Denver just released an “affordable housing program” with new requirements for low-income housing. Multifamily will have large requirements for low-income housing that will drastically alter the type and number of units constructed. Furthermore, all property owners will pay the new fees including office, industrial, retail, and single family homes. What is in the new initiative and how much will it cost all property owners? Will the new affordable housing initiative have the opposite effect where Denver becomes less affordable?

What is in the new Denver affordable housing initiative and how will property owners be impacted?

The new initiative is broken into three primary focus areas:

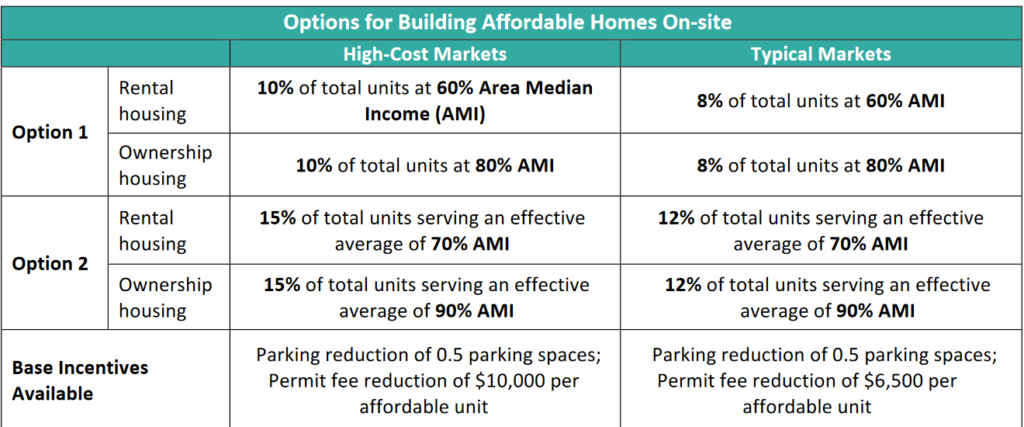

- 10 unit or greater multifamily: Below is a chart that outlines the impact on multifamily. The two key items are a requirement to build between 10-15% of units for low income residents either on the sale side or on the rental side. Furthermore the linkage fee if you want to “buy out” the affordable requirements is prohibitive starting at $250,000

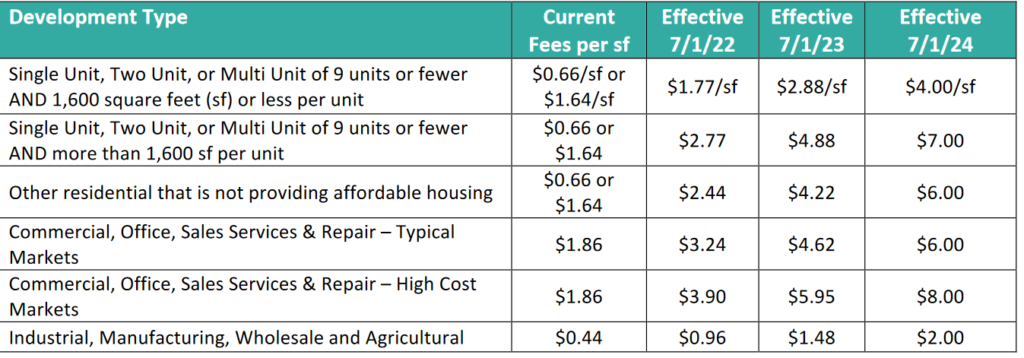

- 9 units or fewer multifamily/single family: Even for small properties, there will be low-income requirements via a linkage fee based on number of units and square footage

- All other properties pay a linkage fee: Even office and industrial properties are included in the proposal with office/Sales/Service/repair paying the highest linkage fee of $8/ft. For example, a 30k foot office building will pay a fee of $24,000 for low-income housing.

More details about Linkage fees: Every property type will pay large sums

Below is a schedule of linkage fees for every build type. Note it will be nearly impossible to build 10+ unit complex without affordable housing as the linkage fee would be between $250,000 – $478,000 making it nearly impossible to pencil out a new development without affordable housing.

Furthermore, let’s look at the impact on some other property types. Let’s assume that a builder was going to build a new office building downtown that was 150k feet, the linkage fee would be 8/ft in a few years (if they haven’t started already, it would take a few years by the time you get through zoning, planning, break ground on a large development), the increased cost would add $1.2 million to the cost of the project.

The end user and/or buyer will pay as these increased build costs will be passed on either through higher rents or increased sale costs. This in turn will lead to higher prices for residential single family, office, retail, etc… along with higher rents for tenants from a duplex to an industrial building.

Major difference between affordable and low-income housing

Let’s define affordable housing and low-income housing. There is a radically big difference.

Affordable housing: Affordable means that starting teachers, firefighters, nurses, and other critical functions within the city can afford to live in the city. Unfortunately, how the current initiative is written, all of these professions are excluded from affordable housing. The starting salary for a teacher in Denver Public schools is 47,000 but eliminated from affordable housing. As stated above the requirements for rental housing is 60% of the Average median income which is 44,016 for a single person so not even a first-year teacher for Denver Public Schools would qualify for a rental property under the proposed guidelines

Low-income housing: Denver’s guidelines at 60% of the Average Median Income price out basically any young professional that is unable to live in the area and essentially eliminates affordable housing for most young professions. The initiative needs to be titled low income housing as many who need affordable housing are not allowed to rent these units as they make too much

Denver’s initiative eliminates affordable housing

It is a bit ironic that an initiative titled affordable housing does just the opposite. Let’s look at three possible scenarios builders will take because of the new initiatives:

- Builders incorporate low-income housing. With build costs continuing to escalate, the project cost will have to be recouped over fewer market rate units. To make the numbers work, the remaining units will become more expensive so the builder/owner can recoup the below market units, this will eliminate more traditional market rate apartments as the complex will be low income or high income so that the project makes financial sense. This is not just a theory, look at any mountain town that has this requirement. This is exactly what happens with deed restricted low-income units and million-dollar condos.

- Builders who go this route will likely provide substantially smaller units that are considered affordable vs rest of the project. For example, instead of building a 2-bedroom affordable unit, they are better off building a one-unit affordable unit and making the market rate units larger, thereby eliminating a substantial amount of “low income” housing for families.

- Builders pay a linkage fee: In lieu of providing low income housing a builder can opt for a linkage fee on smaller projects (9 units or less), let’s say they are building a townhome project, each 1600 feet that has 4 units, the builder would have to pay a fee of 11,200 a unit in 2024 (7/ft) or almost $45,000 just in linkage fees for the project. This is a new fee on top of all the other fees/costs for building. The builder will be forced to focus on high end properties as there is more margin for higher cost properties to absorb the cost.

- For example the linkage fee is 6% of a 200k build as opposed to 3% of a 350,000 property. The linkage fees will further push the market towards higher income building pricing out affordable housing buyers/renters

- Builders decide to build elsewhere: As prices continue to increase for building, there will be a tipping point where builders decide to pursue other opportunities outside of Denver as the numbers no longer work. This will further reduce the supply of properties and in turn drive up prices even further for existing properties.

Summary

It is very ironic that the initiative is named “affordable housing” when it does just the opposite. The Denver initiative will make living/working in Denver less affordable for teachers, firefighters, nurses, and other critical workers as they do not qualify for any of this new housing. The Denver initiative forces builders to construct low-income housing and in turn high income housing to compensate for the loss of revenue. Denver’s affordable housing initiative will eliminate any market rate affordable housing forever.

Additional reading/resources

- https://www.denvergov.org/files/assets/public/housing-stability/documents/2021-income-limits-pub.pdf

- https://denverteachers.org/wp-content/uploads/21-22-DCTA-Step-and-Grade-Schedule-Eff.-8-1-2021.pdf

- https://www.denvergov.org/files/assets/public/housing-stability/documents/2021-income-limits-pub.pdf

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)