U.S.-listed shares of major cannabis producers surged after Democratic vice president nominee Kamala Harris said marijuana would be decriminalized at a federal level in the United States under a Biden administration. How would this change impact real estate in Colorado? Will legalization at the federal level create a Cannabis gold rush?

What is happening in the Cannabis industry currently due to the federal prohibition?

- No access to traditional financing

- Paying above market rents

- State by State patchwork of laws

How would decriminalization on the federal level impact Cannabis?

- Traditional banking

- Traditional market rate leases

- Trade among states will drive costs lower

- More outdoor growing in temperate climates

- Surge of big Corporate/Wall street in the industry

What would this do for Colorado Cannabis Real estate?

As corporate America continues to plow into the Cannabis industry, real estate will be drastically altered. There are three distinct impacts:

- Indoor grows: Indoor grows will not be profitable as prices continue to decline. Many of these growing operations will be mothballed. This is where the largest impacts will be in real estate.

- Manufacturing: The manufacturing of oils/products should do better than the grow side. There will be a continued demand for oils/finished products and the specialized locations/equipment for these processes. You will see consolidation on the manufacturing side as larger players either build their own processing capabilities (like a bottling plant for wine) or buy up smaller players.

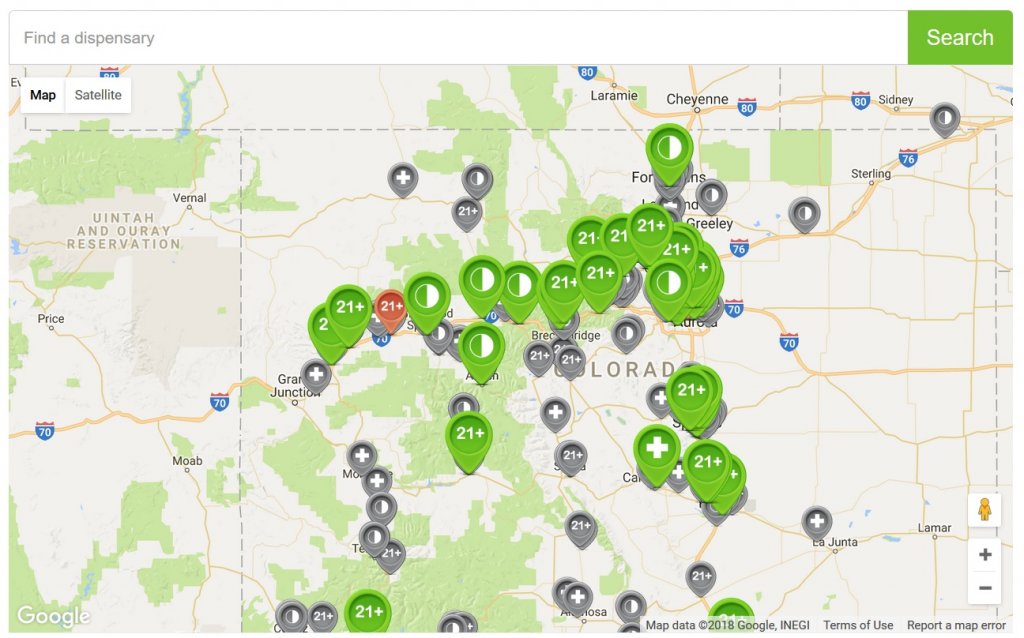

- Retail Operations: Retail operations will be impacted as I see Cannabis evolving like liquor stores where it is a specialty store. There will be consolidation on the retail side as you will see large chains in many markets (like McDonalds or Wendy’s on the food side). Colorado has made online sales of recreational marijuana legal during the coronavirus pandemic. Now under Colorado’s emergency rules, customers can pay for marijuana online and then pick up their purchase at the store. This will further consolidate the retail side of the industry to larger players. What happens when sales go fully online with some sort of delivery option similar to Wine.com?

Before the proposed announcement of the decriminalization of Cannabis at the federal level, the impacts are already starting to flow through the Cannabis real estate with industry consolidation as larger players enter the market. Federal legislation will jump start this process.

Prices will continue to adapt to the industry changes and be reduced substantially with interstate commerce. This will heavily impact indoor grows leaving this real estate worth considerably less than today. Manufacturing and Retail should fare better but will still feel the impacts of the industry changes.

As more states legalize Cannabis further pricing pressure will occur driving even more consolidation and commoditization as cannabis will transform similar to the wine or spirits industry. Unfortunately, these changes are creating substantially more downside risk on Colorado Cannabis real estate properties than upside. How do you think the Colorado Cannabis real estate will perform with all the industry changes?

Additional Reading/Resources

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)