Big changes in store for Colorado real estate in the upcoming legislature

Colorado Governor Polis, in a recent interview, called short term rentals paying residential rates a “loophole” that he supports closing. “Residential properties that work like hotels should be taxed as a commercial property” he said. What was in the prior legislation that would likely serve as a template to “close the loophole”? Why would property tases triple on nightly rentals?

In 2021 there was a proposal introduced in the legislature to tax residential nightly rentals as commercial properties that looks to resurface this year based on the governor’s comments. The prior proposal will likely be used as a template in the upcoming legislative session.

What is in the prior proposal to tax nightly rentals as commercial properties.

The proposal would tax vacation homes like hotels and motels, which are subject to a higher assessment, on the days they are being rented and deliver the extra revenue to public schools, fire departments, libraries and other districts that rely on property taxes. State Sen. Chris Hansen, a Denver Democrat who sits on the powerful Joint Budget Committee and is leading the push for the legislation, said the idea is to boost revenue for local communities.

“There’s a really strong need for us to stabilize our property tax system and increase our local share,” said Hansen, referring to the rising education funding burden on the state budget. “If this is something we don’t get ahead of, it’s going to spiral out of control for the state”.

Here are some highlights of the bill as it is written today.

- Properties rented nightly rental more than 30 days a year are subject to commercial property tax rates for the days they are rented.

- The commercial property tax rate is 29% while the residential rate is 6.9%

The practical matter of the bill; some items need to be worked out

How the prior bill is currently rented will be challenging for assessors to track and calculate when a property is taxed at residential vs commercial. Assessors do not track nightly rentals as many are not licensed, take Steamboat for example, only properties not in the mountain area need to be licensed. This equates to about 200 licensed properties in Steamboat out of about 3k total nightly rentals. Tracking and enforcing the nightly rental tax would be a nightmare for assessors.

I assume as the bill gets closer to passing that there will be substantial changes and for simplification a new property type will be created for any property rented over 30 days or not a primary residence. This new property class will pay a fixed hotel/lodging tax rate as opposed to a per diem commercial rate that is currently proposed.

Will this legislation pass in an upcoming session?

I’d handicap this bill at 60/40 with a 60% plus chance of passing. The legislature continues promoting land use bills and increased taxes. The bill is being pitched to help target the continuing funding issues of schools and local governments. On the flip side, there will be some intense lobbying by the realtor’s association and nightly rental companies.

Furthermore, I assume that some big changes will be made as this bill progresses especially regarding which properties are classified as nightly rentals and how assessors will enforce the new law to appropriately tax them. Long and short, there are a lot of variables, but based on the legislatures current focus there is a greater than 50% chance it will pass.

This is just the beginning of taxation of nightly rentals

Regardless of the status of this bill, the tide has changed on nightly rentals. Voters in Avon, Crested Butte, Steamboat, etc.. have voted to increase taxes on short-term rentals. Telluride has recently implemented a 857/bedroom fee and will be voting on further taxes in the next election. Councils and commissioners in several other communities have stalled or capped the flow of permits for vacation homes.

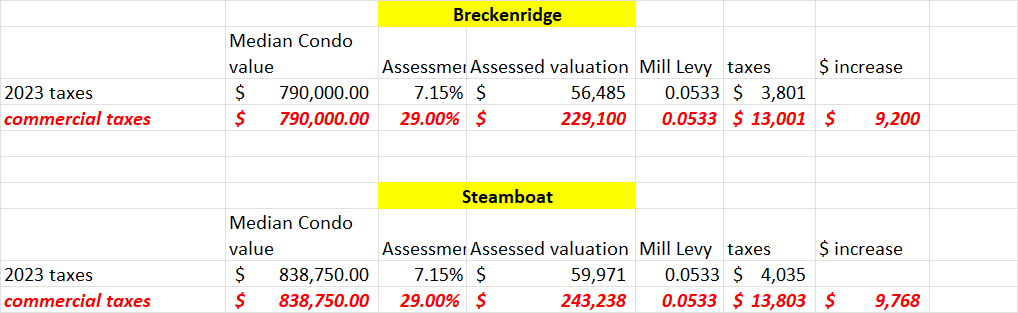

Huge impacts on Colorado ski towns if nightly rentals taxed as commercial

One issue that is not being addressed in the state house measure is that every ski town is now getting substantial revenue off nightly rental taxation in some way shape or form. Unfortunately, the industry could not support triple property taxes, bedroom fees, and excise taxes and remain viable.

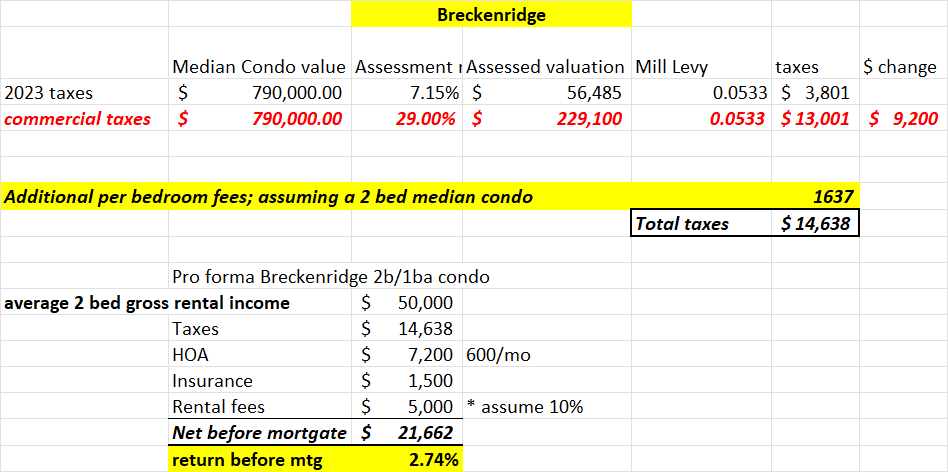

For example, Steamboat is planning on spending 70 percent of the revenue generated from an excise tax on nightly rentals for a new affordable housing development. If the state changes the property tax structure, these funds will disappear as the nightly rental industry will not be able to price room rates high enough to cover all the fees/taxes. Below is an example of what the return looks like in Breckenridge (excluding mortgage payments). The numbers do not work to support all the taxes.

What will the taxes and caps on nightly rentals do to real estate values?

If you were buying a property with the intent of renting it heavily, higher taxes and prospective moratoriums are huge. Furthermore, some owners that rely on nightly rental for their mortgage payments or retirement will feel these changes the most.

There will likely be pricing impacts if nightly rentals are forced to pay commercial property tax rates as this is a huge increase in costs. Many properties will no longer be viable as nightly rentals and ultimately values will decrease as shown above for Breckenridge. Fortunately, in Breckenridge, Vail, Aspen, Steamboat, Crested Butte, etc.., and other ski towns there is zero available inventory and considerable pent-up demand which will help ensure that there is not a free fall in real estate prices or sales but there will be a reset in prices if this legislation passes.

Summary:

Long and short nightly rentals are in the cross hairs as their impacts are felt by more locals. As a result, radical changes are coming down the pipe from the statehouse and local governments. The biggest themes are increased taxes, capping the number of nightly rentals, and prohibiting nightly rentals in certain property types and locations. Although I can’t say with certainty which particular bill/measure will pass, with this much momentum one or many of these initiatives is likely to pass and will have a profound impact on the nightly rental industry.

Additional Reading/Resources:

- https://coloradosun.com/2023/10/10/telluride-regulatory-fee-short-term-rentals/

- https://coloradosun.com/2021/10/14/short-term-rentals-tax-bill-colorado

- https://www.the-journal.com/articles/property-taxes-would-more-than-triple-for-colorado-short-term-rental-owners-under-proposal/

- https://www.metrodenver.org/do-business/taxes-and-incentives/property-taxes

- https://coloradorealtors.com/market-trends/regional-and-statewide-statistics/

- https://www.townofbreckenridge.com/your-government/short-term-rentals/-fsiteid-1#!/

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender