I’m asked daily what happens to prices in high cost cities like Denver. Will prices stabilize due to the Golden handcuffs of low rates? Will prices go into a free fall due to higher mortgage rates? Historically there is a correlation between rents and prices, during covid this correlation went out the window, but in a rising rate environment it would be wise to understand what the numbers are telling us.

Before getting into the analysis, it is important to answer the question; will the Golden Handcuffs of low rates ultimately stop declines in prices?

“Golden Handcuffs” is a short term phenomenon especially in high cost areas like Denver

There has been a theory that the ultra low rates would prevent inventory from rising and furthermore we have a huge inventory shortage which will keep prices from falling. Unfortunately, this narrative is only partially true in the short term.

Depending on the economy if we have a very shallow recession and rates peak soon and then fall back shortly, the golden handcuffs scenario will likely hold up as property owners wait out the market.

The reality is that rates will likely remain higher for longer and the recession could also be deeper and longer. Higher rates for longer are the base case for most economists which means that inventory will ultimately increase for 3 reasons:

- Life Happens: Divorce, Marriage, kids, deaths, etc… In the short term if there is an economic hiccup most will hold on for a little while, but you can’t plan life around the economy and eventually life happens. From Marriage, Divorce, job changes, kids, empty nesters, deaths, etc… all these events will ultimately cause a sale or purchase of real estate which will cause real estate to turn. How extensive these events are will depend on how long the recession lasts and how high rates remain.

- Unemployment rate will increase: It is not possible to get inflation under control without addressing the wage pressures in the labor market. We are already seeing many high tech companies cut headcount from Google, Microsoft, Amazon, etc… As rates rise, the unemployment rate will also rise which will force people to give up the golden handcuffs. Although we have yet to see this occur in the labor market data, I can say with 100% certainty it will happen, it is just a matter of time.

- Migration back/out: As the unemployment rate rises, the bargaining power of employees will decline. You will see more companies requiring workers back in the office and/or adjusting pay to compensate for the location. Denver was recently ranked the second largest net “out migration” destination in a redfin study which will further crimp demand.

What happens to real estate prices in Denver

There are two primary scenarios that could play out depending on the depth of the next recession and how high the federal reserve must raise rates

- Golden Handcuffs buffer the market a little: Under this scenario rates peak early next year and quickly come down as inflation falls and we enter a mild scenario. This is the optimistic case which would lead to about a 10% decline in prices year over year. As the chart above shows, Denver is already down more than this which leads to the more likely option below.

- Base case of higher rates for longer prevails: If inflation doesn’t come down as quickly as the market is pricing in and the federal reserve is forced to raise rates higher for longer the odds of a deeper recession increase. Under this scenario, look for prices to fall around 20% in Denver metro.

Rental Correlation to Denver real estate prices

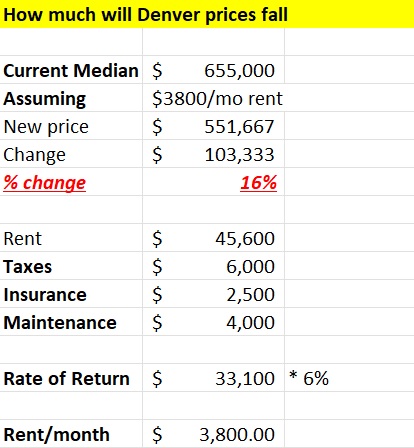

There is a maximum amount of rent that can be charged for a property. As interest rates rise and the rates of returns on treasuries rise, this will in turn push up the rate of return an investor would pay for a property. Don’t get me wrong, many houses are sold to owner occupants so they don’t do this analysis, but over the long term, investors will increasingly drive the direction of prices due to their return on investment. Below is an analysis that puts numbers to the correlation between rent and values.

For my analysis I made a few common assumptions:

- Median rent around 3800 for a Single Family

- Average rate of return is 6%

- Median home price $655,000

- I used average tax, insurance, and maintenance numbers.

How much will Denver prices fall |

||

| Current Median | $ 655,000 | |

| Assuming | $3800/mo rent | |

| New price | $ 551,667 | |

| Change | $ 103,333 | |

| % change | 16% | |

| Rent | $ 45,600 | |

| Taxes | $ 6,000 | |

| Insurance | $ 2,500 | |

| Maintenance | $ 4,000 | |

| Rate of Return | $ 33,100 | * 6% |

| Rent/month | $ 3,800.00 | |

Summary

Just like earlier in the year where everyone was stating that we were short millions of houses and yet inventory is now increasing substantially (not from new construction), there is a big question about how tight the “golden handcuffs” of low rates will be. Unfortunately, the golden handcuffs are a short term phenomenon so it is critical to analyze what happens when they loosen.

To understand how low prices will go it is important to look at how someone analyzes a rental property and the return they expect to receive. One of the largest buyers of bulk houses is now institutional investors which will only buy if their investment criteria is met. Their buying will create a “floor” underneath prices as others sit on the sidelines. Below is a simple analysis of what a “floor” price in Denver might look like.

My base case scenario is for a drop of around 10% in real estate prices, with a probable scenario of a drop as large as 20% (maybe 25%). Note, if rents decline substantially of their peaks, then the equation changes rapidly with substantially lower prices. Remember what happens in Denver typically spreads throughout the state of Colorado within about a year, so brace for a rocky 2023 in real estate throughout Colorado. Also note, the drop will not be immediate, the third or fourth quarter of 2023 is when the adjustment should begin to occur

Additional Reading/Resources

- https://www.bloomberg.com/opinion/articles/2022-10-25/think-homeowners-will-stay-put-austin-texas-suggests-otherwise?

- https://car-co.stats.showingtime.com/docs/lmu/2019-09/x/DenverCounty?src=page

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender