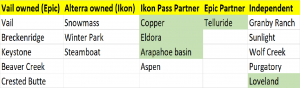

Ski season officially opened in Colorado on Friday (above is a pic of the first snow of the 19/20 season in Steamboat). One Ikon resort (Arapahoe basin) and one Epic resort duked it out for the honors with Arapahoe basin opening hours before Keystone. What caused the “revolution” in skiing? How will real estate be impacted? Which pass will win the “war” and who will lose?

It is interesting how the skiing landscape has changed not only in Colorado but throughout the country over the last ten years. Vail resorts and Alterra have been on a spending spree gobbling up and/or partnering with most major resorts. What does this mean for various Colorado resorts? Who is affiliated/owned by each company?

The history of the ski pass

It started back in 2008 when Vail resorts had a novel idea to offer one pass with access to 5 different resorts. The idea quickly took hold with Vail selling over 750,000 season passes generating 600 million in revenue. That is before any ski lessons, rentals, hotel rooms, 30 dollar cheeseburgers on the mountain and countless other revenue streams they generate. This concept has quickly caught on with the Epic pass now encompassing 19 resorts with limited access at another 10 resorts.

Alterra’s Ikon Pass came on the scene in 2018 quickly buying Steamboat, Winterpark, and Snowmass assembling 14 mountains with unlimited skiing and another 14 with limited dates. This was the first real challenge to the Epic pass and sales reached 250,000 in the first year. With Alterra and Vail the behemoths in Snowsports, the industry consolidation has taken off with Crested Butte getting bought along with countless others either getting bought or partnering with Alterra or Vail.

Why the pass?

Selling a pass, ie a subscription, is a novel idea in the skiing industry. It insulates the major companies from weather events as they price their passes for purchase primarily in the summer at deeply discounted rates thereby locking in substantial revenue regardless of what the weather throws during the season. It is an amazing concept to greatly mitigate the risk of weather in a very volatile business. It also not only ensures revenue from the pass sale but also visitation. If someone spends a thousand dollars on a pass, regardless of the snow conditions they will likely venture up to the mountain to use their pass investment which will lead to greater revenue for the resorts in vending sales, lessons, parking, etc….

The pass further “locks” skiers into a group of mountains as it is unlikely they will venture frequently to other mountains. For example, if you buy an Epic pass you will likely hit Breckenridge, Vail, and Keystone and likely not venture to Copper where the pass doesn’t work. This furthers the “revenue circle” for the various pass products making it difficult for the smaller resorts to compete.

The industry risk

As Vail and Alterra are forcing skiers into a pass product they are creating a risk within the industry. With the pricing strategies of the two largest resorts, either you buy a pass for between 600 and 1,000 dollars or you pay 200+ for a day pass. Clearly the pass will pay for itself if you ski more than 3 or 4 times, but the cost of entry is becoming prohibitive for new Snowsports enthusiast.

For example to see if you enjoy skiing you could pay for 3 days of tickets and lessons that would cost around 750, add in lodging and meals and you are up to over 1500 to just see if you are interested in skiing at a major resort. The pass product will eliminate a group of new Snowsports enthusiasts due to the cost to see even if they like the sport. Long term this will lead to a decline in Snowsports throughout the country as fewer young people are venturing into the sport which will impact future revenue streams.

Will Epic or Ikon win?

Who will win is tough to call at this juncture. Both Alterra and Vail have compelling products. They have split the industry into two parts with different models. At this point it looks like both will win to some extent but there is considerable uncertainty as to which one will be more profitable. My gut says Alterra will be more profitable as they are focusing on a higher price point and going less “mass market” than Vail. Alterra reminds me of the Costco strategy where they are positioning themselves as a premium product but only time will tell who will “win” the pass wars.

On the flip side, who will lose is a much simpler question to answer. Every major resort will either need to be acquired by one of the two major resorts or at a minimum partner with one. A good example is Telluride; they are staying an independent mountain but have partnered with Vail to offer the Epic pass on a limited basis. Resorts that don’t partner or get bought by Vail or Alterra will have a difficult time staying alive due to the seasonality of skiing and the huge capital improvements that must be made to stay relevant.

Impact on Real Estate

Regardless of who wins the pass wars, real estate will be impacted. As the industry consolidates further, many smaller resorts will no longer be able to compete which is why real estate located in mountains that are either owned or affiliated with Alterra or Vail will outperform other areas. If you are looking to invest in mountain areas the resorts owned by Alterra or Vail will be the best bet as they will continue to invest heavily in their own mountains. For example, Steamboat is getting a new gondala and over 40 million is being invested in the resort. This investment will continue to propel mountains like Steamboat, Snowmass, Vail, or the various other mountains which are owned by the respective companies. This investment will trickle down to real estate as guests/ real estate buyers are attracted to the newer amenities.

Summary

At this time, I don’t foresee a clear winner in the pass wars. This is like retail where there will be two or three major players. For example there is room for Walmart, Amazon, and Costco to all cater to various retail market places. Each of these retailers are successful and very profitable but they have pushed many of the smaller retail players out. The same strategy will play out in skiing with Alterra emulating the Costco model at a little higher price points while Vail is going for more mass market acceptance at a lower relative price point. Regardless of who will ultimately win, in the interim it is quickly becoming a two-person race. When evaluating mountain real estate it is imperative to be on one of the two horses or at a minimum located in a resort that is affiliated with one of the two.

Resources/ Additional Reading

- https://www.bloomberg.com/news/features/2019-03-01/epic-vs-ikon-battle-for-the-best-ski-pass

- https://www.snowboarder.com/transworld-snowboarding-archive/snowboarding-news/everything-you-need-to-know-about-the-ikon-pass/

- https://www.newschoolers.com/news/read/How-Vail-EPIC-Pass-Changed-Game

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)