With initiative 74, which I wrote about last week, looking to likely pass, legislatures agreed to a last-minute compromise to try to avert a showdown over initiative 74. The solution, Senate Bill 238 to reduce property taxes. Unfortunately, the math doesn’t add up and your taxes will still increase substantially!

What is in Colorado Senate Bill 238 ?

Below is a summary of the changes from SB 238 to the way that property taxes are calculated.

The bill makes the following changes to property tax assessment rates for the 2023 property tax year:

- The assessment rate for all residential property is reduced to 6.765 percent, from 6.95 percent for single family property and from 6.80 percent for multifamily property; and

- the assessment rate for nonresidential property, other than oil and gas, agricultural, and

renewable energy producing property, is reduced to 27.9 percent from 29.0 percent.

The bill makes the following changes to property tax assessment rates for the 2024 property tax year:

- the assessment rate for multifamily residential property is reduced to 6.80 percent from

15 percent; - the assessment rate for agricultural and renewable energy producing property is reduced to

4 percent from 29.0 percent; and - the assessment rate for single family residential property is set at a level to be determined by the state property tax administrator, such that the projected total revenue reduction attributable to the changes in the bill is $700 million over the 2023 and 2024 property tax years.

Where does the lost revenue come from?

The bill designates the first $240 million of the backfill above as a TABOR refund mechanism to refund

a portion of the state’s FY 2022-23 TABOR surplus. The refund mechanism will be used only if the

FY 2022-23 surplus is sufficient to first fully fund the current law 2023 property tax exemptions for

seniors and disabled veterans, and the income tax rate reduction for tax year 2023. Any backfill

required in the bill that exceeds the TABOR refund obligation, or that exceeds the $240 million limit

on the amount of TABOR refunds to be paid using this mechanism, is paid instead from the General

Fund

In essence, the legislature is merely moving the refund that taxpayers would get from Tabor to property taxes so the net savings is very “questionable” in my mind.

Prices continue to appreciate throughout Colorado

Unless you have been living under a rock, it is no surprise that prices have increased throughout Colorado and the rest of the nation. The April market trends report from the Denver Metro Association of Realtors, released today, April 5, amplifies a trend that’s developed over the early months of 2022. The new average price for a detached home in the Denver area jumped by nearly $60,000 over the course of a single month; it currently resides just south of $800,000. Even if this trend stops today with zero appreciation, most markets will experience a 20-40% increase in assessed rates in next year’s revaluation cycle

Will this new bill actually reduce your property taxes?

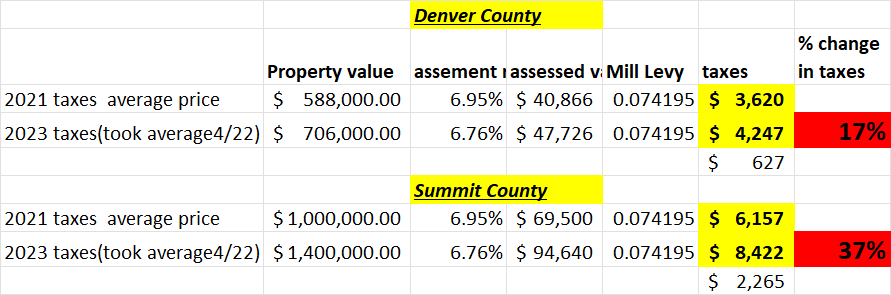

Unfortunately, the answer is no, the only way it will save you money is if you live in an area in Colorado with no appreciation. I don’t know of a single Colorado market that has declined in value the last two years. Below is an example based on the calculation of the average home price in Denver in 2021 versus the average home price in 2022 (a 20% increase).

Denver County Average sales prices & taxes

| Property value | assement rate | assessed valuation | Mill Levy | taxes | % change in taxes | |

| 2021 taxes average price | $ 588,000.00 | 6.95% | $ 40,866 | 0.074195 | $ 3,620 | |

| 2023 taxes(took average4/22) | $ 706,000.00 | 6.76% | $ 47,726 | 0.074195 | $ 4,247 | 17% |

With the new reduction in Assessment rate, the property taxes for the average homeowner in Denver still increases 17%. Look at Summit County, another fast-appreciating market in Colorado home to Breckenridge, Keystone, Frisco, Silverthorne, Copper Mountain.

Summit County Average sales prices & taxes

| Summit County | ||||||

| 2021 taxes average price | $ 1,000,000.00 | 6.95% | $ 69,500 | 0.074195 | $ 6,157 | |

| 2023 taxes(took average4/22) | $ 1,400,000.00 | 6.76% | $ 94,640 | 0.074195 | $ 8,422 | 37% |

Summary

I’m constantly perplexed at the Colorado legislature. SB 238 will not reduce your upcoming tax bills based on the large rates of appreciation throughout Colorado it merely reduces the increase by about 3% which is a drop in the bucket if you are still facing a 17-37% overall increase. Remember, this is on top of 20% plus increases last year.

Furthermore SB 238 is only in place for 2 years and is back-filled with Tabor refunds that taxpayers were slated to get so the real savings are questionable at best. What happens after 2 years when prices appreciate further? Colorado property owners are going to be facing some enormous tax bills in the future and SB 238 does nothing to solve the long term disconnect between property tax appreciation and inflation. Although it doesn’t appear initiative 74 will be on the November ballot, look for it or an alternative to come back to address the rising property tax issue.

Additional Reading/Resources

- https://leg.colorado.gov/sites/default/files/documents/2022A/bills/fn/2022a_sb238_r2.pdf

- https://www.westword.com/news/denver-record-home-price-average-800000-update-13807869

- https://www.dmarealtors.com/sites/default/files/file/2022-04/DMAR_MarketTrendsReport_Apr2022_EDITED.pdf

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender