the only comparables that can be used are prior to 6/30/22 (typically a two year period), statute says that you cannot go back more than 5 years unless there are extenuating circumstances

- Check your facts: This is low hanging fruit. Ensure the assessor has your info correct, is the property and office building yet classified as mixed use? Is the square footage correct? Is other information accurate. Correcting this info could substantially reduce your tax burden

- On residential, it is a numbers game: How residential appraisals work is the county calculates a neighborhood average and finds sales in close proximity to your house with similar characteristics. The averages can lie. For example in my neighborhood when I appealed in 17, there were a number of lower sales (also some higher one), I was able to make the case that I felt my house was closer to the lower sales (remember you are not talking about market value, nor does this influence the sale price of your home, etc…). I was successful in my appeal and got my property value reduced over 30%

- On Commercial, use both methods: On a commercial property both the sales and income approach are used. If you had a tenant during this time period, the income approach (take net operating income divided by the applicable capitalization rate—the income approach on a commercial property is a separate article I’ll post at a later date) is a very good method to start with. The sales approach is the second method that can be utilized. Commercial is a bit more in depth than the residential appeal since commercial properties are considerably less uniform than residential properties.

- Use various tools to get your facts straight: To win an appeal, the appeal must be fact based. Saying you “feel your property is overvalued” is a waste of time. Make sure you have your facts straight (at a minimum 3 applicable sales for residential; for commercial address both the income and sales approach). You can get both sales comparables from the county websites for a specific neighborhood (do not use Zillow or Trulia, the square footages can be inaccurate, make sure you use the county data to ensure you compare above grade square footage and you will also have to input the parcel id numbers for each of your comparables). For a commercial property use a tool like loopnet.com or Costar to see what asking rents are , get sales comps, etc… loopnet has many pictures and details on various commercial properties.

Summary

Long and short, Colorado is a bit unique in that even though real estate prices are falling/softening there will still be huge jumps in taxes as the prior increases have not fully factored in. Fortunately, you do have the ability to protest but it will be difficult to get much reprieve as basically every real estate value went up during the revaluation period. If you do appeal, make sure you follow the steps above to the T to increase your odds of winning.

Also note, do not take your frustration of higher taxes out on the assessor as they are just following the law, if you don’t like the higher taxes, the legislature, governor, and ballot box is where you should focus your efforts. Remember one of the key reasons for the huge jump in taxes is the elimination of the Gallagher amendment that balanced commercial with residential assessments which led to huge jumps in residential property taxes.

Additional Reading/Resources:

- https://car-co.stats.showingtime.com/docs/lmu/2020-06/x/DenverCounty?src=page

- https://www.steamboatpilot.com/news/property-taxes-101-owners-should-prepare-for-big-increases-on-may-notice/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender