When the Coronavirus first hit, my predictions were for a flat to slightly declining market. Wow, I missed that one! The Denver metro area and all the resort towns have set records with appreciation skyrocketing. What does this mean for real estate the remainder of the year?

What was in the Data for July?

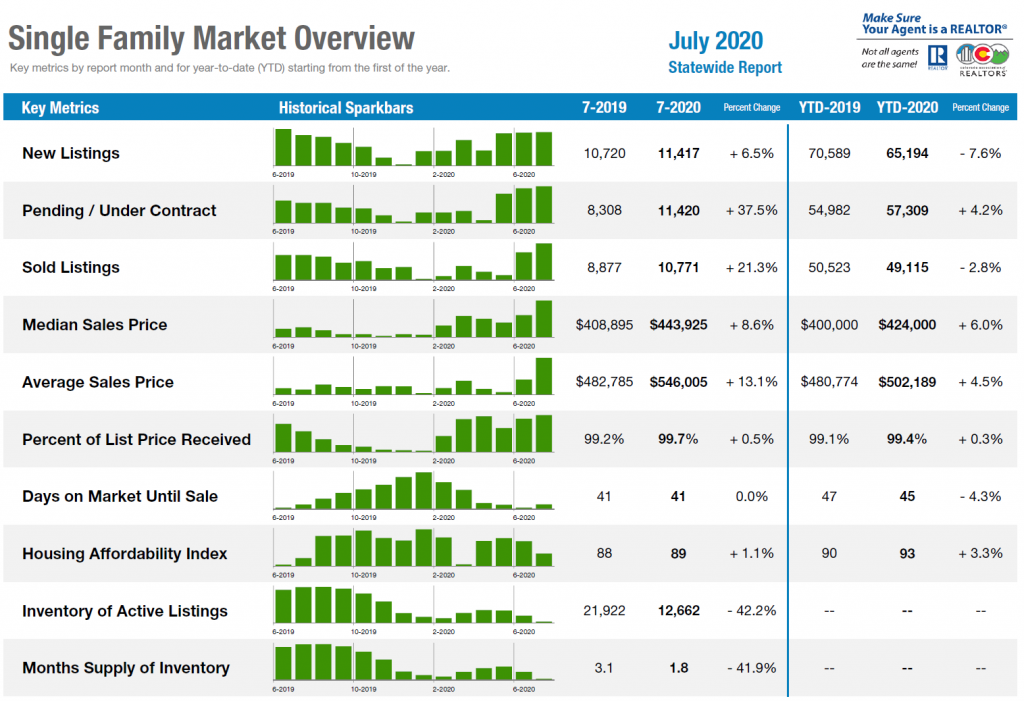

I highlighted some interesting statistics from July throughout Colorado. The Colorado Association of Realtors publishes these reports monthly

Denver Metro

- Average sales price up 10% from last year

- Inventory of homes for sale – 42%

Denver County

- Average sales price up 12.4% from last year

- Inventory of homes for sale -44%

Summit County (Breckenridge, Copper, Keystone, Frisco, etc…)

- Average sales price up 25% from last year

- Inventory of homes for sale -34%

Colorado Statewide:

- Average sales price up 13.1% from last year

- Inventory of homes for sale -42%

The numbers above paint a vivid picture of how “hot” real estate in the metro area and the resort communities continues to be.

What caused the huge run up in prices?

- Huge drop in mortgage rates: Historically low rates have led to a huge surge in buying. With the 30-year fixed rates below 3%, borrowers can afford 25-30% more house than when rates were in the 4% range a few months ago. Rates look to remain at historic lows for the next 3-5 years based on recent federal reserve guidance which will help drive

- Limited housing Supply: Supply in most markets throughout Colorado never got out of hand this economic cycle as capital for spec building was constrained, this limited supply is a primary factor driving the market higher and shows no sign of abating as building costs have soared and available land remains scarce.

- Consumer behavior did a U-turn: With the new work from home and shelter in place, this totally changed consumer behavior. Prior to the virus, there was a trend towards smaller is better, that trend is out the window as buyers demand yards, more space for home offices, and more space in general to spread out with the whole family spending more time at home.

- Flight to safety: Denver and the various resort communities are seen as safe havens versus larger coastal cities. As the virus intensified in February and March many prospective buyers made plans for themselves and their families to move to a “safer” location. We are now seeing this in the July numbers.

What does this mean for real estate this rest of 2020?

I don’t see any major events derailing the residential market in the Denver metro and resort communities. Interest rates will remain low and inventory is at historic lows with no major influx of inventory in most markets on the horizon. I don’t think that appreciation will continue at the same torrid pace, for example 25% appreciation in Summit county, but appreciation should continue through the remainder of the year.

Will Colorado real estate continue huge appreciation in 2021?

Mortgage rates will stay at historic lows and inventory will remained constrained which will continue to drive the market higher. Furthermore Colorado will remain a desirable relocation destination. In the last 10 years, according to Atlas moving statistics of migration patterns, more people have relocated to Colorado than moved out each year. Although it is impossible for the annual appreciation rate to continue at the current pace, Colorado real estate should continue to outperform the majority of the nation.

Summary

The sudden jump in Colorado real estate will not last into perpetuity. Humans are creatures of habit and will eventually return to many of their old ways when the pandemic resides with offices reopening, kids going back to school, and cities once again becoming desirable places to live. As “normalcy” returns and the pandemic subsides look for real estate to also return to more historic levels with appreciation of 2-5% at best.

Additional Reading/Resources

- https://www.atlasvanlines.com/migration-patterns#pop

- https://www.bloomberg.com/news/articles/2020-08-31/new-yorkers-flee-for-florida-and-texas-as-mobility-surges

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)