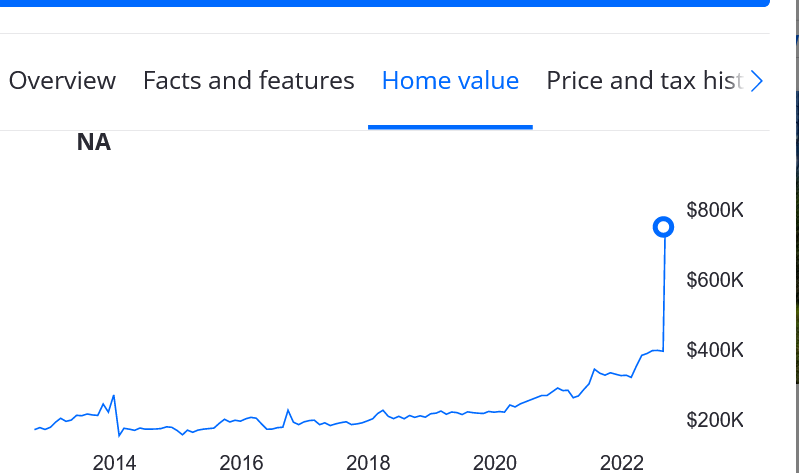

I was recently looking at a property in Colorado and looked up its Zestimate (above)… it is a miracle that the Zestimate suddenly increased 300% with no changes to the property. I’ll bet 900 million that the Zestimate is not accurate. Why did the Zestimate jump so profoundly? How accurate is this number and should you rely on it?

I was recently looking at a property in Colorado and looked up its Zestimate (above)… it is a miracle that the Zestimate suddenly increased 300% with no changes to the property. I’ll bet 900 million that the Zestimate is not accurate. Why did the Zestimate jump so profoundly? How accurate is this number and should you rely on it?

Why did the Zestimate jump on this property?

The answer is simple, they listed the property! Whatever the list price is becomes the new Zestimate regardless of if there are comparables to support it. I have yet to see a recent example of a property where the Zestimate is radically different than the list price.

Why is the list price now the Zestimate?

About 5 years ago, Zillow faced numerous lawsuits over its zestimates that were supposedly lower than what a property was worth, and the sellers were ultimately harmed. Although Zillow prevailed with multiple court wins, Zillow “updated” its models to better account for listing prices. I have not seen any lawsuits against Zillow the last several years as the Zestimate is for all intensive purposes “guided” by list prices.

How accurate is the Zestimate in Colorado

On the particular property above, I independently pulled comparables to see what was really going on in the market and immediately saw a few big red flags:

- Assessed value is 500% lower than the list price: In Colorado there is a lag of assessed values as properties are only reevaluated ever odd year. Even with this lag, the county assessor is rarely off by this amount as they have an incentive to accurately assess a property as this is what taxes are based on.

- Major deficiencies with the property: On this particular property access is seasonal (maybe 5 months of the year), there is no power, no live water, the house was on top of a large road, there was no septic, and the water was from a spring (no creek). It is not possible for Zillow or any other Automated Valuation model to accurately capture any of these items.

- Actual sales nowhere near the value of the property: Even if Zillow somehow could factor in the property deficiencies, the comparable sales were nowhere near the value of the Zestimate.

The real value of the property was closer to the assessed value in the 150-225 range. I know this is a big range, but the property had some unique issues that would take a very unique buyer.

Zestimate not totally accurate even in urban areas throughout Colorado

Even in urban areas, whatever the sales price is, this is the guiding number for the Zestimate. Remember Zillow makes its money from realtors, so it is ill advised for them to upset the apple cart of those that are driving the revenue.

A few years ago, Zillow began buying homes based on the Zestimate only in urban areas where they knew their model was most accurate. Unfortunately, this didn’t work out so well as they were paying 10-20% above market and ultimately had to exit the business. Zillow ultimately lost almost 900 million dollars.

Zestimate model will overshoot in declining markets throughout Colorado

With Denver and other markets throughout Colorado beginning to correct/cool, the Zestimate model cannot account for the swift changes in market sentiment and will continue to “overshoot” on values as they are weighting currently list prices heavily in their models. Furthermore, it takes a month or so for sales to begin reflecting the declines in values and the model is too heavily weighted on listings. To make the model even less accurate, many of the listings that are driving the Zestimate are overpriced as 58% in Denver ultimately required price cuts.

If the Zestimate is not correct, how should you value Colorado real estate?

- Know the market or find someone to work with that does: Since 2008, real estate throughout Colorado has been relatively simple as just about everything has increased in value. Unfortunately, the party will not last, and it is now more critical than ever to know the micro real estate market and the direction it is heading. If you are not in the market regularly, ensure you engage a pro that can assist. When I am in new markets, I have a close network of realtors that I trust to provide the needed insight.

- Look at assessed value as a baseline: Usually assessed value is not that far off from market value so when you see a huge difference in the two, this should be a red flag on the value. It is also good to look at what the county has for square footage, beds/baths, etc…

- Independently pull comparables: I subscribe to a lender comp service to quickly do radius searches, but you can do a similar search (typically not as easy) at the county where it shows the recorded sales. Also, if you have access to the MLS you can get good comps in a close radius

- Ignore the Zestimate: Hopefully from the information above you agree that the Zestimate is an optimistic view of value especially in a changing market. I would give zero weight to the Zestimate in any of your decision making.

Summary

It is amazing the weight that many buyers and sellers are putting on the Zestimate. Unfortunately, this will ultimately lead to poor decisions either overpaying for properties or listing properties too high. With a changing market, these poor decisions will be exemplified. Now is the time to independently evaluate values (or find a trusted pro that can assist) to ensure you don’t overshoot on listing price and/or overpay on a purchase. Remember the past is not an indicator of future success, the last cycle has been relatively easy in real estate, the next cycle will be considerably more challenging as we are already seeing in declining markets.

Additional Reading/Resources:

- https://www.wsj.com/articles/zillows-shuttered-home-flipping-business-lost-881-million-in-2021-11644529656

- https://www.geekwire.com/2019/appeals-court-sides-zillow-lawsuit-zestimate-accuracy/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender