It is likely no mystery that the Colorado ski towns are getting considerably more expensive, but the recent data released by HUD is eye opening. HUD releases income figures every year based on census data and other factors, such as the rate of inflation. What do the huge changes in income mean for “affordable” housing. How are the changes in incomes impacting each mountain town?

What was in the recent data from HUD on Colorado ski town incomes?

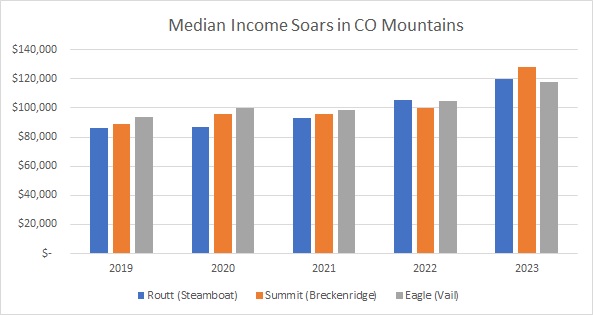

I went back and looked at each year from 2019 to 2023 to see the changes in median income. Summit county, home to Breckenridge, leads the pack with a 44% increase in median income since the pandemic (2019) but each town had substantial increases in median income.

| Median Income | |||||||

| County | 2019 | 2020 | 2021 | 2022 | 2023 | % change pre pandemic | Affordable housing (80%) |

| Routt (Steamboat) | $ 86,100 | $ 87,200 | $ 93,000 | $105,600 | $ 119,900 | 39% | $ 95,920 |

| Summit (Breckenridge) | $ 89,100 | $ 95,900 | $ 96,100 | $ 99,800 | $ 128,300 | 44% | $ 102,640 |

| Eagle (Vail) | $ 94,000 | $ 99,900 | $ 98,300 | $104,700 | $ 117,800 | 25% | $ 94,240 |

| Source:HUD | |||||||

Why is median income soaring in the Colorado ski towns?

The big driver of the huge increases in Median income is due to the changing demographics of the mountain towns. Although the total population of most mountain towns has not changed substantially since Covid, real estate prices have radically altered each town. Many long time locals have cashed out for cheaper locations and newer arrivals must earn substantially more to afford the lifestyle.

Furthermore, remote work has also enabled many high income workers to relocate permanently to the mountains bringing their big city salaries to much smaller markets.

One note, I do wonder how much of the median income in the respective ski towns was pushed up by the huge transaction volumes and prices in real estate. For example a realtor in Steamboat could easily make 6 figures when the market was going crazy, I would assume that number will substantially decrease in the next cycle, but I don’t know how much this contributed or even if it changed the median at all but it will be something to watch for in 2024 numbers

“Affordable” housing radically changing

With the huge jumps in median income, the number of people who now qualify for subsidized housing, childcare, etc… has jumped enormously. Furthermore, in Steamboat and Summit county there are new projects coming online that allow you to earn up to 120% of the median income. In Summit County that would mean affordable housing would encompass income up to $154,000.

Exasperates the housing shortage

With someone now making up to $154 thousand a year now being classified as “affordable” in Breckenridge substantially more households will now qualify. At the same time there have been some new projects coming online, but the demand will continue to far outstrip the affordable supply of housing. This begs the question is what is the real intent of affordable housing and where do you draw the line on “affordable”?

Should Colorado ski counties now change the definition of affordable housing to encompass only up to 50% of the median income of the area to ensure that they are truly helping those that need it most?

Summary

Whenever the government gets involved with a one size solution it never turns out well. Breckenridge and Steamboat are radically different than Detroit but the metrics of 80% of median income are the same.

Furthermore, I don’t think most residents in the respective towns would be willing to continue to increase taxes to subsidize someone making 154k a year to live in Breckenridge. This huge mismatch in affordable housing begs the question of where does this end and do counties need to refocus their efforts on much lower income residents.

I routinely get article ideas from people on my email list like this one from Dennis C. I always appreciate the insight and heads up on news and happenings in real estate throughout Colorado so please continue to engage and send me your thoughts and article ideas 😊.

Additional Reading/Resources

- https://www.summitdaily.com/news/federal-data-shows-a-sharp-rise-in-average-income-for-a-summit-county-family-of-four-local-officials-say-the-numbers-are-baffling/

- https://www.huduser.gov/portal/datasets/il/il2023/2023summary.odn?STATES=8.0&INPUTNAME=NCNTY08117N08117*0811799999%2BSummit+County&statelist=&stname=Colorado&wherefrom=%24wherefrom%24&statefp=08&year=2023&ne_flag=&selection_type=county&incpath=%24incpath%24&data=2023&SubmitButton=View+County+Calculations

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender