The National Association of Realtors released their “marijuana and real estate- a budding issue” research paper that found that 27% of realtors had seen a decrease in property values near dispensaries, while 12% has seen an increase in values. What does this mean for Colorado real estate? Why do other studies show a 6% increase in values?

What was in the NAR research paper?

- 27% of realtors “felt” that prices decreased slightly or substantially near a dispensary

- 12% of realtors “felt” that prices increased near a dispensary

- 24% of realtors “felt” that inventory had tightened due to all cash purchases from the cannabis industry

- As marijuana in real estate is a growing market, currently only two to five percent of residential respondents were aware of their MLS containing a specific marijuana field.

Glaring flaws with the study

Unfortunately, the NAR study was more of exploratory paper on “feelings” as opposed to using hard data. Members were surveyed to determine the impact on residential and commercial real estate to determine their “thoughts” on the cannabis impact on real estate. This allows intrinsic biases as opposed to being based on hard data. This is glaring as less than 5% of realtors even knew of a “marijuana specific field” in the MLS. Furthermore, the data conflicts with 12% seeing increases and 27% decreases, unfortunately data doesn’t lie, but feelings can mislead. With no way to accurately track a property in close proximity to a Cannabis location, how are values determined.

This study had me think about Colorado and the impacts to real estate from Cannabis legalization. First, due to zoning all of the grow locations in metro Denver are in industrial locations so the impact on residential values is nonexistent as they are not typically intermingled with heavy residential areas. Second, Dispensaries are located in typical retail areas, typically free-standing buildings in class B/C locations. For example, you don’t see them on main street in Steamboat Springs, they are in less visible locations. Many of these dispensaries are not in high density residential areas. For example, you don’t see a dispensary interspersed amongst houses in Cherry creek or in a new neighborhood center in Castle Rock. Long and short, it is impossible to draw any correlations on values either increasing or decreasing from this study as the impact on real estate is negligible. This was merely a paper on how realtors “felt” as opposed to what is actually occurring in the market.

An opposing study shows an increase

According to a recent research paper by two University of Mississippi professors, they found legalization of marijuana leads to a 6% increase in values in cities in Colorado compared to municipalities that did not legalize marijuana. They conclude being close to a marijuana shop makes a property’s value increase more than other properties. How is this possible? Are they correct?

Who smoked too much before writing this report! Why would just marijuana increase property values as opposed to a wine store or Costco? Just like in the NAR report this study is unscientific as there are a multitude of variables increasing prices.

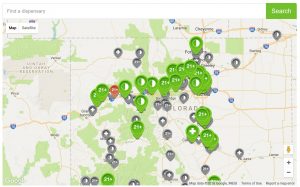

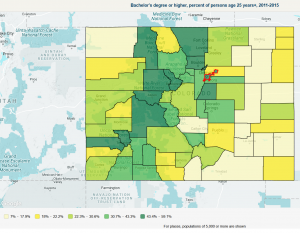

Are marijuana dispensaries really increasing prices? Unfortunately, the researchers are drawing conclusions that just aren’t there. Marijuana is not the driver of higher prices. If you look at the map above of marijuana dispensaries in Colorado they are clustered around certain areas. Ironically, these are the same areas with high education levels (see below). Education levels are the leading driver of house appreciation/ growth both in the US as a whole (see US map showing the correlation and in Colorado. The lighter areas of the state (lighter yellow) have seen considerably less appreciation than the darker areas. These lighter areas are also many of the same areas that banned marijuana. Marijuana didn’t cause lower values, the lower education levels did.

The researchers got it backwards! Marijuana is not the driver of house appreciation. Education is the driver and marijuana dispensaries are an effect (see what Colorado city will grow the fastest by 2050). Looking at the map above, the dark green areas (highly educated) also have the largest percent of marijuana dispensaries. The areas in dark green are also traditionally more liberal leaning recently (Democratic) and therefore more likely to support marijuana policies (according to a Washington post poll, Democrats favored marijuana by 72% to Republicans around 50%).

Why is this important? As other states legalize marijuana drawing an inference that marijuana will cause property values to increase or decrease is just plain wrong. There is no correlation that shows putting in a marijuana dispensary will change values any more than another retailer. Marijuana legalization is the result of education levels and other policies that are the real drivers of appreciation.

With anything new there is always considerable “hype” about the effects on both sides of the aisle which needs to be vetted. Regardless of your political view on marijuana, it is important to focus on the facts surrounding legalization and not smoke and mirrors. I would caution the professors of this study and the National Association of realtors not to “smoke” and theorize relationships that don’t exist in real life.

Sources/Additional Reading

- https://www.nar.realtor/reports/marijuana-and-real-estate-a-budding-issue

- https://www.thecannifornian.com/cannabis-news/recreational-pot-boost-home-price/

- http://www.colgate.edu/portaldata/imagegallerywww/2050/ImageGallery/teh_jobmktpaper.pdf

- https://www.denverpost.com/2016/01/01/marijuana-gap-divides-colorado-towns-that-sell-pot-those-that-dont/

- https://www.coloradopotguide.com/where-to-buy-marijuana/

- https://www.washingtonpost.com/news/wonk/wp/2017/10/25/for-the-first-time-a-majority-of-republicans-support-marijuana-legalization/?utm_term=.a34172d034c6

- https://coloradohardmoney.com/2017/11/26/what-colorado-city-will-grow-fastest/

I need your help!

Don’t worry, I’m not asking you to wire money to your long lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).