New vacant building tax immediately implemented

Lakewood, CO just implemented the first vacant building tax I have seen in Colorado. It seems a bit counterintuitive to put more taxes on a property owner that is already struggling with vacancy. Why did Lakewood implement this new tax? What is in the new tax and who will pay for it? Will the new tax encourage or discourage future investment in the area?

What is in the new Lakewood vacant building tax ordinance?

The new ordinance, which Lakewood Planning Director Travis Parker said went into effect immediately, requires owners of non-residential vacant buildings to pay a $700 “registration fee” every six months. On top of that, owners will be charged $800 every time emergency services are called to the property.

Why did they pass the vacant building tax in Lakewood?

According to the press release, there are more calls/issues at vacant buildings as opposed to occupied buildings. I’m not sure how accurate this assumption is as if a property is vacant, the only item that could occur would be a property crime. If a building is occupied there could also be crimes against people, their vehicles, etc… So to solve the issue supposedly being caused by vacant buildings the council implemented a tax on vacant buildings.

It is even legal to impose a tax on vacant buildings in Colorado?

I have seen similar fees in other cities. For example, in Milwaukee, WI a building must register as a vacant building and renew the registration every 6 months with a fee. They also require a vacant building inspection every six months. Although I’m not an attorney, I don’t see anything in the Lakewood ordinance that wouldn’t hold up with the courts.

Although legal, is it right to tax vacant property owners in Colorado?

This law is penalizing the victim in the market as opposed to what caused the vacancy in the first place. It is not like anyone who has a vacant building has an incentive to keep it vacant. The reason for the vacancy is due to market conditions like crime in the area, general vacancy like in the office market, or various other reasons outside the property owners control.

The property owner would love to get the property occupied in order to bring in income as opposed to carrying a vacant building with taxes, insurance, etc… Putting a tax on a vacant building does nothing to change the fact that it is vacant or provide any help to get the building occupied.

Lakewood vacant building tax addresses the symptoms not the root cause

Vacancy is a symptom of what is going on a particular market not the cause of the vacancy. The cause of the vacancy is not under the control of the property owner.

- Homelessness: There has been a large increase in vacancy where homeless camps have been set up throughout the metro area. No business owner wants to be near them for various reasons including safety of their employees and customers. For example if someone had a showroom and there was a homeless camp out front, how many customers want to come visit?

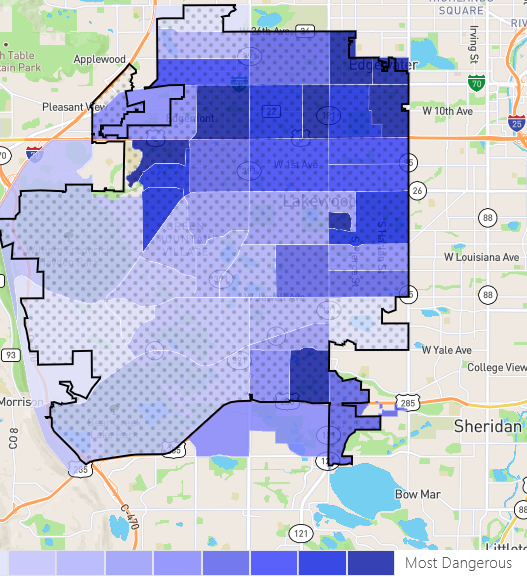

- Crime: There has been a huge spike in violent crime and property crime throughout the metro area including Lakewood. As you can see from the map above, there are various areas that are classified as “dangerous” due to the number of criminal incidents. High crime is by no means a selling point for current or prospective commercial tenants.

- High taxes: As taxes and regulations continue to increase on commercial properties the cost to lease would increase as these items are passed through to the tenant. As the cost increases and the area deteriorates, it becomes very difficult to lease the property. You will see many commercial properties in this building get handed back to the lender as they no longer make sense. We are already seeing this throughout metro Denver.

- Structure of the building: Some properties are just older properties and they have low ceilings and there is little if anything the owner can do to change the structure of the building. This makes them harder to lease.

As you can see above, none of the items above are directly under the control of the property owner and yet they are getting penalized for having a vacant property.

Summary

The vacant building tax is misguided by further penalizing the victim of bad government policies that have not adequately addressed crime, homelessness, etc… while at the same time increasing taxes which makes it even more expensive and therefore harder to lease a commercial property.

It is frustrating to see legislation like the vacant building tax implemented as it does nothing to resolve the issues above that are outside of the property owner’s control. The real solution would be to put resources towards solving the issues to help property owners lease their properties that would ultimately bring in more city revenue. Unfortunately the vacant building tax will do just the opposite and discourage future investment in the area.

Additional Reading/Resources

- https://www.neighborhoodscout.com/co/lakewood/crime

- https://businessden.com/2024/01/29/own-a-vacant-building-in-lakewood-the-city-may-send-you-a-bill/

- https://city.milwaukee.gov/DNSPrograms/VBR/FAQ

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender