For the past 15 years or so, my “mushroom theory” was an amazing tool (no I’m not talking about the magic mushrooms that were approved by voters). Up until Covid the mushroom theory worked like a charm to predict price appreciation in cities like Denver, but recently its predictive powers have crumbled. What is happening in Denver that transformed real estate? Should you be “careful” in Denver (in more than one way)?

What is the mushroom theory?

First, put the magic mushroom down! I’m not talking about actually consuming a mushroom (nor did I consume one in the writing of this article!) although it is now legal in Colorado. Historically, over the last 20 years or so, properties closer to the city core in good areas typically fared better and came back much quicker than other areas. What I saw in the last recession is that the closer in areas came back much stronger than the suburban areas due to demand and lack of new inventory.

If you are trying to find more information out about the mushroom theory, you are out of luck as I invented this theory during the 08 crisis and have been a strong believer in it until now.

Why is the mushroom getting kicked to pieces in Denver

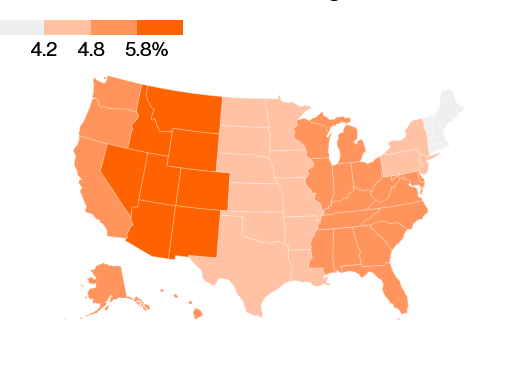

Unfortunately, the past is not always an indicator of future success. Covid has turned theory on its head. The primary reason is simple, safety. Many areas in Denver, as highlighted above, are transitioning the wrong direction as gun violence spikes. In Denver, the amount of unlawful discharges of weapons has more than doubled since 2019 and almost triple 2017. The discharge of guns is not just in “transitional” areas but is migrating to once safe areas throughout the city.

The rise in crime is not just anecdotal: “Denver Police chief Paul Pazen on Tuesday urged the public to contact their elected officials with their concerns over rising crime rates. Driving the news: Pazen said the city has recorded 60 homicides so far this year, and is on pace to not only exceed last year’s total (96), but break Denver’s all-time annual high of 100 homicides set in 1981.

Return to suburban flight of the 90s.

With the return of crime, we are seeing a familiar pattern to the 1980s when crime also last spiked to these levels leading to large suburban flight.

In a Baltimore Sun article in 1992, Robert Reich, a Harvard political economist, has summed it up:

“ In metropolitan America’s increasingly polarized society, the economically mobile have “seceded,” mainly into homogeneous suburban enclaves where their “earnings need not be redistributed to people less fortunate than themselves.” Or, if they remain in central cities, secessionists carve out privatized existences in which their children are sent to private schools and in which they address many of their needs (security, recreation, sanitation) through private rather than public services.”

Denver hasn’t seen the implications like many other large cities as in the 90’s Denver was still a “small” city and just coming onto the scene.

Similar trends of the 90s are emerging in Denver:

Denver is following the same pitfalls that led to a decline in urban living in many cities in the 90s

- Redistribution via taxes (you name it, Denver seems to be increasing taxes to help someone else in every election cycle). Unfortunately nothing has changed even with all the taxes and wealth redistribution.

- Poor education performance

- Spike in homelessness

- Spike in Violence

The trends above are very hard to reverse without first focusing on increased policing which Denver is not. The theory in Denver is that if you provide housing the other items will resolve themselves, unfortunately we have seen this play out in every major city. Without addressing the underlying issues (mental health, job prospects, drug and alcohol abuse, crime, etc…) nothing fundamentally changes.

Real estate prices over the long term will be impacted

As crime rises, real estate prices fall. Nobody wants to move their kids into an area with shootings in broad daylight near schools, parks, etc… As we saw in the 90s, prices in these areas will plummet. The same will occur in certain pockets in Denver. Areas that were starting to “gentrify” are now going the opposite direction and this trend will not only continue but accelerate over the coming years.

Not all areas in Denver are impacted the same.

Take for example Cherry Creek. In Cherry Creek we are not seeing the same spike in crime and urban flight as other areas. Robert Reich, in his 92 analysis, summed up what we are seeing today: “secessionists carve out privatized existences in which their children are sent to private schools and in which they address many of their needs (security, recreation, sanitation) through private rather than public services.” History is repeating what occurred in the 90s in Denver and cities throughout the country.

Summary

Denver, along with many other cities, is repeating the same mistakes made in the early 90’s that led to urban flight. With crime increasing rapidly in areas throughout Denver, the results will be the same. Furthermore, Denver has not learned from history that safety is the first priority to ensure a stable urban core. I don’t foresee any major changes coming down the pipe in Denver that will reverse these trends. Unfortunately, in Denver the proposed solution is more taxes going towards failed policies that will hasten the migration out of the challenging areas. Now is the time to be careful in Denver (pun intended) as real estate will not be immune from these forces and many areas will see substantial resets in pricing.

Additional Reading/Resources

- https://denverite.com/2022/12/06/denver-gunfire-gunshots-crime-rising/

- https://www.axios.com/local/denver/2022/08/10/denver-police-chief-curb-crime

- https://www.baltimoresun.com/news/bs-xpm-1992-01-05-1992005091-story.html

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender