The Denver Metro Association predicted “extreme bidding wars” will continue in their August Newsletter. At the same time the National Association of realtor’s chief economist said: “We’re witnessing a housing recession in terms of declining home sales and home building”. Will Denver buck the national trend, or will the housing “recession” overtake Denver’s market?

What was in the Denver metro association of realtors “extreme bidding wars” report?

The average price of a detached home in metro Denver went down slightly last month, after a surprising jump in December 2021. But according to the latest report from the Denver Metro Association of Realtors, another decline will be ultra-unlikely in coming months. Because the number of homes available for sale in the area is at what’s described as a “historic…low,” DMAR predicts “the continuation of extreme bidding wars.”

Demand continues to overwhelm supply in the local real estate market, as has been the case for more than a year. The number of new single-family, detached-home listings active at the end of January, the most recent month for which statistics are available, landed at just 788, an 18.60 percent slide from the 968 lingering at the close of December, and a 37.61 percent dip on a year-over-year basis.

What is predicted by the National Association of Realtors?

More signs are pointing to a housing slowdown as existing-home sales—completed transactions for single-family homes, townhomes, condos and co-ops—fell 5.9% month over month and 20% year over year, according to the National Association of REALTORS®’ latest housing report. “We’re witnessing a housing recession in terms of declining home sales and home building,” says NAR Chief Economist Lawrence Yun. “However, it’s not a recession in home prices. Inventory remains tight and prices continue to rise nationally, with nearly 40% of homes [on the market] still commanding the full list price.”

The median price for an existing home jumped 10.8% from a year ago, reaching $403,800. However, that’s down $10,000 from last month’s record high of $413,800, NAR reports. July’s decrease in home sales, the sixth consecutive month of declines, likely was due to higher mortgage rates sidelining more buyers, Yun says. Homebuilders echoed that sentiment this week, reporting that new-home sales fell 10% annually in July and were at the lowest level since the onset of the COVID-19 pandemic in 2020.

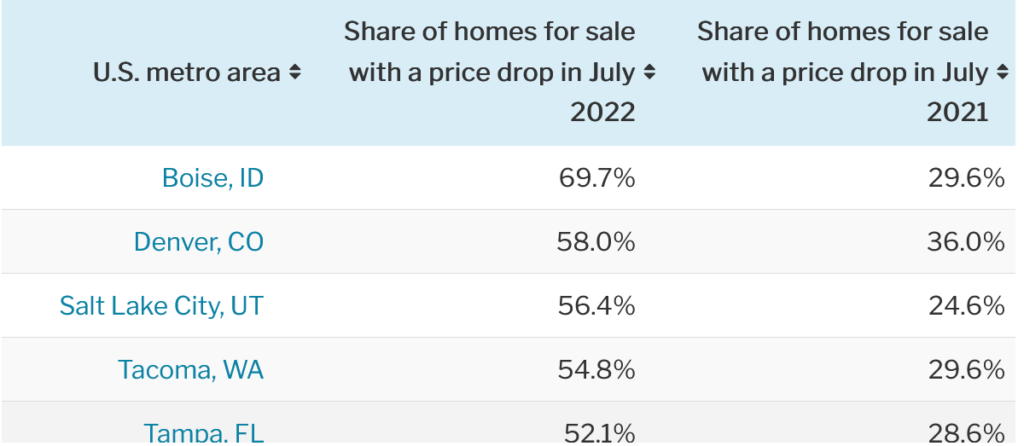

All four major regions of the country reported a drop in existing-home sales last month. The Western region of the U.S. posted the sharpest annual sales decline as well as the largest housing inventory increase. “It’s likely some Western markets will see prices decline, and that will be welcome news for buyers who watched rapid price jumps during the past two years,” Yun says.

Will Denver’s real estate market succumb to National forces?

Denver, like every other market, will not be immune from the macro forces slowing housing for the rest of the nation. As interest rates rise, recession fears linger/increase, and the stock market resets Denver will be impacted. Over the remainder of the year and into next year there will be considerable increases in inventory which should all but eliminate bidding wars and put downward pressure on prices. Currently I don’t foresee a free fall in prices, but Denver, like the rest of the nation, is due for a “reset”. This real estate reset should lead to about a 10-15% decline in prices over the next year or so.

Summary

The Denver metro association’s prediction of a continuation of bidding wars is a bit optimistic. Based on macro factors the bidding wars in Denver will be almost eliminated by the end of the year with price cuts replacing the huge price increases over the last several years. In the last data I have seen in July, 58% of all listings in Denver had price cuts. Unfortunately with prices being cut, bidding wars a pandemic relic, the only step left is a reset in the real estate market that will lead to declines in the 10-15% range. Remember Denver was up almost 30% year over year the last two years so a little air out of the market in the 10-15% range is to be expected.

Additional Reading/Resources:

- https://www.westword.com/news/denver-home-buying-extreme-bidding-wars-update-13370952

- https://magazine.realtor/daily-news/2022/08/18/latest-home-sales-data-points-to-housing-recession

- https://www.housingwire.com/articles/homebuilders-are-done-until-mortgage-rates-fall/

- https://www.housingwire.com/articles/the-housing-market-recession-continues-despite-starts-data/

- https://www.bloomberg.com/news/articles/2022-08-22/cheap-homes-house-prices-are-being-slashed-in-former-pandemic-boomtowns?srnd=premium

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender