Denver office vacancy exceeds 30% for first time since 1990’s

In 2019 office vacancy stood around 16%, lower than the national average. Fast forward and Denver office vacancy has almost doubled to over 30%. Why is the vacancy rate so important to Denver County? What does this mean for property values and in turn taxes?

What was in the data on vacancy in Denver?

At the end of the third quarter, total office vacancy in the city’s core was 30.6%, according to CBRE. The real estate services firm said it’s the first time downtown total vacancy has hit 30% “in the post-2000 era.” A spokeswoman provided quarterly figures going back to 2006, which show vacancy was as low as 9.5% in early 2008 and during the Great Recession went only as high as 17.4%.

A representative of JLL, another massive real estate services firm, confirmed that its own research also shows downtown Denver has hit the 30% mark. Note the 30% vacancy is an average across all office grades.

CBRE’s research found that Class B and C office buildings are the drivers behind downtown’s rising vacancy, with those buildings collectively having vacancy of 35.5% at the end of the third quarter, up 2.8 percentage points year over year.

Why the huge surge in Denver office Vacancy?

Five primary drivers:

- Work from home: with less bodies in the office 5 days a week, the amount of space businesses need is drastically reduced.

- Crime: Unfortunately it is a chicken before the egg scenario, crime is higher in the downtown core as there are less people in these areas every day which has led to an increase in crime, yet businesses do not want to return due to the increase in crime.

- Homelessness: the homeless epidemic continues in Denver with no end in sight. Homeless encampments are popping up throughout the city which is a deterrent for businesses to return to the office

- Less expensive alternatives: With the negatives of the Denver core, there has been a huge shift to suburban office markets as they are also considerably less expensive.

- Supply: the 30% vacancy rate does not capture the number of firms not currently utilizing all their space, but will likely not be renewed when leases come up. There is considerable “shadow” space which fill further increase the vacancy rate over the next several years.

Will high vacancy rates for office continue in Denver?

Yes. I don’t see a huge end in sight. A half-dozen smaller office buildings are under construction in Cherry Creek and RiNo. And in April 2022, a Chicago-based developer broke ground on a 30-story, 700,000-square-foot tower downtown. The additional class A space, coupled with the current inventory will keep vacancy up.

Trickle effect to other businesses in the area?

Although I have focused on the huge increase in office vacancies, at the end of the day retail and restaurants that cater to these same downtown office users will also suffer. Look for an uptick in ancillary properties over the next year or so.

What about suburban office markets?

“Our suburban markets are notably tighter — 10 percentage points lower, in fact — and resting below suburban vacancies across a good number of cities throughout the US. JLL data indicates an overall vacancy rate of 22.9%, which is in line with the national average among primary markets,” JLL Research Director TJ Jaroszewski said in a statemen

The property tax bomb heading for Denver County

The media seems to be grasping onto the headline of huge increases in vacancy, but the real story is that there will be an even bigger drop in property tax revenue for Denver in 2025 (the next reassessment period). Remember, commercial properties pay about 3 times the residential property tax rates.

With office vacancies hitting 30%, the values of these properties will plummet during the next assessment as the income generated is at a min 30% lower which means the values have dropped between 30-50% when coupled with higher treasury rates.

Denver has a huge concentration of large office buildings that are now worth substantially less than a few years ago which will lead to an enormous drop in property tax revenue for the county of Denver.

Summary

Denver is sitting on a property tax time bomb that will go off in 2025 when office properties are revalued down between 30-50% due to high vacancy and increased cap rates. This translates into a huge revenue loss for Denver County. At the same time tax revenue is going down, spending is increasing at a rapid pace. In 2022, the budget was 3.76 Billion, fast forward to 2023 and the budget has increased to 4.04 billion.

The disconnect between spending and future revenue does not bode well for the city solving the issues leading to the high vacancy in the first place, crime, homelessness, cheaper alternatives, etc… This will ultimately lead to even more vacancy along with higher taxes to cover the revenue shortfall. Unfortunately many major cities including Denver will have a tough few years ahead as revenues decrease due to substantially higher vacancy rates and in turn substantially lower values and tax revenue.

Additional Reading/Resources

- https://www.loopnet.com/

- https://www.denverpost.com/2023/10/31/denver-downtown-office-buildings-vacant/

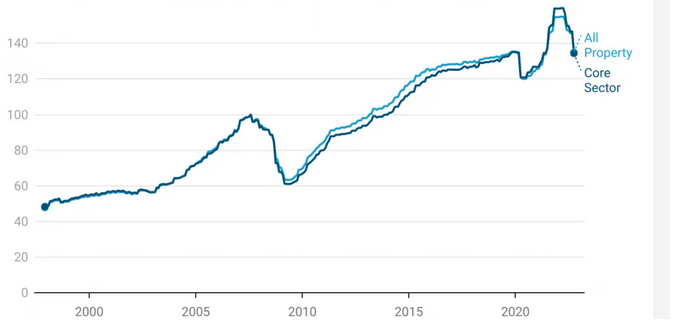

- https://www.fairviewlending.com/commercial-property-prices-slide-13-from-peak-biggest-since-08-where-do-prices-go-from-here/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender