Colorado real estate is on a tear, with appreciation off the charts. In Denver appreciation is up 25% year over year. Unfortunately, all this appreciation could cause some large tax hits based on the new legislation. How will the new legislation impact you and Colorado real estate in general? Why will Colorado property owners feel the impact more than many other cities?

What is in the new legislation that will impact Colorado property owners?

The new Biden tax proposal has three major items that will impact property owners and Colorado property owners in particular

- Limit on 1031 exchange: A 1031 is when you exchange “like properties” and defer the capital gains. For example if a small business owner sold their building, they could roll the proceeds from the sale into a new property tax free. The new tax proposal has placed limits on the 1031 exchange to 500,000 of gains. So if a property owner had bought a building for 100k twenty years ago and sold it now for 1m, they would pay capital gains on 400k of appreciation.

- Increase in Capital Gains: The fallback for elimination of the 1031 exchange would be to hold the property for 18 months to get a lower capital gains tax rate of as low as 15%. Unfortunately, the long term hold strategy is also going by the wayside. Biden’s plan would raise taxes on capital gains by treating them as ordinary income for those earning more than $1 million. On his website he said he would also raise the top rate on ordinary income back up to 39.6 percent from the 37 percent rate put in place by the Tax Cuts and Jobs Act. As such, the top rate on long-term gains would nearly double from 23.8 percent to 43.4 percent.

- Step up in basis: reflects the changed value of an inherited asset. For example, an investor purchasing shares at $2 and leaving them to an heir when the shares are $15 means the shares receive a step-up in basis, making the cost basis for the shares the current market price of $15. Any capital gains tax paid in the future will be based on the $15 cost basis, not on the original purchase price of $2. The new tax proposal eliminates stepped up basis: For example now if you inherit a property that your parents bought for 100k, that is now worth 1m, your tax is now based on the 100k so your gain is 900k that you would pay taxes on.

Why will Colorado property owners get hit harder with the new tax plan than other states?

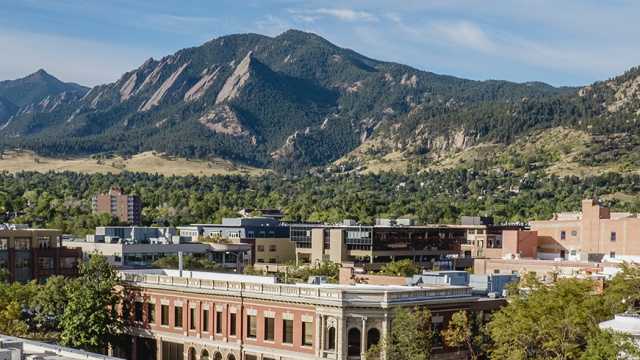

Colorado is an expensive market for both residential and commercial real estate. With the average home selling in Denver for 760k and 1.7m in Breckenridge. There has been considerable appreciation which will lead to some exceptionally large tax bills if people decide to sell. Let us look at a couple examples:

- Summit County primary residence: Assume you bought a house in Summit county pre-covid, the median home price was around 700k, fast forward and now the median home price is 1.6 million. The homeowner is sitting on a 900k gain from the prospective sale of the property. The first 500k is tax free which leaves 400k of capital gains. With the increase in capital gains rates, they could be looking at a 43% tax hit. In this case, the homeowner would owe 172k in taxes, leaving the net gain of 728k.

- Small business owner: Let us assume a small business bought their retail location 20 years ago in Denver for 200k, as Denver has changed so have the values, this property is now worth 2m to a developer. The owner is looking at a gain of 1.8m (assuming they did not depreciate the property). Under the new proposal the taxable gain would be 1.3m and the tax hit would be $560k!

How will the new tax proposal impact Colorado property values?

Regardless of your political affiliation, consumers will react in a “rational” way to changes in the tax laws which will severely impact the economy and real estate.

- Less sales: With huge prospective tax bills, there will be less sales of both residential and commercial property throughout Colorado. If the gain is above the 500k cap for the 1031 or primary residence, sellers will think twice about selling. Why would you sell to take a 43% tax hit; you might as well just hold onto the property or if you wanted a larger house, it is now far cheaper to remodel than sell.

- Further constrained inventory: With less sales this will put further upward pressure on prices. As more people opt to not list their properties due to the tax implications, the market will become even tighter than it is today.

- Higher prices in many areas: With less inventory and constant demand the only way for prices to move is upwards. You will see prices stay at their lofty levels and possibly march even higher than they are today.

Summary

The “economy” levels the playing field just like gravity. The tax proposals assume huge revenue increases from the new levies. Unfortunately, this could not be farther from the truth. There will be exponentially less transactions because of the huge jump in tax liability. This increase in taxes will not only raise less revenue but put even a further strain on affordable housing as prices remain lofty due to the prospective tax hit.

Furthermore, A study was done by professors at the University of Florida to understand the true impacts of the 1031 exchange and the implications on the benefits of a program. They found a reduction in real estate activity and ultimately lower investment. Colorado will feel the effects of the new tax laws more than most states as our property values on residential and commercial properties are substantially higher than many other cities.

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)