Over the last several years both Keystone and Copper Mountain have appreciated at almost double the rate of Breckenridge. Why the sudden change in fate for Copper Mountain and Keystone? What big changes occurred in governmental regulations to cause the surge in prices? Is this recent jump in prices an anomaly or a longer term trend? How will the market react with the upcoming statewide proposals on nightly rental taxes? Should you invest in Copper or Keystone versus Breckenridge?

What is in the data on sales in Copper Mountain and Keystone?

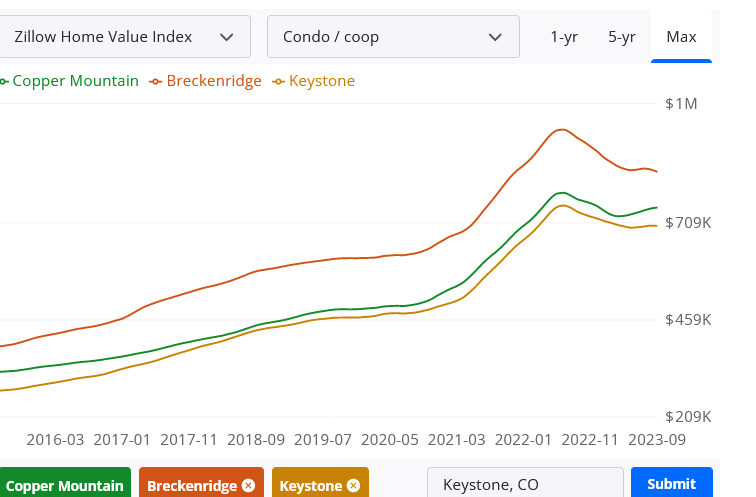

If I look at January of 2019 to present, Copper Mountain and Keystone appreciated at approximately 63% on the flip side Breckenridge still appreciated at 41% which is substantially slower. Furthermore the prices of condos in Keystone and Copper Mountain are quickly catching up with Breckenridge.

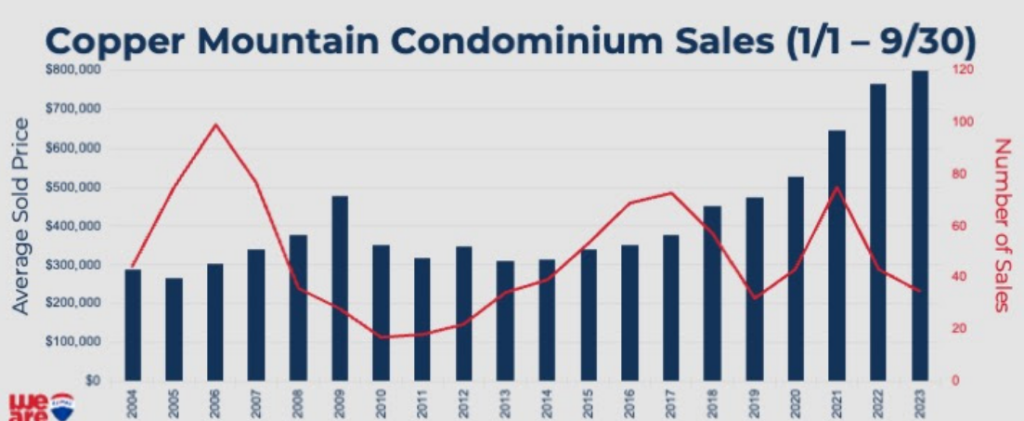

Note, I compared condos amongst the markets as there are not a ton of single family homes in Copper Mountain and Keystone compared to Breckenridge. Above is a chart that show how profoundly prices have increased at Copper Mountain (thanks to Susie Cortright, a Summit County realtor, for the great chart)

Why are Copper Mountain and Keystone appreciating faster than Breckenridge?

There are two primary reasons Copper Mountain and Keystone are outperforming Breckenridge. First both of these markets started at much lower price points than Breckenridge. But price is not the only driver of the stark differences in appreciation. Breckenridge has implemented very restrictive nightly rental regulations that capped the number of licenses and substantially increased the fees on nightly rentals making them considerably more expensive to operate than Copper or Keystone.

Furthermore Summit County implemented their own regulations drastically limiting nightly rentals in the county except for in two locations: Copper Mountain and Keystone. These two locations are the only ones in the county with no regulations/caps on nightly rentals causing huge surges in demand in these markets and driving prices substantially higher.

The bathtub effect of nightly rental regulations in Colorado ski towns

I’m not surprised by the data as nightly rental regulations impact an entire area. As regulations are increased in one location, the nightly rentals migrate to other areas in close proximity like Copper Mountain and Keystone. We can see on the chart that Copper Mountain and Keystone are beginning to gain ground on Breckenridge pricing. In essence the strict regulations in Breckenridge and other parts of the county have substantially increased values in these two markets due to unlimited nightly rentals

Did Breckenridge nightly rental regulations really help affordable housing?

Regardless of your position on nightly rental regulations, it is clear from the data that increasing regulations in one part of the county drastically increased prices in another. Even though, less units are being rented nightly in Breckenridge, areas like Copper Mountain and Keystone are more than picking up these same rentals. Furthermore before all the regulations, Copper and Keystone were still affordable for full time residents to buy. They could easily pick up a condo for around 250-300k, but now the average sales price in Copper Mountain is closer to 800k which is well out of reach for most service workers in Summit County.

Will Keystone and Copper Mountain continue to outperform Breckenridge?

I think the last several years of out performance by Copper Mountain and Keystone are unlikely to continue. There was an arbitrage opportunity due to pricing being substantially lower in Copper Mountain and Keystone. Now the pricing difference has been narrowed to around 100k. Furthermore, there is a statewide initiative to radically alter the nightly rental landscape by taxing nightly rentals at 4 times the rate of other residential property tax rates.

Summary

Real estate operates like a bathtub, as prices increase, or regulations increase buyers move to less expensive and or less regulated markets. This in turn increased the prices in alternative markets like Breckenridge and Copper Mountain and in turn has a huge impact on affordable housing. Unfortunately, each city makes their own regulations when there needs to be countywide coordination to prevent the movement of rentals just from one market to another less expensive market as we have seen play out throughout Summit County.

Additional Resources/Reading

- https://www.zillow.com/home-values/119417/copper-mountain-frisco-co/

- https://www.susiecortright.com/hows-the-summit-county-real-estate-market/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender