While other mountain towns implemented taxes and regulations on short term rentals, Steamboat was a bit late to the party. Locals were not happy and elected a new council. The new ballot question will raise the short term rental tax to 20.4%. Will this pass in November? What does this mean for real estate prices in Steamboat and other mountain communities?

What is in Steamboat Springs ballot initiative to tax Short Term Rentals?

If approved by voters, the total taxes assessed on short-term rental properties near the base area of Steamboat Ski Resort would be 20.4%. The tax would not apply to legacy lodging outlets like hotels, and would sunset after 20 years.

The tax question could earn more than $14 million in the first year and that revenue would be used to fund infrastructure at the Yampa Valley Housing Authority’s Brown Ranch development, which plans to add 2,300 units west of Steamboat over the next two decades. Brown Ranch infrastructure costs have been pegged at $400 million.

Will Steamboat’s initiative to tax short term rentals pass?

I would put the odds at 90% that this new tax will pass in November. Locals in Steamboat and throughout the mountains will absolutely vote for this proposal as the amount of tourism has increased rapidly since Covid putting huge strains on affordable housing and local residents.

Will Steamboat’s new tax “destroy” the lodging community?

The tax has received sharp criticism from Steamboat’s lodging community that says the tax is too much of a burden to place on an industry so central to the local economy. They also warn a recession is looming and this new tax would make things worse.

I am going to take the contrarian view that this tax will have minimal impact on the lodging community. In Steamboat and various mountain towns, many of the lower cost lodging options have been eliminated. For example two “budget” hotels in Steamboat have been turned into employee housing and the same is happening in places like Breckenridge where the Holiday Inn is being converted to long term housing. Furthermore room rates are up a whopping 36%+ in most mountain towns which should provide room to adjust rates a little to compensate for the new tax.

Furthermore, there have been restrictions placed on new licenses which should temper future supply. With decreasing supply, prices can go up without much impact. The short term rental tax will have negligible impacts to tourism.

How will real estate prices in Steamboat and other mountain towns be impacted by the tax increase on short-term rentals?

There are many passionate voices on both sides of the debate. Fortunately, we are going to get to find out what actually happens to real estate in Steamboat and other Colorado ski towns over the next twelve months. Here are a few scenarios to consider.

- Will prices of real estate fall? I hear this time and time again that any action on STRs will cause a real estate collapse. Unfortunately, I don’t see this in the cards. Most of the recent demand for real estate is from high-net-worth buyers looking for a “safe place” outside of an urban center for their personal use. This “safety” is both physical and also from an asset protection standpoint. With markets in turmoil, there is a demand for hard assets and many ski towns fit the bill. Many of these buyers are cash buyers that do not need to short term rent their property. Furthermore, inventory is not increasing meaningfully. As a result, the impact should be muted as there is considerable demand and virtually no meaningful increase in inventory.

- It is also important to note the values have gone up in many Colorado ski towns over 40% so we are destined for a pullback throughout the country as rates rise, and recession clouds loom. It is not plausible to blame any impact in prices on short term rental changes

- It is also important to note the values have gone up in many Colorado ski towns over 40% so we are destined for a pullback throughout the country as rates rise, and recession clouds loom. It is not plausible to blame any impact in prices on short term rental changes

- Will this trigger an increase in real estate values? An increase in prices is a plausible outcome. For example, will Steamboat become more desirable (in higher demand) because of less visitation. Would someone choose to buy in Steamboat over other communities as they can be confident that they will not end up with a house next to a nightly rental and a town overrun with tourists?

- Essentially capping visitation/short term rentals and increasing room rates via taxes should help better balance tourism to enhance the visitor experience. I think that there is a greater than 50% probability that prices could accelerate as demand accelerates due to enhanced user experience.

Summary:

I’ve been saying this for years that only full-time residents get to vote which has led to a huge sea change in mountain towns throughout Colorado regarding short term rentals. Every major resort community is working to address the balance of full-time residents with short term property owners. Fortunately none of the regulations I have seen so far look to have material impacts on property values as supply continues to be tight and desirability remains high throughout the various Colorado ski towns.

Additional reading/resources

- https://www.steamboatpilot.com/news/steamboat-council-passes-str-tax-question-now-in-voters-hands/

- https://www.summitdaily.com/news/local/our-trajectory-is-troubling-breckenridge-to-set-cap-on-short-term-rental-licenses/

- https://www.skyhinews.com/news/no-str-moratorium-yet/

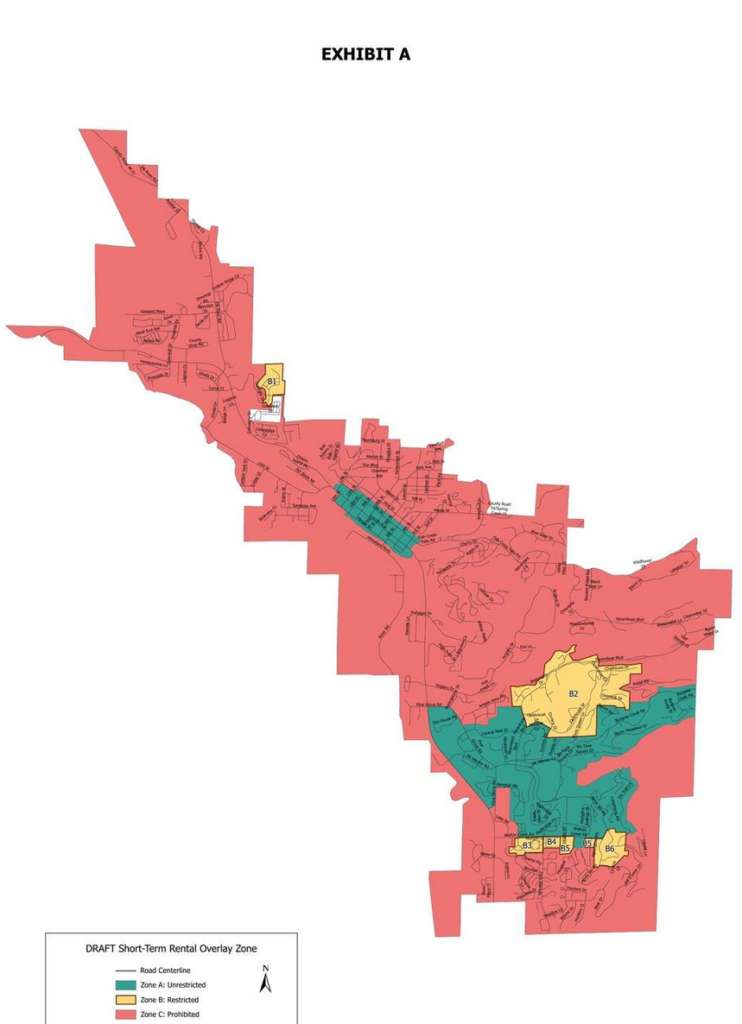

- https://www.steamboatpilot.com/news/steamboat-discusses-prohibited-zones-for-short-term-rentals/

- https://crestedbuttenews.com/2021/07/crested-butte-council-unanimously-approves-str-moratorium/

- https://www.summitdaily.com/news/frisco-resident-starts-petition-to-restrict-short-term-rentals/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender