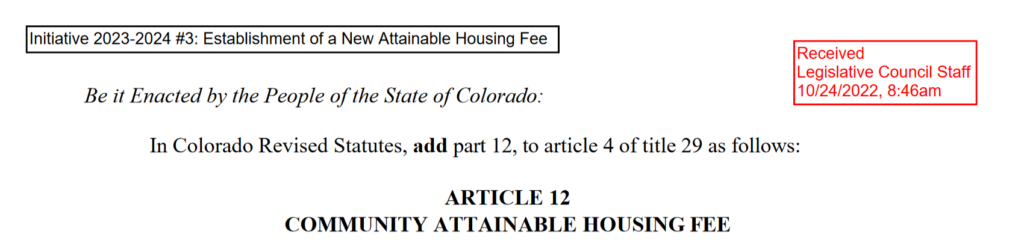

It is amazing, they just called the last races in Colorado a few weeks ago and already there is a ballot initiative to increase taxes further. In the last cycle voters passed an affordable housing initiative and hot on its heals is a new statewide transfer tax proposal this time for “attainable housing”. What is in the new initiative? How will this impact buyers and sellers? Who pays for the new “fee”?

The ballot initiative calls it a “fee” for attainable housing to get around the taxpayer bill of rights.

Highlights of the proposed statewide transfer tax

- Commencing on and after January 1, 2024, to impose on the recording of deeds that effectuate a transfer of real property a fee of one-tenth of one percent of the consideration paid or to be paid for the real property less two hundred thousand dollars and to require the county clerk and recorder to compute and collect the fee as a prerequisite to the recording of a deed.

- To exempt correction deeds and deeds that evidence the conveyance of real property from one spouse or other martial partner to another from the fee.

- To require the revenue, net of collection costs, generated by the fee to be credited to a newly established Colorado attainable housing fund and used only to fund new and existing programs administered by the division of housing that support the financing, purchase, refinancing, construction, maintenance, rehabilitation, or repair of attainable housing in Colorado.

- To define “attainable housing” as housing that is attainable by a household that makes between eighty percent and one hundred and twenty percent of the area median income and is priced so that the household need not spend more than thirty percent of its income on housing costs.

- To exempt revenue generated by the fee from the limitation on state fiscal year

spending as a voter-approved revenue change.

A few notable items on the attainable housing proposal:

- Any transfer unless it is from husband to wife is covered. For example if a parent dies and leaves the house to their children, they would pay a transfer tax when the deed is recorded.

- Every transfer/sale throughout the state will now pay .1% of the value at the time of transfer

- All these funds (other than a small service fee to the county) will be remitted to the attainable housing fund in Denver

Is the attainable housing initiative even legal under Colorado law?

I’m not an attorney, but this is a stretch, it is setup like the transfer taxes that were established in the 80’s in many mountain towns before the taxpayers bill of rights went into effect in 1992. Since 1992 there has not been any transfer taxes passed in any mountain communities that did not pass it before Tabor was implemented.

This new initiative is called a “fee” so that it skirts around TABOR, but it is setup like the transfer taxes already in use so this will likely be determined by the courts. Who knows how the courts will rule, but it seems pretty clear cut that this is a tax just like the transfer tax.

Will this new transfer tax solve the affordable housing issues?

Absolutely not, 12 mountain towns already have transfer taxes and yet affordable housing is still a crisis in every community. In 2020 and 2021, as the mountain real estate market exploded, RETT collections in 10 of the 12 communities — Aspen, Avon, Breckenridge, Crested Butte, Frisco, Gypsum, Snowmass Village, Telluride, Vail and Winter Park — climbed to an all-time high of $178 million. That’s an 84% increase from collections in 2018 and 2019, when collections reached $96 million.

By focusing solely on the lower end of the market, the “middle” is eliminated as there is no longer any move up housing for people to move out of from affordable housing creating even more demand for affordable housing.

Throwing more money at affordable housing will not solve the current situation; it will only transfer costs to other taxpayers as the root causes of the affordable housing issue continue.

What is causing the affordable housing issue in Colorado?

- Lack of supply: it is nearly impossible to build affordable housing in the markets that need them most as land is limited and build costs continue to rise.

- Taxes: As taxes continue to increase it is more difficult for the number to make sense to build fair market affordable housing. For example, if taxes are now 50% higher due to various new tax initiatives (sidewalks, schools, libraries, homelessness, etc…) then the price points no longer work for market rate housing.

- Building policies: As building standards continue to increase, costs also increase substantially. For example, in Denver they are moving towards net zero housing which means increased costs for insulation, ventilation, etc… These investments in a tighter home will benefit the homeowner over the long run with lower annual utility bills, but the costs to get in the house now are increased substantially making it nearly impossible to build lower cost housing.

Affordable housing funds will transfer risks to taxpayers

Additional affordable housing funds will not fundamentally solve the issues above, they could actually make it worse by creating a “moral hazard” for builders. Currently it is very difficult to build housing that is actually affordable due to taxes and building policies. Under the new paradigm where taxpayers are subsidizing affordable housing why would any builder take the risk to build market rate affordable housing without the subsidy. The answer is they will not. The affordable housing subsidy will force builders to focus on the high end where margins are greater or on the low end where the government will help foot the bill to ensure the project is profitable. This new affordable housing tax will do nothing to materially increase the overall supply of housing as supply will just be shifted with government subsidies.

The Colorado ski towns are a good example of this. For example, in Steamboat, I’m not aware of a single new construction project focusing on the lower end of the market that is not subsidized by city, state, or federal affordable housing funds.

Summary:

The courts will have the ultimate say on whether the new transfer tax is actually a fee and if this goes to voters next year. If it does go to voters, it is highly likely to pass based on the huge shift in the last election along with the passing of another statewide affordable housing initiative.

Unfortunately the transfer tax will “transfer” costs to others throughout the state and as with everything else, there will be consequences. By directing even more funds to affordable housing, Colorado will inadvertently hollow out the middle as there will be more profit on the two extremes of the market (low and high). A statewide transfer tax will “transfer” the affordable housing problem to the middle class which will not qualify for affordable housing and yet is not in the “high end” housing market.

Additional reading/resources:

- https://leg.colorado.gov/sites/default/files/initiatives/2023-2024%2520%25233.pdf

- https://coloradosun.com/2022/08/22/colorado-mountain-communities-real-estate-transfer-taxes/

- https://coloradosun.com/2022/12/01/colorado-harvest-record-sales-tax-revenue/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender