Summer has come in with a roar in the Denver metropolitan area as inventory in June jumped 76% year over year. What has caused the huge jump in inventory? What does the change in inventory mean for prices? How will Denver real estate perform compared to the National average?

Summer has come in with a roar in the Denver metropolitan area as inventory in June jumped 76% year over year. What has caused the huge jump in inventory? What does the change in inventory mean for prices? How will Denver real estate perform compared to the National average?

What was in the June Denver sales data?

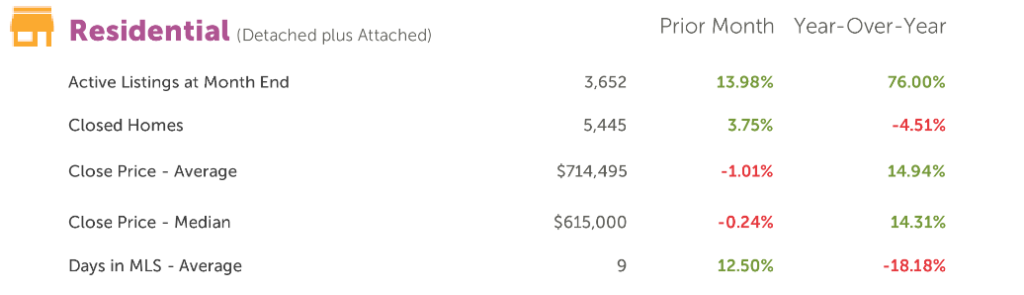

Metro Denver recorded a 76% jump in the number of residential properties available for sale in June, according to a monthly update from the Denver Metro Association of Realtors.

At the same time the median home price sits at 615k which is a .25% drop from last month, but still up 14.3% year over year

Important to keep the data in context

Although inventory rose by a huge percentage amount, it is important to remember that this comes off an extremely low number of listings available for sale. Even with the big increase, there were only 3,600 active condo and single-family homes for sale in metro Denver at the end of June, a fraction of the 13,917 averaged between 1985 and 2021.

One note on the increase in inventory; the largest price points for inventory increases are currently in the 500-750k. This group has been most impacted by the recent surge in interest rates as many are now forced to look in lower price points due to the increased costs.

What is driving the surge in inventory?

There are three primary factors driving the recent uptick in inventory.

- Consumer sentiment change: There is a fear that we are at the top of the market and sellers want to take advantage of the market before it is too late

- Rising rates: As rates rise, properties become relatively more expensive therefore limiting demand. Interest rates have jumped from a low of around 2.75% to over 6%

- Inflation: As car payments are higher, food is higher, and other items are higher due to inflation which means less is available for house payments.

How will prices in Denver be impacted?

Although the average close price declined by a nominal 1%, June’s report is an indicator of a change in market sentiment not only in Denver, but throughout the country. June is just the beginning of the drastic change in the market, with mortgage rates continuing to rise and inflation taking a larger bite out of disposable income the Denver real estate market will continue to reset through the summer and the rest of the year. I’m sticking with my prediction of about a 10% decrease in prices in the Denver metropolitan area with larger drops in rural/exurban locations

Summary

The last couple years of 20% plus appreciation has come to an end. The recent increase in inventory over the past month is an indicator of more to come. As inventory increases, prices will no doubt moderately fall. Although the sky is not falling, as rates increase even further Denver’s inventory will continue to increase, days on the market will increase, and ultimately prices will reset further. June’s data is an indicator of the initial reset in the market. Remember last year appreciation was over 20% in most of Denver so a 10% reset is comparable to about 6 months of appreciation last year.

Additional reading/Resources

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender