I recently receive a Denver Metro Association of realtor’s newsletter touting: “People have been flocking to the Mile High City from more expensive cities in search of a cheaper cost of living and to work remotely in the Rocky Mountains. “ Is this leading to higher prices in Denver? What do the current market statistics say?

Forbes Advisor’s take on Denver: What was in the article

The article gives a glowing report of the Denver market and paints a picture of “gum drops and roses”

- The Denver Metro Association of Realtors Market Trends Committee (DMAR) mentions in its October 2022 report that the average and median closing prices for September 2022 were the highest on record for that particular month.

- The recent trends of decreasing housing prices indicate that the Denver real estate market is transitioning from a seller’s market to a neutral landscape. Libby Levinson-Katz, chair of the DMAR Market Trends Committee, predicts a balanced market is approaching after 16 years of being seller-friendly.

- The article conveniently forgot to mention that both median and average sales prices are declining and inventory is rising at its fastest pace in years.

The whole article appears to be a marketing piece put out by the Denver Metro association of realtors. Also note the article was on Forbes advisor not on the real forbes site written by their staff of writers.

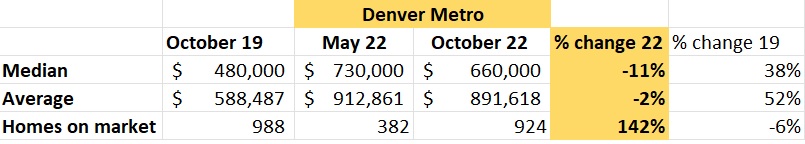

What does the data say is occurring in Denver

The recent statistics on Denver look considerably less rosey and show the market has shifted very quickly to a buyers market.

- Median Price: down 11% since the peak in October, note Median is more accurate of a metric for the market as it is not swayed as much by extremely high or low sales. This has been consistent the last couple of months with median staying constant the last three months or so

- Inventory increasing rapidly: Typically by October we start to see a seasonal decline in inventory, but just the opposite is happening with inventory staying almost constant.

- Inventory is gaining on 2019: in October of 2019, inventory was only 6% higher than in October of 2022. This means that inventory is starting to return to its pre-covid state which leads to the question, will prices follow?

- Not in a balanced market: From the last several months with inventory accelerating to pre-pandemic levels we are seeing a rapid decline in prices off their peak. Almost overnight inventory has returned to 2019 levels. We are clearly in a buyers market with the rapid decline in prices and inventory increasing quickly. Look for these trends to continue into 2023 leading to an even greater buyers’ market.

| Denver Metro | |||||

| October 19 | May 22 | October 22 | % change 22 | % change 19 | |

| Median | $ 480,000 | $ 730,000 | $ 660,000 | -11% | 38% |

| Average | $ 588,487 | $ 912,861 | $ 891,618 | -2% | 52% |

| Homes on market | 988 | 382 | 924 | 142% | -6% |

| Denver Metro September | |||||

| September 19 | May 22 | September 22 | % change 22 | % change 19 | |

| Median | $ 490,000 | $ 730,000 | $ 650,000 | -12% | 33% |

| Average | $ 601,573 | $ 912,861 | $ 814,861 | -12% | 35% |

| Homes on market | 1,105 | 382 | 970 | 154% | -12% |

Summary:

I’m always amazed at how data can be spun to paint whatever picture is desired. As I dug deeper into the Forbes article it was apparent that something was not adding up. As I independently pulled data for the Denver metro from the Colorado Association of Realtors it is pretty apparent that the Denver real estate market is not nearly as robust as the marketing piece in Forbes would suggest. Median and Average are declining off their May highs and most importantly inventory in October was down just 6% from 2019 which shows how quickly the market has increased inventory and flipped from a seller’s to buyer’s market.

Look for the Denver market to continue becoming a stronger buyer’s market in 2023. As inventory continues to increase and rates stay high, many will be priced out of the market leading to ultimately lower prices. Although I don’t see a 08 rerun, there will be considerable pain if prices drop 20% as predicted in a recent fed study. Based on the current trends, the Denver market looks in line with these predictions.

Additional reading/resources:

- https://www.nasdaq.com/articles/denver-housing-market-2022

- https://car-co.stats.showingtime.com/docs/lmu/2019-10/x/DenverCounty?src=page

- https://www.bloomberg.com/news/articles/2022-11-15/mortgage-rates-could-tank-house-prices-by-20-fed-study-shows?

- https://www.dallasfed.org/research/economics/2022/1115

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender