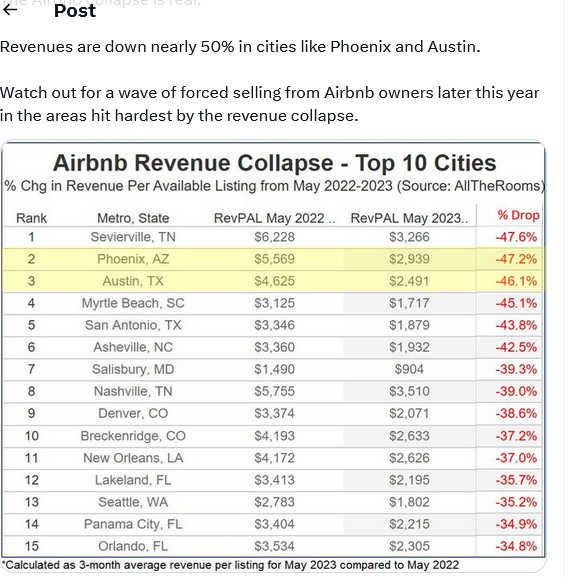

A tweet that went viral last week proclaimed “the Airbnb collapse is real,” with a screenshot of data attributed to AllTheRooms, a short-term rentals analytics company, showing revenue per available listing at Airbnbs between May 2022 and May 2023 down nearly 50%. There were two notable Colorado cities on the list, Denver and Breckenridge. What does the decline mean for real estate prices? How accurate is the data?

What was in the data on an ‘Airbnb collapse’ in Colorado?

Denver and Breckenridge are in the top 10 declines in the country. Both markets are radically different so it is important to look at each one uniquely.

Denver: Denver has very strict nightly rental regulations, but this is not the crux of what is going on. Just like real estate in general there is a push to more suburban locations. The same is happening in and around the metro Denver area with more nightly rentals now in Jefferson county and other areas.

Breckenridge: Breckenridge also increased regulation and created zones for nightly rentals which has pushed substantial traffic to places like Copper or Keystone that are cheaper and have unlimited nightly rentals. Even with this shift to lower cost areas, my gut says that the data on the decline in Breckenridge is not as substantial as the data is showing. Overall mountain visitation in mountain towns like Breckenridge is basically flat so I’m struggling to agree with this data point.

How “real” is the predicted collapse?

Jamie Lane, senior vice president of analytics and chief economist at AirDNA, said in an interview he feels claims spurring from last week’s viral tweet and the data cited were exaggerated and unfounded.

“We are seeing a moderation in growth,” he said, of the short-term rental market. AirDNA is forecasting revenue per available listing nationally to be down, on average, 1.1% this year.

On the flip side of the debate, a lot can be hidden in large data sets. Overall the AirDNA data is correct, but as you dig into the data, each particular market is performing a bit differently

How are Colorado nightly rental regulations impacting nightly rental revenue?

I mentioned above the impact of nightly rental regulations on occupancy and revenue in Breckenridge and Denver. But it is important to look at another city that recently introduced similar regulations but has the opposite effect.

In Steamboat Springs, Colorado, city councilors approved overlay zones to limit or ban short-term rentals in certain areas and established a requirement for rental owners to obtain a license to operate in the city.

In fact, Steamboat Springs is one of the markets tracked by AirDNA seeing its occupancy rate outpace the national average, Lane said, likely correlated in part to the recent regulations.

Steamboat is radically different than Denver or Breckenridge as there are very few other alternatives. Three sides are surrounded by National forest which drastically reduces the alternatives. The alternatives to the West are radically different than Steamboat (Hayden and Craig) and not really substitutes as opposed to Breckenridge that has Frisco, Copper, Silverthorne, Keystone, etc… in relatively close proximity to act as substitutes.

How are real estate prices impacted by declining Airbnb revenue

A study recently published by professors at William and Mary, Purdue University and Chinese University of Hong Kong in “Real Estate Economics” delved into the impact regulations on short-term rentals could have on a city’s long-term rental market. The study focused on Irvine, California, where the authors were able to obtain enough data to evaluate a potential correlation, said Michael Seiler, J.E. Zollinger professor of real estate and finance at William & Mary’s Raymond A. Mason School of Business, one of the paper’s authors.

The study found the city’s short-term rental ban, passed in 2021, drove prices down on long-term rentals in Irvine by about 3% within about two years. It also found banning or allowing short-term rentals in one neighborhood meant people would then buy property for conversion to rentals in adjacent areas.

Summary

In Denver there is likely a substantial decline in nightly rentals, but nightly rentals overall make up a small portion of the Denver market. On the flip side Breckenridge is also seeing a decline in nightly rentals due to “substitution” but there is still considerable demand for the area for tourism, second homes, etc…

Although I’m not fully on board that revenues on nightly rentals are declining almost 40% in Denver and Breckenridge, the trends are worrisome as I don’t think that the bottom has fallen out yet on Airbnb demand as consumer spending is still rising with a focus on travel. Once consumer’s cash flow begins to wane later this year or early next year is when we will see a bigger reset in the markets that are heavily dependent on nightly rentals. At this point we will likely see some bigger declines in real estate prices especially in marginal rental markets.

Additional Reading/Resources

https://www.bizjournals.com/atlanta/news/2023/07/03/short-term-rental-market-growth-airbnb.html

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender