The recent settlement by the national association of realtors will have an outsize impact on Colorado ski towns. Will prospective buyers pony up 70k to pay their buyers agent based on the median home price in Summit County? What does the recent settlement mean for Colorado ski realtors? Why will the impact be felt more in ski towns than other markets?

What was in the realtor settlement?

The $418 million agreement will make it easier for home buyers to negotiate fees with their own agents and could lead more buyers to forgo using agents altogether, which has the potential to drive down commission rates and force hundreds of thousands of agents out of the industry.

NAR agreed to abandon longstanding industry rules that have required most home-sale listings to include an upfront offer telling buyers’ agents how much they will get paid. Under a system in place for a generation, sellers have typically set buyers’ agents fees. Consumer advocates say the arrangement has prevented buyers from negotiating to save money and kept commissions in the U.S. higher than in most of the world.

What is changing for home buyers in the new settlement?

Starting in July, the new rules will require most home buyers to sign agreements detailing how much their agents will be paid for their services. If home sellers are unwilling to cover the cost of the buyer’s agent, these agreements would likely require the buyer to pay the agent directly.

Agents representing buyers will have wide latitude over how to charge their clients. Some might bill at hourly rates, while others might ask for flat fees for their services.

Buyers agents now will need to charge upfront to ensure they are compensated for their time. I think many buyers will balk if they now have to pay 2-3% of a home price. For example on a 500k home they are unlikely to pay an agent 15k, I assume most buyers will negotiate a flat fee/hourly rate for whatever services they need.

Why are Colorado ski towns more impacted by the recent realtor settlement?

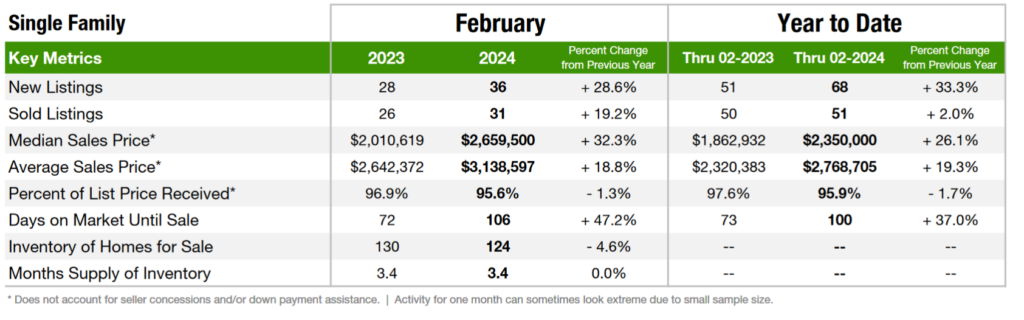

Prices in Colorado ski towns are well above average, as illustrated by the chart, the average home price in 2024 Summit County is 2.8m. On average buyers’ agents make 2.5% of the sales price which leads to compensation of approximately 70k on the average home sold. Under the new rules in the settlement, buyers would have to negotiate their agent’s compensation up front. I doubt any prospective buyers will agree to pay 70k up front as the sellers also will balk at this fee.

There will be enormous losses in income for buyers agents as I’m certain a flat fee model will evolve where prospective buyers pay a flat fee for a showing and then they could have an attorney draft a contract saving thousands of dollars.

Colorado ski towns are different than metro markets

Colorado ski towns are very unique compared to other markets. For example in Denver, there are hundreds, if not thousands, of companies paying great wages from Google, Microsoft, Intel, etc… all located throughout the front range. The Colorado ski towns do not have this luxury as there are very few, if any, high paying jobs that are not remote. For example, in Steamboat there are not many six figure local jobs other than real estate. As buyers commissions are drastically reduced, many of these high paying real estate jobs will be lost. The predicted loss by various economists is close to 30% of all real estate professionals will exit the business. I would guess this number is even higher closer to 50-60% as it will not be possible to make much money part time showing houses as compensation declines.

Summary: impact of real estate settlement on Colorado ski real estate

The new real estate rules will not have much if any impact on prices, but they will have an outsize impact on the amount of people that can afford to live and work in the various mountain towns. At a minimum, 30% of the realtors in the various ski towns will not be able to make it under the new settlement. Unfortunately, there are not many local alternatives to transition these highly paid professionals into which will ultimately lead to a decline in the full time population in many mountain towns. The ruling is set to go into effect this summer so look for the effects to begin showing up by year end.

Additional Reading/Resources

- https://car-co.stats.showingtime.com/docs/lmu/x/SummitCounty?src=page

- https://www.fairviewlending.com/realtors-reach-game-changing-settlement-in-home-buying-and-selling/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal from this blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender