Of U.S. cities with more than half a million residents, only Denver’s overall violent crime (including aggravated assault, sex assault, robbery and homicide) has risen by more than 90% between 2012 and 2022, according to FBI data. What does the surge in crime mean for real estate values? What areas are faring worse than others? How will this impact the “suburban flight”?

What was in the data on Denver’s crime?

Assaults causing serious bodily injury, so-called aggravated assaults, nearly doubled since 2012 — the fastest rate of growth of any city with more than half a million residents, according to data reported to the FBI. Denver Police report there were 4,790 aggravated assaults last year, up from 2,463 in 2012.

Homicides, meanwhile, have tripled in the last decade. They now occur roughly twice a week, rising from 31 in 2014 to 90 in 2022, according to FBI data. In Denver, the number of unlawful discharges of weapons has more than doubled since 2019 and almost triple 2017. The discharge of guns is not just in “transitional” areas but is migrating to once safe areas throughout the city.

Return to suburban flight of the 90s.

With the return of crime, we are seeing a familiar pattern to the 1980s when crime also last spiked to these levels leading to large suburban flight.

In a Baltimore Sun article in 1992, Robert Reich, a Harvard political economist, has summed it up:

“ In metropolitan America’s increasingly polarized society, the economically mobile have “seceded,” mainly into homogeneous suburban enclaves where their “earnings need not be redistributed to people less fortunate than themselves.” Or, if they remain in central cities, secessionists carve out privatized existences in which their children are sent to private schools and in which they address many of their needs (security, recreation, sanitation) through private rather than public services.”

Denver hasn’t seen the implications like many other large cities as in the 90’s Denver was still a “small” city and just coming onto the scene.

Similar trends of the 90s are emerging in Denver:

Denver is following the same pitfalls that led to a decline in urban living in many cities in the 90s

- Redistribution via taxes (you name it, Denver seems to be increasing taxes to help someone else in every election cycle). Unfortunately nothing has changed even with all the taxes and wealth redistribution violent crime continues to increase.

- Poor education performance

- Spike in homelessness

- Spike in Violence

The trends above are very hard to reverse without first focusing on increased policing which Denver is not. The theory in Denver is that if you provide housing the other items will resolve themselves, unfortunately we have seen this play out in every major city. Without addressing the underlying issues (mental health, job prospects, drug and alcohol abuse, illegal guns, etc..) nothing fundamentally changes.

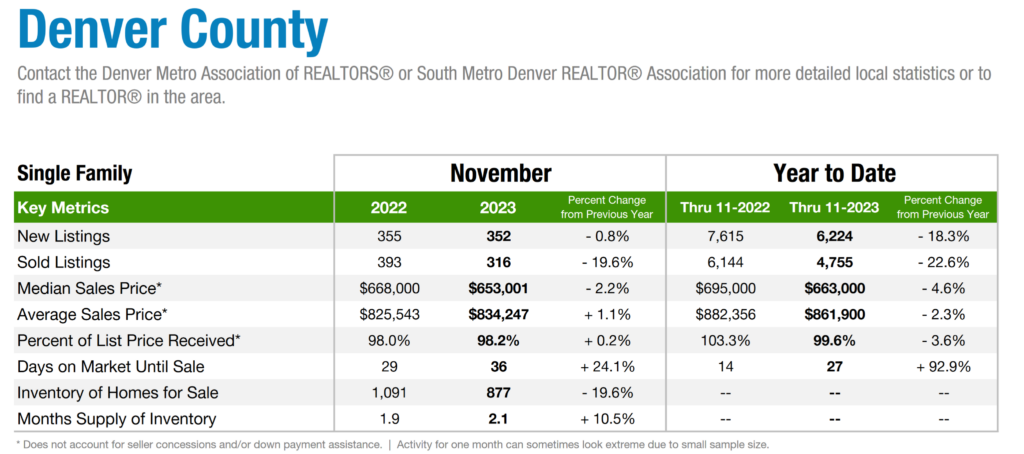

Real estate prices will be impacted

As crime rises, real estate prices fall. Nobody wants to move their kids into an area with shootings in broad daylight near schools, parks, etc… As we saw in the 90s, prices in these areas will plummet. The same will occur in certain pockets in Denver. Areas that were starting to “gentrify” are now going the opposite direction and this trend will not only continue but accelerate over the coming years.

Not all areas in Denver are impacted the same.

Not all areas in Denver are impacted the same.

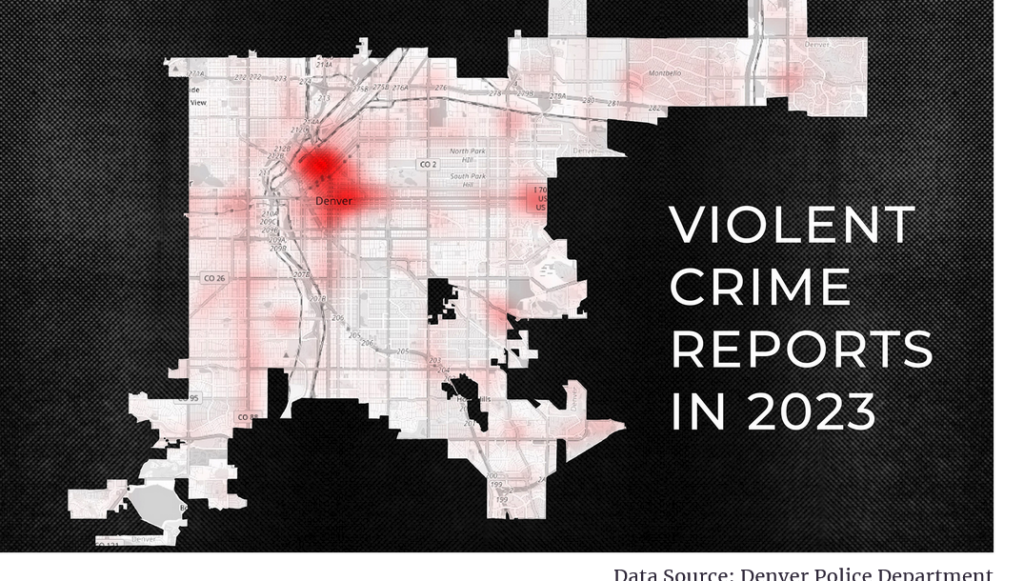

Violent crime is not evenly spread across the city, and two neighborhoods stand out: Five Points and Montbello. Downtown and Capitol Hill suffer high rates of shootings and assaults. Violent crime also plagues neighborhoods to the northeast like Green Valley Ranch, and southwest, around Westwood.

Take for example Cherry Creek. In Cherry Creek we are not seeing the same spike in crime and urban flight as other areas. Robert Reich, in his 92 analysis, summed up what we are seeing today: “secessionists carve out privatized existences in which their children are sent to private schools and in which they address many of their needs (security, recreation, sanitation) through private rather than public services.” History is repeating what occurred in the 90s in Denver and cities throughout the country.

Summary

Denver, along with many other cities, is repeating the same mistakes made in the early 90’s that led to urban flight. With crime increasing rapidly in areas throughout Denver and our elected officials continuing to throw more money at the problem unfortunately the results will be the same as we are seeing today. Nothing is fundamentally changing in Denver to change the trajectory of the enormous increase in violent crime. Furthermore, Denver has not learned from history that safety is the first priority to ensure a stable urban core.

Real estate will undoubtedly be impacted by the surge in violent crimes with many areas eventually showing double digit declines. Fortunately, not every area in Denver will not be impacted the same, many areas are not seeing the same spike in crime and will continue to be desirable. A good example is Cherry Creek.

If there are not radical changes in Denver county in regards to crime the suburban flight will repeat again as it did in the 80s and lead to a negative spiral for many areas as we saw in the past. Currently the solution is more money for homelessness and creating encampments to house them. Denver politicians should take a short trip to Portland, OR to see how disastrous these policies are.

Additional reading/Resources

- https://denverite.com/2023/11/21/a-new-era-of-violent-crime-in-denver-shows-few-signs-of-slowing-down/

- https://denverite.com/2022/12/06/denver-gunfire-gunshots-crime-rising/

- https://www.axios.com/local/denver/2022/08/10/denver-police-chief-curb-crime

- https://www.baltimoresun.com/news/bs-xpm-1992-01-05-1992005091-story.html

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender