Well’s Fargo just released its midyear housing update and from the surface it looks rosy for Denver and Colorado. How accurate are their assumptions? Will Colorado real estate continue to increase in light of an impending recession? Hint, don’t get too comfortable or believe everything you read :<

What was in the Wells Fargo data on housing price appreciation?

There is little doubt the housing market has reached a clear turning point. Buyer traffic has fallen off, inventories have risen, and sellers are increasingly reducing asking prices. The slowing is evident throughout the supply chain, with prices for lumber and other key building materials declining and mortgage lenders substantially reducing staff. While the housing market is turning, we do not expect the sector to endure a severe correction. Homeowners are sitting on a mountain of equity and mortgage underwriting has been far more cautious than in prior cycles, which means we are unlikely to see a repeat of the foreclosure crisis that occurred over a decade ago.

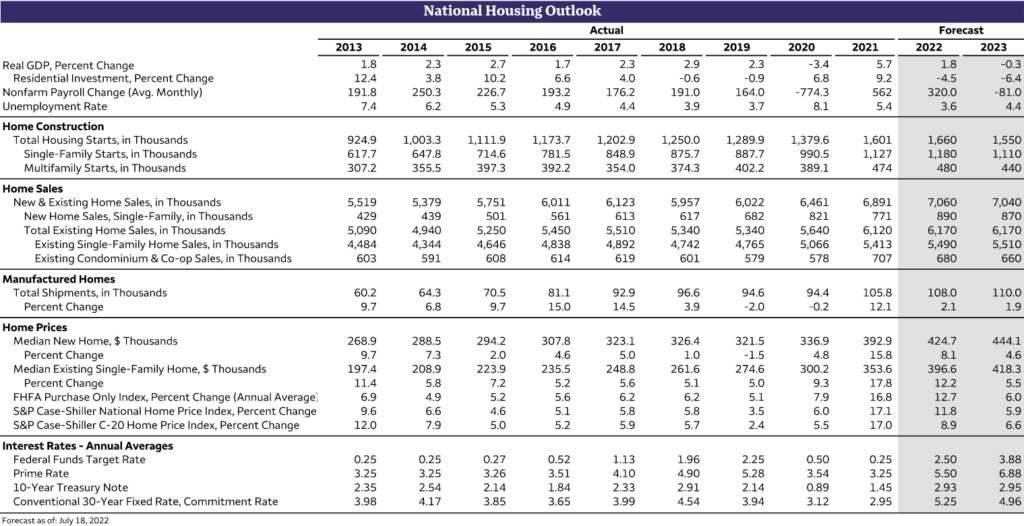

Here are some of the key points of Wells Fargo’s analysis:

- Appreciation continues at 8.1% in 2022 and 4.6% in 2023

- Sales continue to increase around 2% in 2022

- Mortgage rates end 2022 around 5.25% and drop in 23 to 4.96%

How accurate was their analysis?

I would take the Well’s forecast with a healthy grain of salt. There are two key items I disagree with and the market seems to be on my side

- Mortgage predictions way off. Currently mortgage rates are around 6%, the federal reserve is poised to increase rates even further to quell inflation. Wells and others are discounting how entrenched inflation is. As a result, the federal reserve will have to raise rates more and longer than anticipated. I predict rates will be 1% higher this year ending around 6.25% to 6.5% and either holding at these levels in 23 or rising even more to 7%. The Well’s analysis assumes the federal reserve will begin cutting rates next year as we enter a recession. Unfortunately, I don’t think they will have this ability due to stubborn inflation.

- Demand will wane: Mortgage demand just hit a 20-year low due to rising rates and inflation. According to a recent fed study, every 1% rise in interest rates decreases demand 10%. It is impossible to maintain current demand with rising inflation and interest rates as the pool of available buyers is considerably smaller as prices have also risen. The only way demand comes back is when either interest rates fall substantially, which isn’t in the cards, or prices fall.

How will Denver real estate perform with a recession

Denver should end 2022 around flat at best. The first half showed appreciation around 8%, to end the year flat means prices will drop 8% from where they are today. I think this is a reasonable assumption as demand wanes and inventory increases substantially.

There will be a larger market reset in 2023 as interest rates bite and stimulus finally starts to wane. 2023 will end the year down 5-10% as we cycle through a recession which unfortunately is impossible to avoid at this point due to the rapid pace of interest rate hikes from the Federal reserve.

On a positive note, Denver should outperform most other markets throughout the country due to strong employment and desirable location. Furthermore, supply is still constrained which should soften the landing.

How will Colorado real estate perform with a recession

Colorado is a big state so I will break it down into regions:

Northern Front range: cities like Boulder and Ft. Collins will continue to perform well and mirror Denver, the smaller markets might see a little more downside on prices as wages cannot keep up with rising interest rates.

Southern Front range: cities like CO Springs will perform similar to Northern front range cities. Areas like Pueblo are more at risk due to lower salaries and less local employment opportunities.

Resort markets: In the urban cores of major ski markets, values should basically be flat to a little up this year with maybe a small decline next year 5-10%. Further non-core markets will likely see a bit more of a reset. For example, Silverthorne, outside of Breckenridge, could see declines approaching 15% by the end of 2023. Remember that just last year these same areas saw price growth approaching 40%.

Rural markets: This is the biggest risk as people get back into old habits and are forced to migrate closer to urban centers. There could be a reset approaching 20% in some of these markets as there is not enough local employment and wages to support prices.

Summary

I was a bit surprised to see the Wells’ analysis predicting continuing increases in real estate prices considering rapidly rising rates. The “market” is also not believing the rosy forecast with mortgage demand dropping to its lowest in 20 years and rates rising into the 6% range. Fortunately, Denver and the Northern front range cities will outperform most other areas with only slight declines in prices. Non-core areas outside of the resort communities will have a bumpier ride with larger risk of price declines. The most risk is in rural areas. Hang on to your saddle as the trail ahead looks a bit rough.

Additional Reading/Resources:

- https://www.cnbc.com/2022/07/20/mortgage-demand-drops-to-lowest-level-in-22-years.html

- https://wellsfargo.bluematrix.com/links2/html/2747ee85-62bd-423e-a9c3-a2f80d4ef4ab

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender