The Federal government has released a new tool to track both short term and long term mortgage delinquencies. I was quite impressed at the new tool since the last time I went to the post office the guy was staring at a screen that looked like a pac man game from the 1980s 😊 The new tool from the CFPB allows you to see delinquency data down to the county level. You should look at this for any county you are looking at or own real estate in.

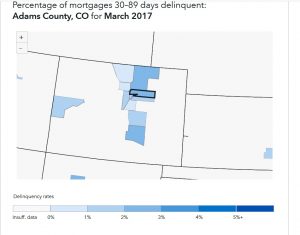

The Colorado data was quite intriguing. According to data as of March 2017 (this is the most recent data on the site), there is an anomaly. Adams county (in Denver metro) has a delinquency rate (between 30 and 90 days) that is almost 5 times higher than Boulder or Douglas counties and 20% above the national average.

Short term delinquencies are usually indicative of deeper problems that will occur in the future; it is typically the first sign of duress for a borrower. The million-dollar question is why Adams county is so much higher than the rest of the metro area on delinquencies between 30-90 days.

Why is Adams County higher?

Unfortunately, the data only goes down to the county level and Adams county is a large very diverse county (see map) encompassing both the metro area of Denver and the eastern plains. A couple theories:

- Rural Areas: The smaller markets like Strasburg have higher default rates than the metro areas: we have seen in the past recession that the farther out exurbs had considerably higher default rates in the outlying areas

- Newer neighborhoods: Many people are being pushed out of Denver county as a result of pricing and searching out lower priced areas like Adams county. Are these borrowers “stretched” and under more financial duress?

From the data, it is difficult to say for sure what is causing the spike in Adams county. What we saw in the last recession was areas like Adams county got hit worse than Denver County.

What should you do? Make sure you are right on your numbers, this is not an area to “stretch” on your values. The delinquencies rates are flashing a warning sign that should be factored into any real estate decisions. Areas with higher short-term delinquencies are at much higher risk of more serious defaults with any economic hiccup.

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-launches-new-mortgage-performance-trends-tool-tracking-delinquency-rates/

- https://www.consumerfinance.gov/data-research/mortgage-performance-trends/

I need your help!

Don’t worry, I’m not asking you to wire money to your long lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)