Denver City Council recently approved five new bond initiatives to appear on the November ballot. The total amount of this spending is 450 million paid for by anyone who lives or owns property in Denver. What was in the bond initiative? How high will your property taxes go? Will this pass initiative pass?

What is included in the 450 million in new bond proposals in Denver?

- $63.3 million: Transportation projects like expanding Denver’s sidewalks; renovating existing bike lanes and adding new ones; rebuilding portions of the Morrison Road corridor to add a cultural and arts district; building an urban trail downtown.

- $54 million: Parks projects like new ones in northeast and south Denver; restoring athletic fields and courts; replacing playground and recreation equipment; and rebuilding the pool at Mestizo-Curtis Park.

- $38.6 million: Housing and shelter projects, the biggest being building or renovating shelters for the homeless; that could also mean purchasing or converting buildings into shelters.

- $104 million: Denver facilities projects, including repairs and improvements at the Denver Botanic Gardens, Bonfils Theater Complex, Denver Museum of Nature and Science and the Denver Zoo; two new libraries; renovation of a city-owned youth empowerment center; accessibility upgrades for city buildings.

- $190 million: A new arena at the National Western Complex and renovations at the existing 1909 Building.

Will the new Denver bond initiatives pass?

Yes. Since 1982, Denver voters have approved all but one of the 11 bond packages sent to them. I don’t see why these new bond initiatives would break the prior voting pattern.

How will Denver pay for the new 450 million in spending?

According to the Denver.gov website, existing mill levies “should” be able to cover the new spending. By voting for these bond measures, voters are giving the city a blank check to increase their mill levies to fund this new bond initiative. In essence, Denver already has the highest mill levies in the metro area and this initiative will keep the levies at there existing rates at a minimum or increase them if needed.

How are property taxes calculated in Denver County and Colorado as a whole?

To calculate your property taxes:

Assessed value X Assessment rate (fixed at 7.15%) X Mill Levy ( in Denver: 0.074195) –> property taxes

There is no doubt your taxes are going up at least 35% in Denver county

Remember in Colorado properties are assessed every odd year. So 2021 used sales up to 6/30/20 to calculate your values. Based on recent statistics form the Colorado Association of Realtors in Denver county the median home price has already increased 26% since the last assessment. Assuming a 10% (more normal) appreciation this leads to a 36% increase in values and in turn property taxes. Remember that the assessment rate is now fixed at 7.15% and the Mill levy will not decrease based on the new bond initiatives. The wildcard is how much will/could the mill levy increase to fund the new 450 million dollar package.

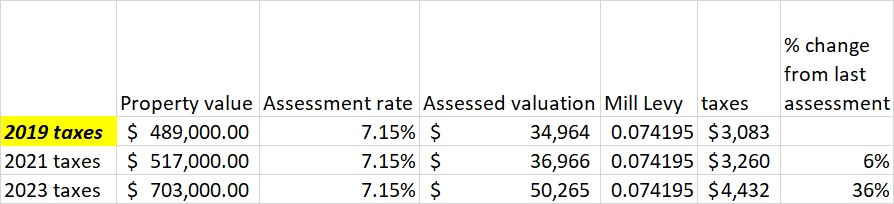

Here is the calculation:

| Property value | assesment rate | assessed valuation | Mill Levy | taxes | % change from last assessment | |

| 2019 taxes | $ 489,000.00 | 7.15% | $ 34,964 | 0.074195 | $ 3,083 | |

| 2021 taxes | $ 517,000.00 | 7.15% | $ 36,966 | 0.074195 | $ 3,260 | 6% |

| 2023 taxes | $ 703,000.00 | 7.15% | $ 50,265 | 0.074195 | $ 4,432 | 36% |

Want to know how high your property taxes will go? Substitute in your property value X 7.15%X.074195 –> your Denver property taxes

What do substantially higher taxes mean for Denver real estate values?

As taxes go up, affordability goes down. Currently we are in a fortunate place with mortgage rates remaining at historic lows which has led for a “break even” in payments as values have risen. Unfortunately taxes don’t work the same way. As taxes go up everyone pays from property owners to residential and commercial tenants.

On the commercial side, you will see a slowdown in commercial leasing as rates are increased (or NNN expenses) to “pass through” the higher property taxes. Remember commercial property taxes are about four times higher than residential rates.

On the residential side, homeowners will be hit with higher escrows which will increase their monthly payments. Tenant rents will be increased to compensate for the increased expenses as well.

The million dollar question is when do taxes rise so high that property values are curtailed or fall? If the current trends in Denver County of tax and spend continue we will find out very soon where the tipping point is.

Summary:

I always find it ironic that cities continue to raise property taxes so high. This is occurring while property values are also rising which unto itself will increase taxes. Property taxes are a regressive tax meaning that lower income residents pay more. For example, in the recent bond initiative, whatever the costs are they will be passed on to not only property owners, but also commercial and residential tenants.

Regardless of what the politicians are saying, money doesn’t grow on trees. There is no doubt that residents and businesses in Denver county will be hit with substantially higher taxes. One of the bond initiatives is for the homeless; ironically, the large increase in taxes will further exacerbate Denver’s affordable housing crisis as rents are increased to pay for the higher taxes therefore creating more demand for these services. The only question remaining is how high will your taxes continue to go before real estate hits a tipping point.

Additional Reading/Resources:

- https://denverite.com/2021/05/20/inside-denvers-latest-bond-project-proposal/

- https://www.denverpost.com/2021/08/23/national-western-center-denver-bonds-mayor-hancock/

- https://www.coloradorealtors.com/market-trends/regional-and-statewide-statistics/

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)