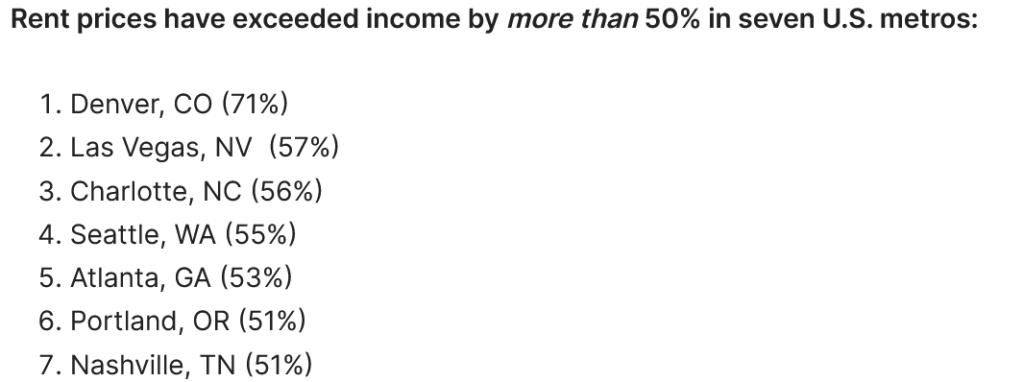

Metro Denver apartment rent inflation has outstripped income gains by a higher margin than any other major city in the U.S. since 2009, according to a recent study by Real Estate Witch. Furthermore, Denver has experienced the second highest jump in rents in the country. What big changes in Denver are causing the huge jump in rents? Will this trend continue?

What was in the data on rents?

Nationally, median monthly rents went from $817 in 2009 to $1,163 in 2021, a gain of 42%. Denver’s gain was 82%, going from $856 a month to $1,554. That jump, almost double the pace experienced nationally, was second to only San Jose, the hub of California’s Silicon Valley, where monthly rents went up 85%, from $1,360 to $2,511.

Denver was different than San Jose as income did not come close to keeping pace with the huge jumps in rent causing an even larger rent “burden” on tenants.

Is Demand causing the huge spike in rents?

The first thing that comes to mind as to why Denver rents keep increasing is that Denver is a popular place and that the huge demand spike is the issue. Unfortunately, the data on net migration is telling a different story:

Denver County, which averaged a 2.1% annual rate of population growth between 2010 and 2019, lost population in 2021 and started growing again in 2022. But it remains down by about 4,304 residents over the 2-year period, or 0.3% per year. The county’s deacceleration was among the largest regionally and nationally, according to EIG. As in many places with population losses, it reflected a big drop in international migration, outflows of residents to other areas and other states, and a higher death rate because of the pandemic.

Denver, Boulder, Jefferson and Arapahoe counties lost nearly 34,000 residents combined in domestic out-migration in the past two years, according to counts from the U.S. Census Bureau. Over the same period, Weld, Douglas and Larimer counties saw net migration of 35,656 people.

What is causing the huge jump in rents in Denver?

If demand is not the biggest driver of price increases, then it is important to look at supply. In 2021 Denver county ratified a new building requirement for net zero homes that drastically increased building costs and furthermore implemented a “linkage” fee for new construction to help with affordable housing.

Net Zero: Denver county has ratified a timeline to require all new homes by 2024 to be net zero homes and all electric, with all new buildings (including commercial) by 2027. These updated requirements will substantially change how homes are built and their costs.

Linkage Fees: Denver along with net zero building requirements also passed a program to charge linkage fees on new construction. Here are more details from a prior article I did on the Denver Linkage fees. Last year Denver passed an “affordable housing program” that requires multifamily developments to pay linkage fees and/or reserve a percentage of units for low income housing. This has led to an 88% decline in new apartment permits further decreasing supply.

Impossible to build lower cost houses in Denver

As costs continue to increase on both materials and labor it is impossible to build lower cost houses. For example, the median home price in Denver is over $600,000. How can a service worker afford a 600k home; they can’t; How will they afford a 650k house due to the new requirements, the answer is the same, they can’t! On top of the new building requirements add on linkage fees furthering the inability to build lower cost properties.

These new requirements further raise the price point that is required to actually make a profit. A builder is going to focus on a higher margin product that can absorb all the new costs leading to an even higher build cost and entry point into the single-family market.

Further Raise real estate prices and in turn rents

The increased building costs will further raise real estate prices throughout the county. As building costs increase substantially existing homes will also increase in price as they will cost less than building a new home. For example, if the build costs for a 3k foot home are now 300/ft due to the new requirements, this essentially puts a floor under prices as lower priced homes look like a bargain compared to new construction. This will put further upward pressure on existing home stock especially under 1 million dollars.

We are seeing this play out in rents as more expensive homes demand higher rents. Furthermore there are few if any less expensive homes available which is drastically increasing rents.

Summary

It is no mystery why Denver rents are outpacing income. As building prices continue to increase due to new building requirements and linkage fees it is basically impossible to build lower cost housing without substantial government assistance. Supply on the lower price points is substantially reduced causing huge jumps in rents.

Unfortunately the supply issue is not going to be resolved anytime soon in the front range of Colorado as building costs continue to increase which means that rents will likely stay high. The silver lining is that as rents remain high, ultimately this will reduce demand as prospective tenants look for cheaper alternatives which we are now seeing with the increases in net migration out.

Additional Reading/Resources

- https://www.realestatewitch.com/rent-to-income-ratio-2023/

- https://coloradohardmoney.com/denver-passes-affordable-housing-law-88-decline-in-apartment-permits/

- https://www.denverpost.com/2023/07/08/denver-top-in-nation-rent-increases/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender